On premium payments and retirement plans

Life Insurance Products Valuation in R

Katrien Antonio, Ph.D.

Professor, KU Leuven and University of Amsterdam

Paying premiums

Goal of premium calculation:

- Premiums + interest earnings should match benefits.

Solution:

- Set up actuarial equivalence between premium vector and benefit vector.

- Treat premium payments as a life annuity on $(x)$.

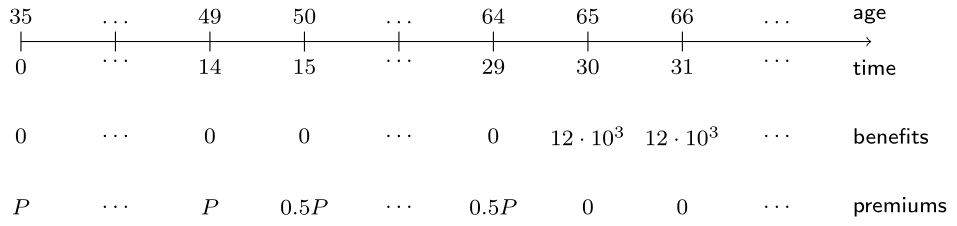

Mrs. Incredible's retirement plan

Mrs. Incredible is 35 years old.

She wants to buy a life annuity that provides 12,000 EUR annually for life, beginning at age 65.

She will finance this product with annual premiums, payable for 30 years beginning at age 35. Premiums reduce by one-half after 15 years.

What is her initial premium?

Mrs. Incredible's retirement plan pictured

Mrs. Incredible's retirement plan in R

She is 35-years-old, living in Belgium, year 2013.

Interest rate is 3%.

Survival probabilities

# Survival probabilities of (35) kpx <- c(1, cumprod(px[(35 + 1):length(px)]))Discount factors

# Discount factors discount_factors <- (1 + 0.03) ^ - (0:(length(kpx) - 1))

Benefits

# Benefits benefits <- c(rep(0, 30), rep(12000, length(kpx) - 30)) # EPV of the life annuity benefits sum(benefits * discount_factors * kpx)70928.84Premium pattern rho

# Premium pattern rho rho <- c(rep(1, 15), rep(0.5, 15), rep(0, length(kpx) - 30)) # EPV of the premium pattern sum(rho * discount_factors * kpx)16.01978

Mrs. Incredible's retirement plan in R

- Actuarial equivalence

$$ P = \frac{\text{EPV}(\text{benefits})}{\text{EPV}(\text{rho})}. $$

# The ratio of the EPV of the life annuity benefits

# and the EPV of the premium pattern

sum(benefits * discount_factors * kpx) / sum(rho * discount_factors * kpx)

4427.578

Let's practice!

Life Insurance Products Valuation in R