Actuarial equivalence

Life Insurance Products Valuation in R

Katrien Antonio, Ph.D.

Professor, KU Leuven and University of Amsterdam

Actuarial equivalence of cash flow vectors

Establish an equivalence between two cash flow vectors.

Examples:

mortgage: capital borrowed from the bank, and the series of mortgage payments;

insurance product: benefits covered by the insurance, and the series of premium payments.

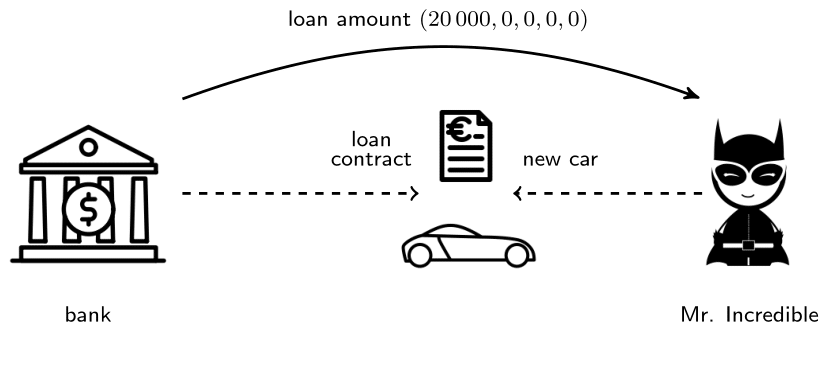

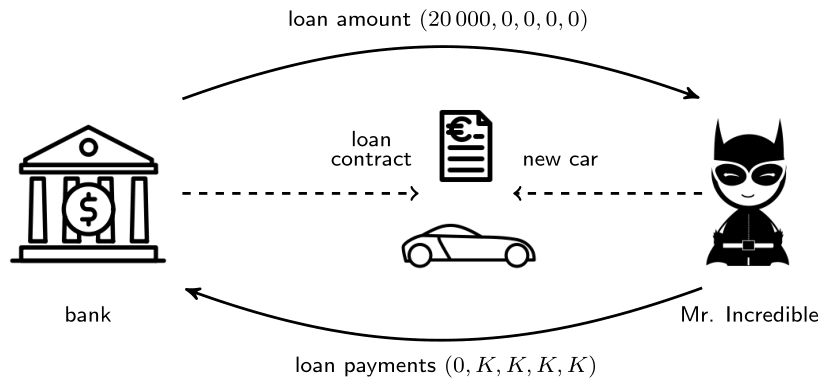

Mr. Incredible's new car

Mr. Incredible's new car

Mr. Incredible's new car

Mr. Incredible's new car

- Car is worth $20 \, 000$ EUR;

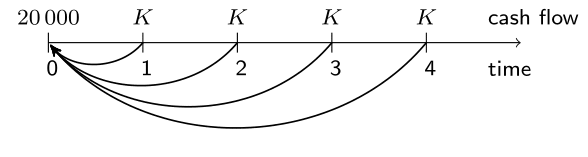

Mr. Incredible's loan payment vector is $(0,K,K,K,K)$ with Present Value:

$$ \sum_{k=1}^4 K \cdot v(0,k) \, $$

Then, establish equivalence and solve for unknown $K$!

$$ 20\ 000 = \sum_{k=1}^4 K \cdot v(0,k). $$

Mr. Incredible's new car in R

# Define the discount factors discount_factors <- (1 + 0.03) ^ - (0:4)# Define the vector with the payments payments <- c(0, rep(1, 4))# Calculate the present value of the payments PV_payment <- sum(payments * discount_factors)# Calculate the yearly payment 20000 / PV_payment

5380.541

Let's practice!

Life Insurance Products Valuation in R