Change of period and term structure

Life Insurance Products Valuation in R

Roel Verbelen, Ph.D.

Statistician, Finity Consulting

Moving away from constant, yearly interest

Two questions:

How to deal with interest rates when applying a change of period (e.g. from years to months)?

How to go from constant interest rate to a rate that changes over time?

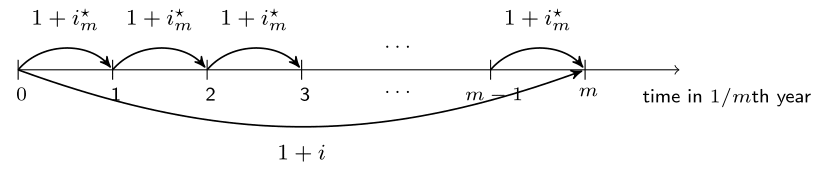

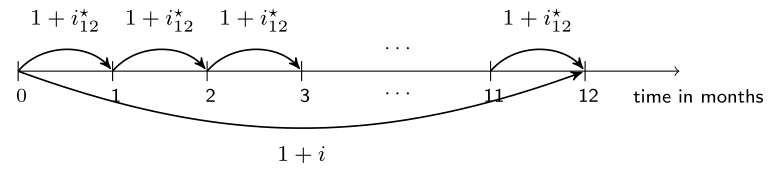

From yearly to $m$th-ly interest rates

Yearly interest rate $i$.

How to derive $i^{\star}_m$ the rate applicable to a period of $1/m$th year?

$\qquad$ Then:

$$ 1+i = (1+i^{\star}_m)^m \quad \Leftrightarrow \quad i^{\star}_m = (1+i)^{1/m}-1. $$

From yearly to $m$th-ly interest rates in R

# Yearly interest rate i <- 0.03# Calculate the monthly interest rate (monthly_interest <- (1 + i) ^ (1 / 12) - 1)

0.00246627

# From monthly to yearly interest rate

(1 + monthly_interest) ^ 12 - 1

0.03

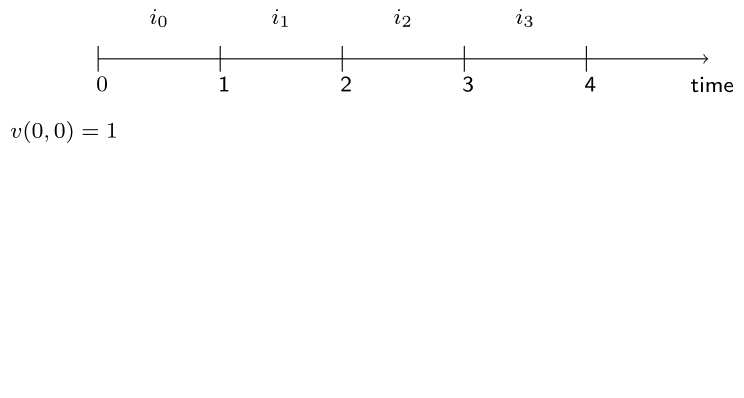

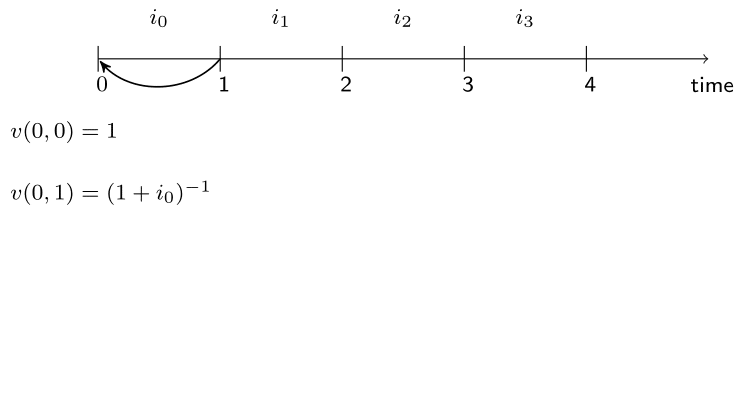

Non-constant interest rates

Observations:

interest rates are not necessarily constant;

the term structure of interest rates or yield curve.

Incorporate this in our notation and framework!

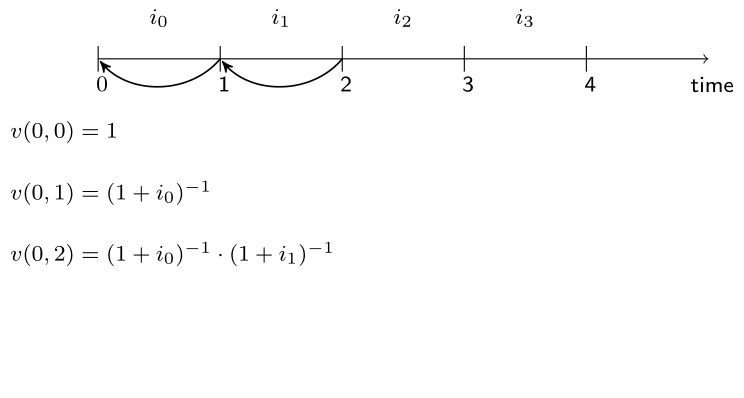

Non-constant interest rates

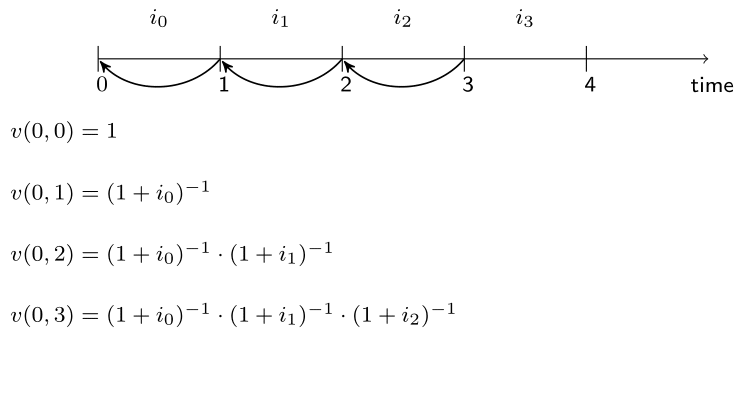

Non-constant interest rates

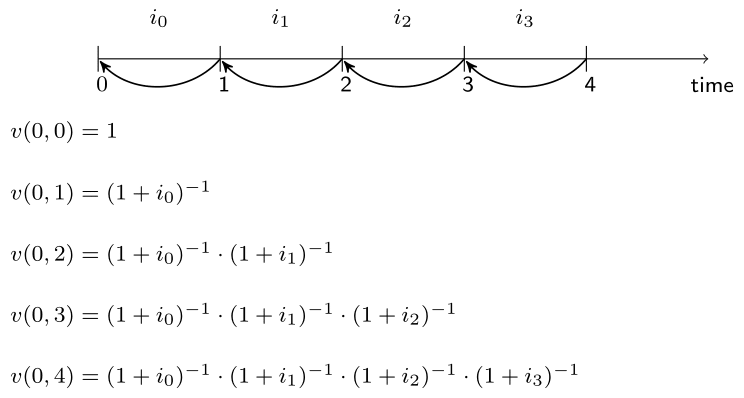

Non-constant interest rates

Non-constant interest rates

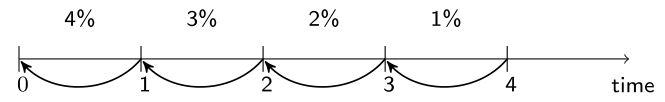

Non-constant interest rates

# Define the vector containing the interest rates

interest <- c(0.04, 0.03, 0.02, 0.01)

# Define the vector containing the inverse of 1 plus the interest rate

yearly_discount_factors <- (1 + interest) ^ - 1

# Define the discount factors to time 0 using cumprod()

discount_factors <- c(1 , cumprod(yearly_discount_factors))

discount_factors

1.0000000 0.9615385 0.9335325 0.9152279 0.9061663

Let's practice!

Life Insurance Products Valuation in R