The whole, temporary and deferred life annuity

Life Insurance Products Valuation in R

Katrien Antonio, Ph.D.

Professor, KU Leuven and University of Amsterdam

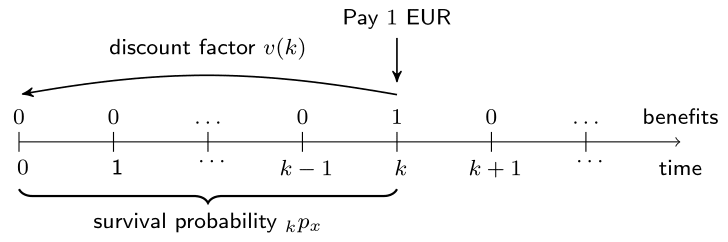

A series of benefits

- What if?

- The benefit is $c_k$ EUR instead of 1 EUR?

- A series of such pure endowments instead of just one?

General setting

A life annuity on $(x)$ with benefit vector

$$ (c_0,c_1, \ldots, c_k, \ldots) $$

Sequence of pure endowments:

- each with $c_k \cdot v(k) \cdot {}_kp_x$ as Expected Present Value (EPV)

- together:

$$ \sum_{k=0}^{+\infty} c_k \cdot v(k) \cdot {}_kp_x $$

$\quad \, \quad \,$ the EPV.

Life annuities in R

benefits <- c(500, 400, 300, rep(200, 5))

discount_factors <- (1 + 0.03) ^ - (0:7)

kpx <- c(1, cumprod(px[(65 + 1):(71 + 1)]))

sum(benefits * discount_factors * kpx)

1945.545

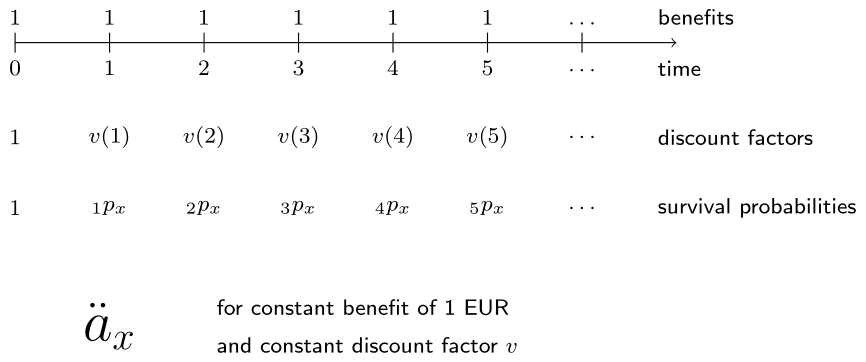

Whole life annuity due

Whole life annuity due: pay $c_k$ at beginning of year $(k+1)$.

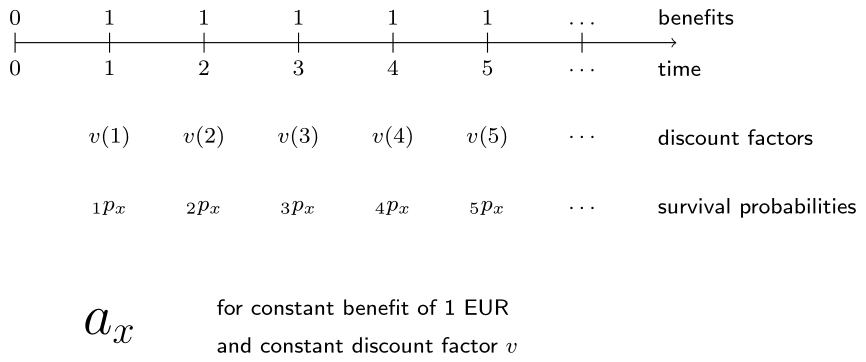

Whole life immediate annuity

Whole life immediate annuity: pay $c_k$ at end of year $(k+1)$.

Whole life annuities in R

Compute $\ddot{a}_{35}$ (due) for constant interest rate $i = 3\%$

# whole-life annuity due of (35)

kpx <-

c(1, cumprod(px[(35 + 1):length(px)]))

discount_factors <-

(1 + 0.03) ^ - (0:(length(kpx) - 1))

benefits <- rep(1, length(kpx))

sum(benefits * discount_factors * kpx)

24.44234

and $a_{35}$ (immediate)

# whole-life immediate annuity of (35)

kpx <- cumprod(px[(35 + 1):length(px)])

discount_factors <-

(1 + 0.03) ^ - (1:length(kpx))

benefits <- rep(1, length(kpx))

sum(benefits * discount_factors * kpx)

23.44234

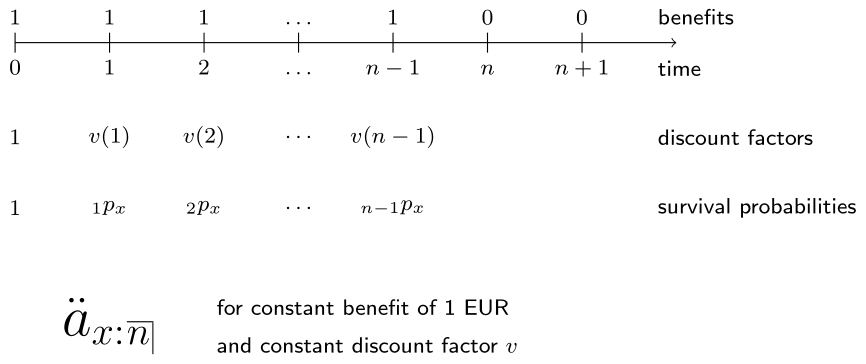

Temporary life annuity due

Temporary annuity due: maximum of $n$ years, at time $0$ until $n-1$.

Deferred whole life annuity due

Deferred whole life annuity due: no payments in first $u$ years.

Let's practice!

Life Insurance Products Valuation in R