Binomial experiments

Life Insurance Products Valuation in R

Roel Verbelen, Ph.D.

Statistician, Finity Consulting

The life table in R

life_tablecontains the period life table for males in Belgium of 2013.

head(life_table, 10)

age qx lx dx ex

1 0 0.00381 100000 381 77.95

2 1 0.00047 99619 47 77.24

3 2 0.00019 99572 19 76.28

4 3 0.00015 99553 15 75.30

5 4 0.00013 99538 13 74.31

6 5 0.00010 99525 10 73.32

7 6 0.00011 99514 11 72.32

8 7 0.00008 99504 8 71.33

9 8 0.00011 99496 11 70.34

10 9 0.00008 99485 8 69.34

# Variables used in this video

qx <- life_table$qx

px <- 1 - qx

lx <- life_table$lx

dx <- life_table$dx

A binomial experiment: surviving one year

- Focus on $\ell_x$ in

life_table.

lx[0 + 1]

1e+05

A binomial experiment: surviving one year

- The number of survivors up to age $x+1$ follows a BIN($\ell_x$,$\ p_{x}$).

lx[72 + 1]

73977

px[72 + 1]

0.97369

rbinom(n = 1, size = lx[72 + 1], prob = px[72 + 1])

72022

A binomial experiment: surviving one year

- Now in a vectorized way!

sims <- rbinom(n = length(lx), size = lx, prob = px)

head(sims)

99637 99567 99553 99546 99525 99515

A binomial experiment: surviving $k$ years

The number of 1-year survivors follows a BIN($\ell_x$,$\ p_{x}$).

$\quad \,$ Expected value:

$$ \ell_{x+1} = \ell_x \cdot p_x. $$The number of $k$-year survivors follows a BIN($\ell_x$,$\ _{k}p_{x}$).

$\quad \,$ Expected value:

$$ \ell_{x+k} = \ell_{x} \cdot \ _{k}p_{x}. $$

$\quad \,$ Thus:

$$ _{k}p_{x} = \frac{\ell_{x+k}}{\ell_{x}}. $$

A binomial experiment: the number of deaths

- The number of deaths follows a BIN($\ell_x$,$\ q_{x}$).

$\quad \,$ Expected value: $$ \large \begin{aligned} d_x &= \ell_x \cdot q_x \\ &= \ell_x \cdot (1-p_x) \\ &= \ell_x -\ell_{x+1}. \end{aligned} $$

dx[72 + 1]

1946

lx[72 + 1] - lx[73 + 1]

1946

Survival probabilities in R

Compute $_5p_{65} = \dfrac{\ell_{70}}{\ell_{65}}$.

# Probability that (65) survives 5 more years

lx[age == 70] / lx[age == 65]

0.9143957

# Alternatively

lx[70 + 1] / lx[65 + 1]

0.9143957

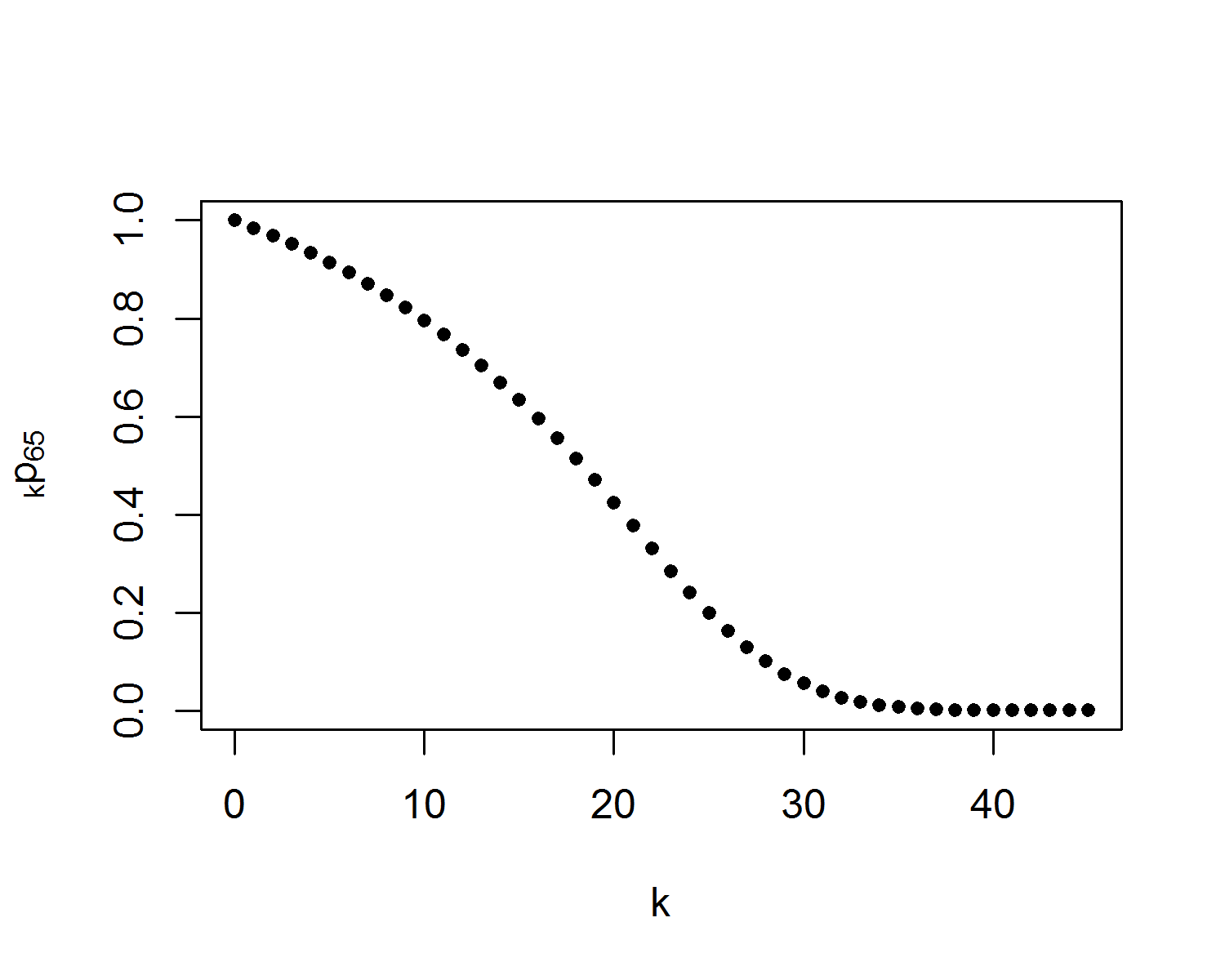

Picturing survival probabilities in R

# probability that (65) survives to age 65 + k

k <- 0:45

plot(k,

lx[65 + k + 1] / lx[65 + 1],

pch = 20,

xlab = "k",

ylab = expression(paste(""[k], "p"[65])))

Let's practice!

Life Insurance Products Valuation in R