Calculating probabilities

Life Insurance Products Valuation in R

Katrien Antonio, Ph.D.

Professor, KU Leuven and University of Amsterdam

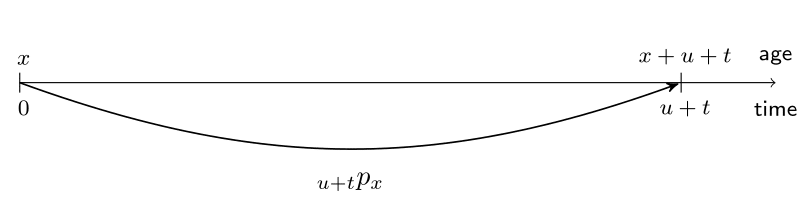

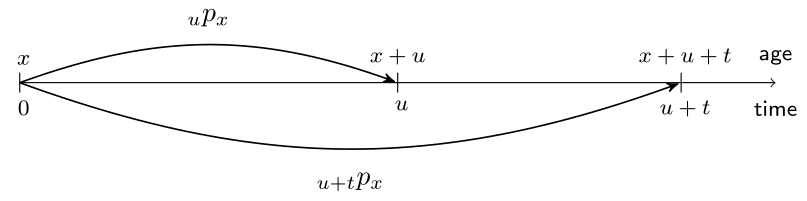

From one-year to multi-year survival probabilities

From one-year to multi-year survival probabilities

From one-year to multi-year survival probabilities

From one-year to multi-year survival probabilities

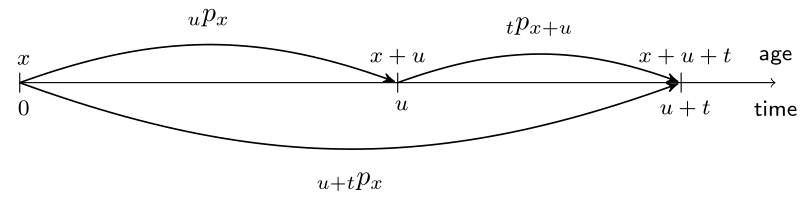

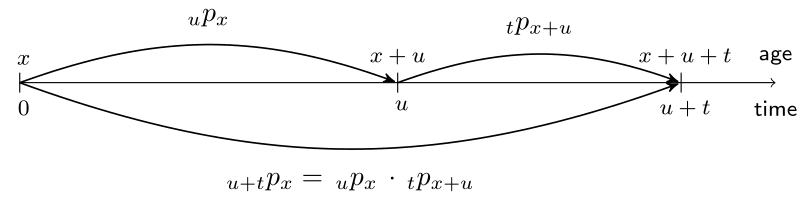

The multiplication rule

- Rewriting the survival probabilities:

$$ _{t+u}p_x =\ _{u}p_x \cdot \ _{t}p_{x+u}. $$

The multiplication rule

Rewriting the survival probabilities:

$$ _{t+u}p_x =\ _{u}p_x \cdot \ _{t}p_{x+u}. $$

With $k$ an integer we obtain:

$$ \begin{aligned} _kp_x &= p_x \cdot \ _{k-1}p_{x+1} \\ &= p_x \cdot p_{x+1} \cdots p_{x+k-1} \\ &= \prod_{l=0}^{k-1} p_{x+l} \end{aligned} $$

$\quad \,$ which is a product of one-year survival probabilities.

Calculating survival probabilities in R

Compute $_5p_{65} = p_{65} \cdot p_{66} \cdot p_{67} \cdot p_{68} \cdot p_{69}$.

# One-year survival probabilities

px <- 1 - life_table$qx

px[(65 + 1):(69 + 1)]

0.98491 0.98320 0.98295 0.98091 0.97935

# Probability that (65) survives 5 more years

prod(px[(65 + 1):(69 + 1)])

0.9144015

Compute $_5p_{65} = \frac{\ell_{70}}{\ell_{65}}$.

# Alternatively (difference due to

rounding)

lx[70 + 1] / lx[65 + 1]

0.9143957

Cumulative product of survival probabilities in R

Compute $_kp_{65}$ for $k = 1, 2, 3, 4, 5$.

# One-year survival probabilities

px[(65 + 1):(69 + 1)]

0.98491 0.98320 0.98295 0.98091 0.97935

# Multi-year survival probabilities of (65)

cumprod(px[(65 + 1):(69 + 1)])

0.9849100 0.9683635 0.9518529 0.9336820

0.9144015

Compute $_kp_{65}$ for $k = 0, 1, 2, 3, 4, 5$.

# Multi-year survival probabilities of (65)

c(1, cumprod(px[(65 + 1):(69 + 1)]))

1.0000000 0.9849100 0.9683635 0.9518529

0.9336820 0.9144015

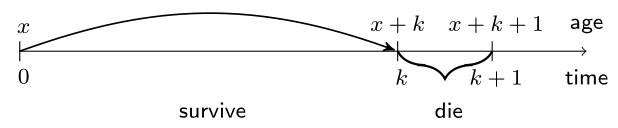

A deferred mortality probability

- Focus on a specific deferred mortality probability:

- $(x)$ survives $k$ whole years, but dies before reaching age $x + k + 1$:

$$ \begin{aligned} _{k|}q_x &= {}_kp_x \cdot q_{x+k}. \end{aligned} $$

A deferred mortality probability in R

Compute $_{5|}q_{65} = {}_5p_{65} \cdot q_{70}$.

# 5-year deferred mortality probability of (65)

prod(px[(65 + 1):(69 + 1)]) * qx[70 + 1]

0.02086664

Compute $_{5|}q_{65} = \frac{d_{70}}{\ell_{65}}$.

# Alternatively (difference due to rounding)

dx[70 + 1] / lx[65 + 1]

0.02086817

Deferred mortality probabilities in R

Compute $_{k|}q_{65} = {}_kp_{65} \cdot q_{65 + k}$ for $k = 0, 1, 2, \ldots$

# Survival probabilities of (65)

kpx <- c(1, cumprod(px[(65 + 1):(length(px) - 1)]))

head(kpx)

1.0000000 0.9849100 0.9683635 0.9518529 0.9336820 0.9144015

# Deferred mortality probabilities of (65)

kqx <- kpx * qx[(65 + 1):length(qx)]

head(kpx)

0.01509000 0.01654649 0.01651060 0.01817087 0.01928053 0.02086664

Let's practice!

Life Insurance Products Valuation in R