A simple life annuity

Life Insurance Products Valuation in R

Roel Verbelen, Ph.D.

Statistician, Finity Consulting

The life annuity

The life annuity

The life annuity

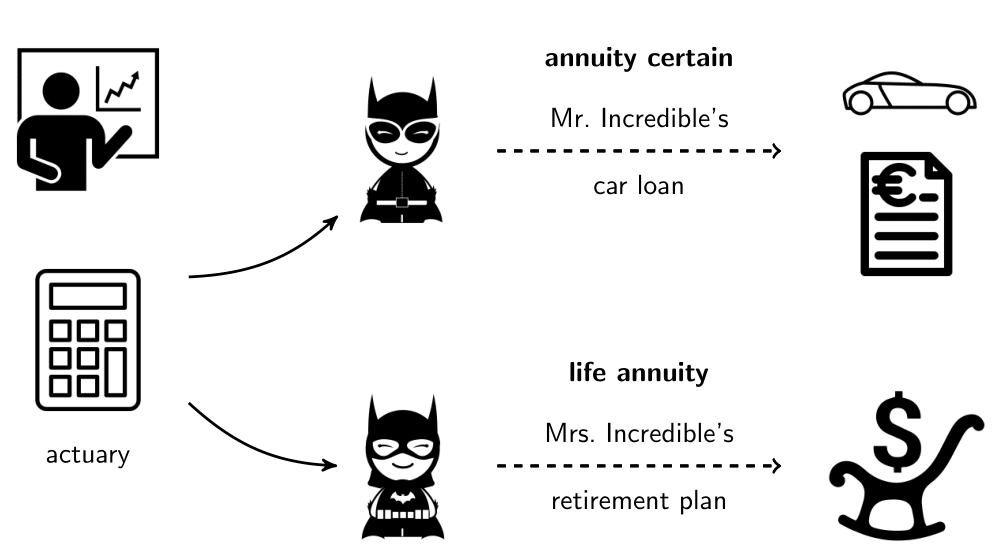

Annuity vs. life annuity: mind the difference!

- Annuity (certain) offers a guaranteed series of payments.

- Life annuity depends on the survival of the recipient.

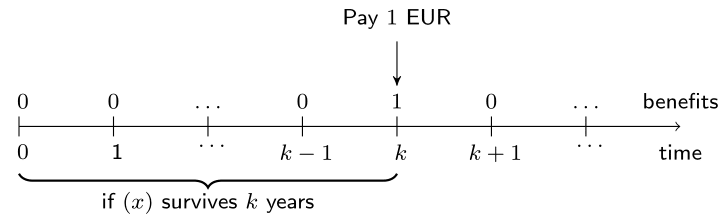

Pure endowment

- The product is sold to $(x)$ at time 0.

EPV of pure endowment

- Expected Present Value:

$\qquad$ The EPV is $$_kE_x = 1 \cdot \ v(k) \cdot \ {}_kp_x \, . $$

Annuity vs. life annuity: mind the difference!

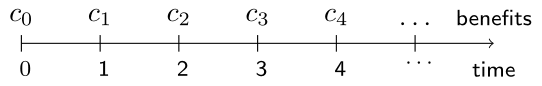

- With an annuity certain, the benefit of 1 euro at time $k$ is guaranteed.

$\quad \,$ PV is $v(k)$.

i <- 0.03

discount_factor <- (1 + i) ^ - 5

1 * discount_factor

0.8626088

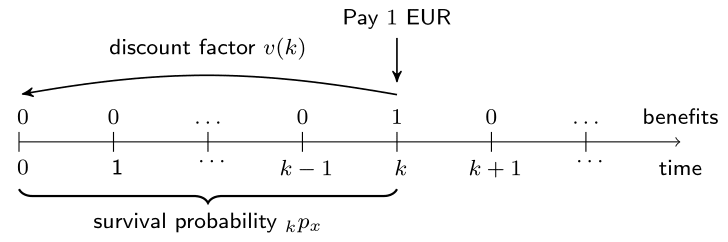

Annuity vs. life annuity: mind the difference!

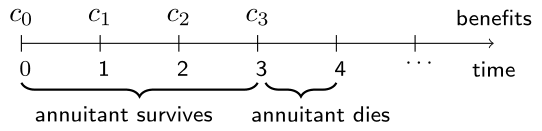

- With a pure endowment, the benefit of 1 euro at time $k$ is not guaranteed.

$\quad \,$ Expected PV is $v(k) \cdot {}_kp_x$.

qx <- life_table$qx; px <- 1 - qx

kpx <- prod(px[(65 + 1):(69 + 1)])

kpx

0.9144015

1 * discount_factor * kpx

0.7887708

Let's practice!

Life Insurance Products Valuation in R