Cash flows and discounting

Life Insurance Products Valuation in R

Katrien Antonio, Ph.D.

Professor, KU Leuven and University of Amsterdam

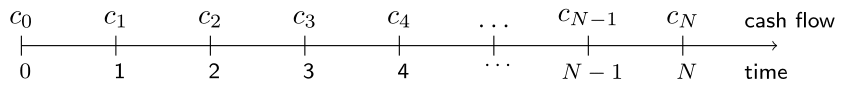

A cash flow

Fix a capital unit and a time unit:

- 0 is the present moment;

- $k$ is $k$ time units in the future (e.g. years, months, quarters).

Amount of money received or paid out at time $k$:

- $c_k$

- the cash flow at time $k$.

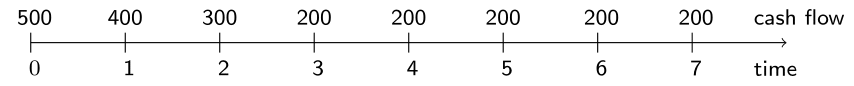

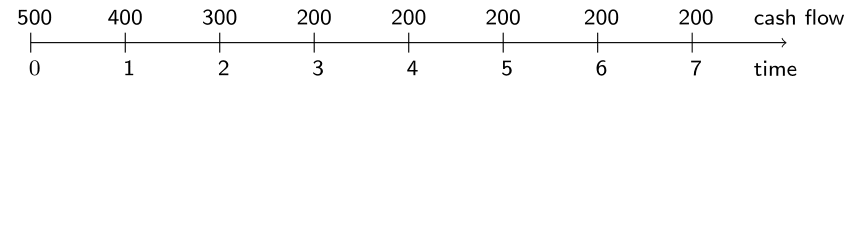

A vector of cash flows in R

- In R:

# Define the cash flows

cash_flows <- c(500, 400, 300, rep(200, 5))

length(cash_flows)

8

- In general: for a cashflow vector $(c_0,c_1,\ldots,c_N)$:

Valuation of a cash flow vector

Crucial facts:

timing of cash flows matters!

time value of money matters!

Interest rate determines growth of money.

Interest rate and discount factor

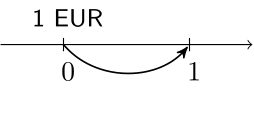

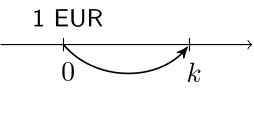

Accumulation

- $i$ is the constant interest rate.

i <- 0.03

1 * (1 + i)

1.03

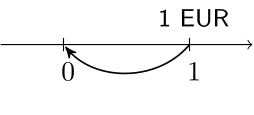

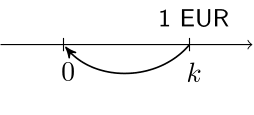

Discounting

- $v=\displaystyle \frac{1}{1+i}$ the discount factor.

v <- 1 / (1 + i)

v

0.9708738

From one time period to k time periods

Accumulation

- the value at time $k$ of $1$ EUR paid at time $0$ $=(1+i)^k = v^{-k}$.

i <- 0.03 ; v <- 1 / (1 + i) ; k <- 2

c((1 + i) ^ k, v ^ -k)

1.0609 1.0609

Discounting

- the value at time $0$ of $1$ EUR paid at time $k$ $=(1+i)^{-k} = v^{k}$.

i <- 0.03 ; v <- 1 / (1 + i) ; k <- 2

c((1 + i) ^ -k, v ^ k)

0.9425959 0.9425959

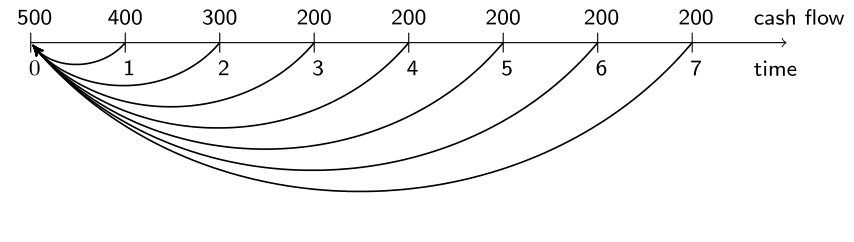

The present value of a cash flow vector

What is the value at $k=0$ of this cash flow vector?

The present value of a cash flow vector

What is the value at $k=0$ of this cash flow vector?

The present value (PV)!

The present value of a cash flow vector in R

# Interest rate i <- 0.03# Discount factor v <- 1 / (1 + i)# Define the discount factors discount_factors <- v ^ (0:7)# Cash flow vector cash_flows <- c(500, 400, 300, rep(200, 5))

# Discounting cash flows

cash_flows * discount_factors

500.0000 388.3495 282.7788 183.0283

177.6974 172.5218 167.4969 162.6183

# Present value of cash flow vector

present_value <-

sum(cash_flows * discount_factors)

present_value

[1] 2034.491

Let's practice!

Life Insurance Products Valuation in R