Guaranteed payments

Life Insurance Products Valuation in R

Roel Verbelen, Ph.D.

Statistician, Finity Consulting

Guaranteed payments

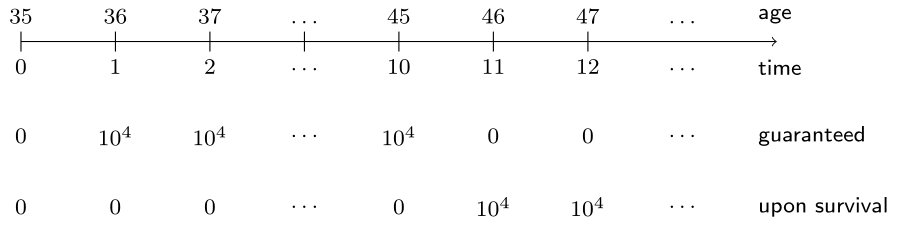

Additional flexibility: life annuities with a guaranteed period.

A typical contract:

- Initially: $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ benefits are paid regardless of whether the annuitant is alive or not.

- Afterwards: $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ $\qquad$ benefits are paid conditional on survival.

Mr. Incredible's prize!

Mr. Incredible is 35 years old.

He won a special prize: a life annuity of 10,000 EUR each year for life!

The first payment starts at the end of the first year. Moreover, the first 10 payments are guaranteed.

Can you calculate the value of his prize?

Mr. Incredible's prize in R

He is 35-years-old, living in Belgium, year 2013.

Interest rate is 3%.

Survival probabilities of (35)

# Survival probabilities of (35) kpx <- c(1, cumprod(px[(35 + 1):length(px)]))Discount factors

# Discount factors discount_factors <- (1 + 0.03) ^ - (0:(length(kpx) - 1))

Mr. Incredible’s prize pictured

# Benefits guaranteed

benefits_guaranteed <- c(0, rep(10^4, 10), rep(0, length(kpx) - 11))

# Benefits nonguaranteed

benefits_nonguaranteed <- c(rep(0, 11), rep(10^4, length(kpx) - 11))

# PV of the guaranteed annuity

sum(benefits_guaranteed * discount_factors)

85302.03

# EPV of the nonguaranteed life annuity

sum(benefits_nonguaranteed * discount_factors * kpx)

149675.3

# PV of the guaranteed annuity + EPV of the nonguaranteed annuity

sum(benefits_guaranteed * discount_factors) + sum(benefits_nonguaranteed * discount_factors * kpx)

234977.3

Let's practice!

Life Insurance Products Valuation in R