Trading signals

Financial Trading in Python

Chelsea Yang

Data Science Instructor

What are trading signals?

- Triggers to long or short financial assets based on predetermined criteria

Can be constructed using:

- One technical indicator

- Multiple technical indicators

- A combination of market data and indicators

Commonly used in algorithmic trading

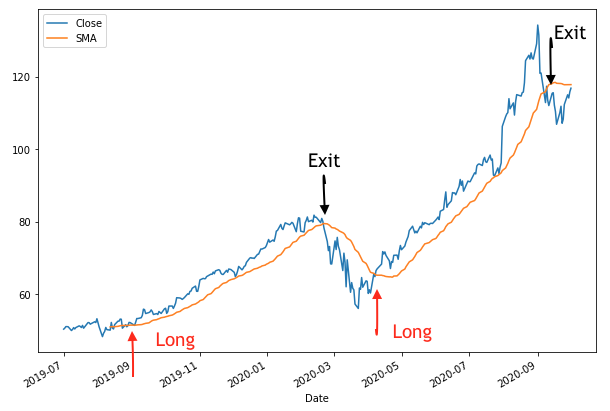

A signal example

- Signal: Price > SMA (long when the price rises above the SMA)

How to implement signals in bt

- Get the data and calculate indicators

- Define the signal-based strategy

bt.algos.SelectWhere()bt.algos.WeighTarget()

- Create and run a backtest

- Review the backtest result

Construct the signal

# Get price data by the stock ticker

price_data = bt.get('aapl', start='2019-11-1', end='2020-12-1')

# Calculate SMA

sma = price_data.rolling(20).mean()

Alternatively, use talib to calculate the indicator:

# Calculate SMA

import talib

sma = talib.SMA(price_data['Close'], timeperiod=20)

Define a signal-based strategy

# Define the signal-based strategy

bt_strategy = bt.Strategy('AboveEMA',

[bt.algos.SelectWhere(price_data > sma),

bt.algos.WeighEqually(),

bt.algos.Rebalance()])

- For simplicity, we assume:

- Trade one asset at a time

- No slippage or commissions

- Slipage: the difference between the expected price of a trade and the price at which the trade is executed

- Commission: fees charged by brokers when executing a trade

Backtest the signal based strategy

# Create the backtest and run it

bt_backtest = bt.Backtest(bt_strategy, price_data)

bt_result = bt.run(bt_backtest)

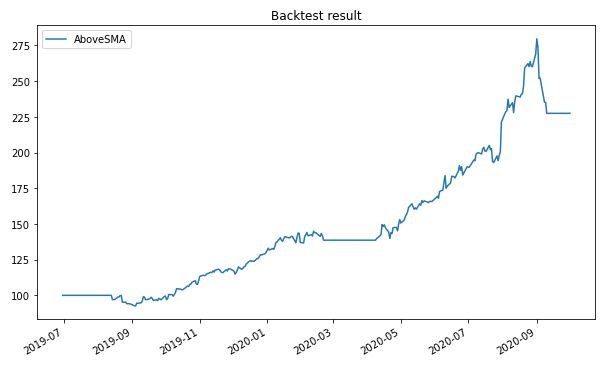

Plot the backtest result

# Plot the backtest result

bt_result.plot(title='Backtest result')

Let's practice!

Financial Trading in Python