Mean reversion strategy

Financial Trading in Python

Chelsea Yang

Data Science Instructor

RSI-based mean reversion strategy

Buy the fear and sell the greed

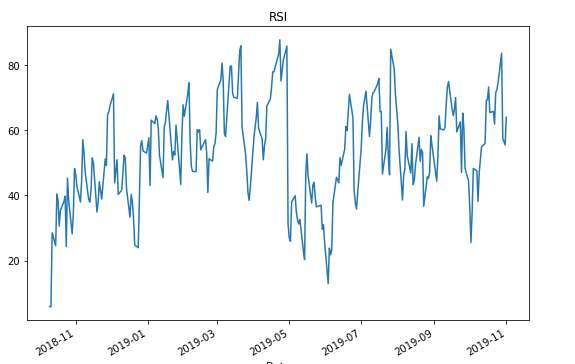

- RSI-based mean reversion strategy:

- Short signal: RSI > 70

- Suggests the asset is likely overbought and the price may soon reverse

- Long signal: RSI < 30

- Suggests the asset is likely oversold and the price may soon rally

- Short signal: RSI > 70

Calculate the indicator

import talib

# Calculate the RSI

stock_rsi = talib.RSI(price_data['Close']).to_frame()

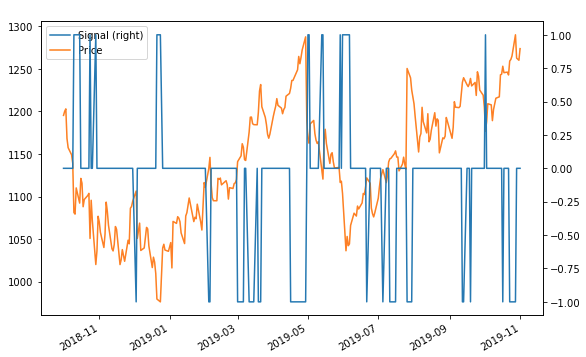

Construct the signal

# Create the same DataFrame structure as RSI signal = stock_rsi.copy() signal[stock_rsi.isnull()] = 0# Construct the signal signal[stock_rsi < 30] = 1signal[stock_rsi > 70] = -1signal[(stock_rsi <= 70) & (stock_rsi >= 30)] = 0

Plot the signal

# Plot the RSI

stock_rsi.plot()

plt.title('RSI')

# Merge data into one DataFrame combined_df = bt.merge(signal, stock_data) combined_df.columns = ['Signal', 'Price'] # Plot the signal with pricecombined_df.plot(secondary_y = ['Signal'])

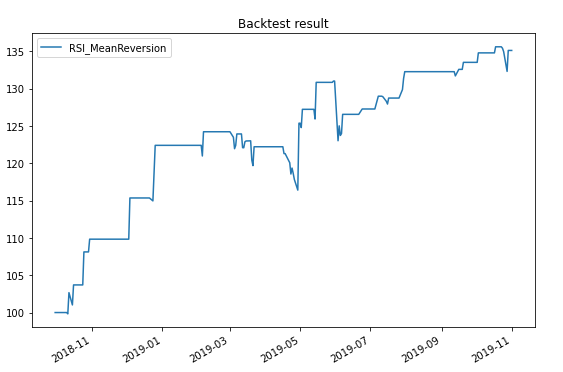

Define the strategy with the signal

# Define the strategy

bt_strategy = bt.Strategy('RSI_MeanReversion',

[bt.algos.WeighTarget(signal),

bt.algos.Rebalance()])

Backtest the signal-based strategy

# Create the backtest and run it

bt_backtest = bt.Backtest(bt_strategy, price_data)

bt_result = bt.run(bt_backtest)

Plot backtest result

# Plot the backtest result

bt_result.plot(title='Backtest result')

Let's practice!

Financial Trading in Python