Trend indicator MAs

Financial Trading in Python

Chelsea Yang

Data Science Instructor

What are technical indicators?

- Mathematical calculations based on historical market data

- Assume the market is efficient and the price has incorporated all public information

- Help traders to gain insight into past price patterns

Types of indicators

- Trend indicators: measure the direction or strength of a trend

- Example: Moving averages (MA), Average Directional Movement Index (ADX)

- Momentum indicators: measure the velocity of price movement

- Example: Relative Strength Index (RSI)

- Volatility indicators: measure the magnitude of price deviations

- Example: Bollinger Bands

The TA-Lib package

TA-Lib : Technical Analysis Library

- Includes 150+ technical indicator implementations

import talib

Moving average indicators

- SMA: Simple Moving average

- EMA: Exponential Moving Average

- Characteristics:

- Move with the price

- Smooth out the data to better indicate the price direction

Simple Moving Average (SMA)

$ SMA = (P_1+P_2+...+P_n)/n $

# Calculate two SMAs stock_data['SMA_short'] = talib.SMA(stock_data['Close'], timeperiod=10) stock_data['SMA_long'] = talib.SMA(stock_data['Close'], timeperiod=50)# Print the last five rows print(stock_data.tail())

Close SMA_short SMA_long

Date

2020-11-24 1768.88 1758.77 1594.74

2020-11-25 1771.43 1760.65 1599.75

2020-11-27 1793.19 1764.98 1605.70

2020-11-30 1760.74 1763.35 1611.71

2020-12-01 1798.10 1765.02 1619.05

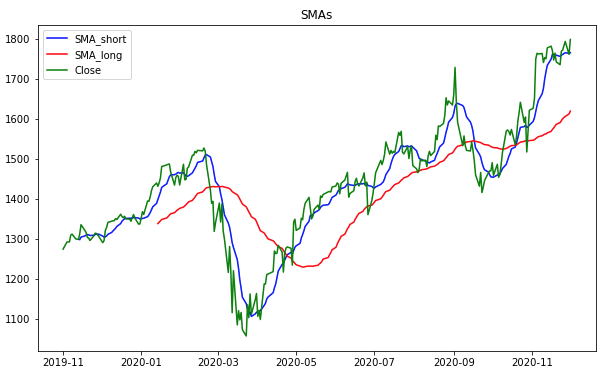

Plotting the SMA

import matplotlib.pyplot as plt

# Plot SMA with the price

plt.plot(stock_data['SMA_short'],

label='SMA_short')

plt.plot(stock_data['SMA_long'],

label='SMA_long')

plt.plot(stock_data['Close'],

label='Close')

# Customize and show the plot

plt.legend()

plt.title('SMAs')

plt.show()

Exponential Moving Average (EMA)

$EMA_n = P_n \times multiplier + \text{previous EMA} \times (1-multiplier)$

$multiplier = 2 / (n + 1)$

# Calculate two EMAs

stock_data['EMA_short'] = talib.EMA(stock_data['Close'], timeperiod=10)

stock_data['EMA_long'] = talib.EMA(stock_data['Close'], timeperiod=50)

# Print the last five rows

print(stock_data.tail())

Close EMA_short EMA_long

Date

2020-11-24 1768.88 1748.65 1640.98

2020-11-25 1771.43 1752.79 1646.09

2020-11-27 1793.19 1760.13 1651.86

2020-11-30 1760.74 1760.24 1656.13

2020-12-01 1798.10 1767.13 1661.70

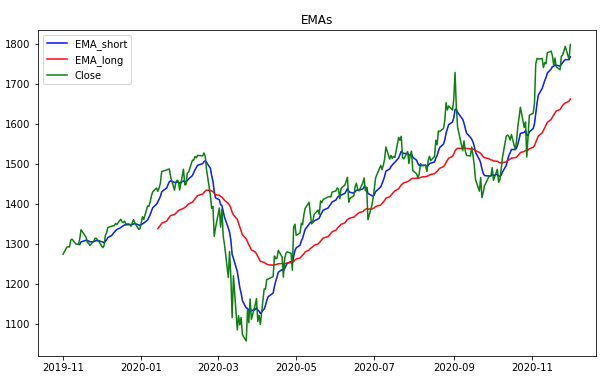

Plotting the EMA

import matplotlib.pyplot as plt

# Plot EMA with the price

plt.plot(stock_data['EMA_short'],

label='EMA_short')

plt.plot(stock_data['EMA_long'],

label='EMA_long')

plt.plot(stock_data['Close'],

label='Close')

# Customize and show the plot

plt.legend()

plt.title('EMAs')

plt.show()

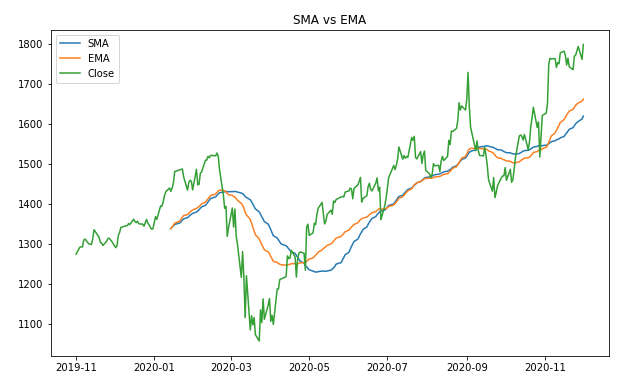

SMA vs. EMA

EMA is more sensitive to the most recent price movement

Let's practice!

Financial Trading in Python