Getting familiar with your trading data

Financial Trading in Python

Chelsea Yang

Data Science Instructor

Different types of traders

- Day Trader: holds positions throughout the day but usually not overnight

- Swing Trader: holds positions from a few days to several weeks

- Position Trader: holds positions from a few months to several years

Resample the data

Date Close

2019-11-29 04:00:00 1.1010

2019-11-29 08:00:00 1.1005

2019-11-29 12:00:00 1.0993

2019-11-29 16:00:00 1.1016

2019-11-29 20:00:00 1.1020

# Resample from hourly to daily

eurusd_daily = eurusd_h.resample('D').mean()

Date Close

2019-11-25 1.10165

2019-11-26 1.10165

2019-11-27 1.10058

2019-11-28 1.10083

2019-11-29 1.10093

# Resample from hourly to weekly

eurusd_weekly = eurusd_h.resample('W').mean()

Date Close

2019-11-03 1.11248

2019-11-10 1.10860

2019-11-17 1.10208

2019-11-24 1.10659

2019-12-01 1.10113

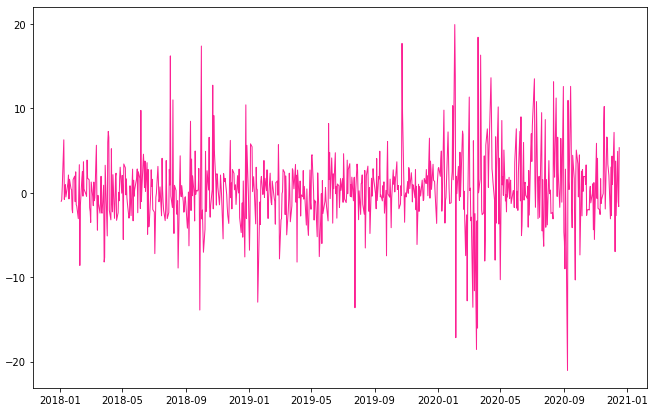

Calculate daily returns

# Calculate daily returns

stock_data['daily_return']

= stock_data['Close'].pct_change() * 100

Close daily_return

Date

2020-12-11 609.99 -2.723779

2020-12-14 639.83 4.891883

2020-12-15 633.25 -1.028398

2020-12-16 622.77 -1.654955

2020-12-17 655.90 5.319781

# Plot the data

plt.plot(stock_data['daily_return'])

plt.show()

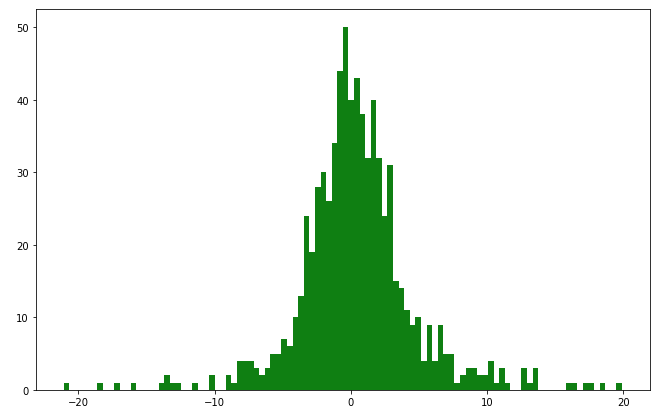

Plot a histogram of daily returns

stock_data['daily_return'].hist(bins=100)

plt.show()

Data transformation

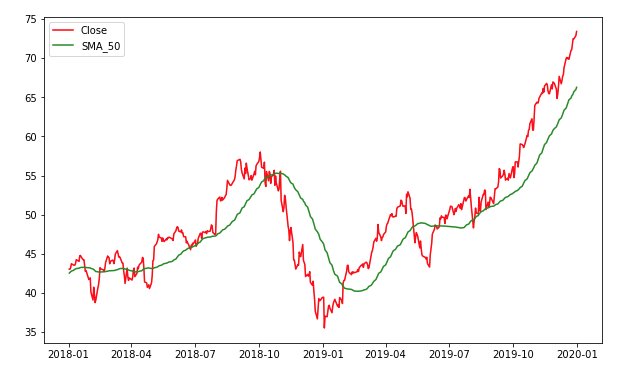

Technical indicators: various types of data transformations

Simple moving average (SMA): arithmetic mean price over a specified n-period

stock_data['sma_50'] = stock_data['Close'].rolling(window=50).mean()

Close sma_50

Date

2020-12-11 122.41 117.7474

2020-12-14 121.78 117.9226

2020-12-15 127.88 118.1502

2020-12-16 127.81 118.4432

2020-12-17 128.70 118.7156

Plot the rolling average

import matplotlib.pyplot as plt

plt.plot(stock_data['Close'],

label='Close')

plt.plot(stock_data['sma_50'],

label='SMA_50')

plt.legend()

plt.show()

Let's practice!

Financial Trading in Python