Sharpe ratio and Sortino ratio

Financial Trading in Python

Chelsea Yang

Data Science Instructor

Which strategy performs better?

$$

Strategy 1:

- Return: 15%

- Volatility (standard deviation): 30%

$$

Strategy 2:

- Return: 10%

- Volatility (standard deviation): 8%

Risk-adjusted return

- Make performance comparable among different strategies

- A ratio that describes risk involved in obtaining the return

Sharpe ratio

$$ \text{Sharpe Ratio} = (R_p - R_r)/\sigma_p $$

$$

- $R_p $: Return of a strategy, portfolio, asset, etc.

- $R_r $: Risk-free rate

- $\sigma_p $: Standard deviation of the excess return ($R_p-R_f$)

$$

- The bigger the Sharpe ratio, the more attractive the return

Now choose again

$$

Strategy 1:

- Return: 15%

- Volatility (standard deviation): 30%

- Sharpe ratio: 15%/30% = 0.5

$$

Strategy 2:

- Return: 10%

- Volatility (standard deviation): 8%

- Sharpe ratio: 10%/8% = 1.25

Obtain Sharpe ratio from bt backtest

resInfo = bt_result.stats

# Get Sharpe ratios from the backtest stats

print('Sharpe ratio daily: %.2f'% resInfo.loc['daily_sharpe'])

print('Sharpe ratio monthly %.2f'% resInfo.loc['monthly_sharpe'])

print('Sharpe ratio annually %.2f'% resInfo.loc['yearly_sharpe'])

Sharpe ratio daily: 0.49

Sharpe ratio monthly 0.48

Sharpe ratio annually 1.34

Calculate Sharpe ratio manually

# Obtain annual return annual_return = resInfo.loc['yearly_mean']# Obtain annual volatility volatility = resInfo.loc['yearly_vol']# Calculate Sharpe ratio manually sharpe_ratio = annual_return / volatility print('Sharpe ratio annually %.2f'% sharpe_ratio)

Sharpe ratio annually 1.34

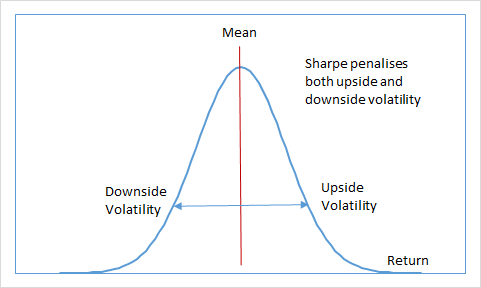

Limitations of Sharpe ratio

- Penalize both the "good" and "bad" volatility

- Upside volatility can skew the ratio downward

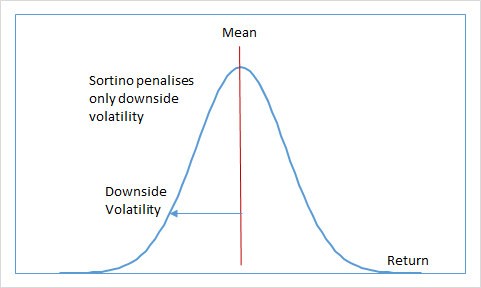

Sortino ratio

$$ \text{Sortino Ratio} = (R_p - R_r)/\sigma_d $$

- $R_p $: Return of a strategy, portfolio, asset, etc

- $R_r $: Risk-free rate

- $\sigma_d $: Downside deviation of the excess return ($R_p-R_f$)

Obtain Sortino ratio from bt backtest

resInfo = bt_result.stats

# Get Sortino ratio from backtest stats

print('Sortino ratio daily: %.2f'% resInfo.loc['daily_sortino'])

print('Sortino ratio monthly %.2f'% resInfo.loc['monthly_sortino'])

print('Sortino ratio annually %.2f'% resInfo.loc['yearly_sortino'])

Sortino ratio daily: 0.70

Sortino ratio monthly 0.86

Sortino ratio annually 2.29

Let's practice!

Financial Trading in Python