Financial trading with bt

Financial Trading in Python

Chelsea Yang

Data Science Instructor

The bt package

A flexible framework for defining and backtesting trading strategies

- Strategy: a method of buying and selling financial assets based on predefined rules

- Strategy backtesting: a way to assess the effectiveness of a strategy by testing it on historical data

import bt

The bt process

- Step 1: Get the historical price data

- Step 2: Define the strategy

- Step 3: Backtest the strategy with the data

- Step 4: Evaluate the result

Get the data

# Download historical prices bt_data = bt.get('goog, amzn, tsla', start='2020-6-1', end='2020-12-1')print(bt_data.head())

goog amzn tsla

Date

2020-06-01 1431.819946 2471.040039 179.619995

2020-06-02 1439.219971 2472.409912 176.311996

2020-06-03 1436.380005 2478.399902 176.591995

2020-06-04 1412.180054 2460.600098 172.876007

2020-06-05 1438.390015 2483.000000 177.132004

Define the strategy

# Define the strategy bt_strategy = bt.Strategy('Trade_Weekly',[bt.algos.RunWeekly(), # Run weeklybt.algos.SelectAll(), # Use all databt.algos.WeighEqually(), # Maintain equal weightsbt.algos.Rebalance()]) # Rebalance

Backtest

# Create a backtest bt_test = bt.Backtest(bt_strategy, bt_data)# Run the backtest bt_res = bt.run(bt_test)

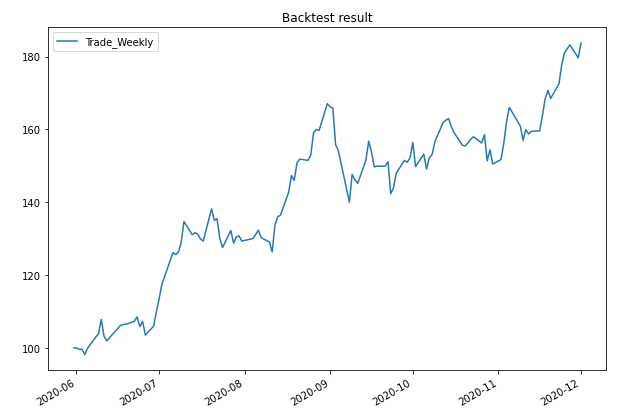

Evaluate the result

# Plot the result

bt_res.plot(title="Backtest result")

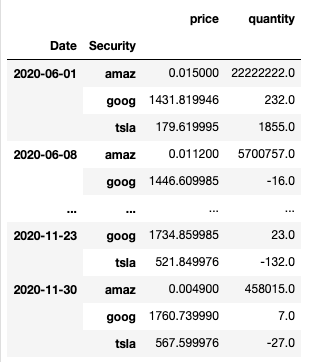

# Get trade details

bt_res.get_transactions()

Let's practice!

Financial Trading in Python