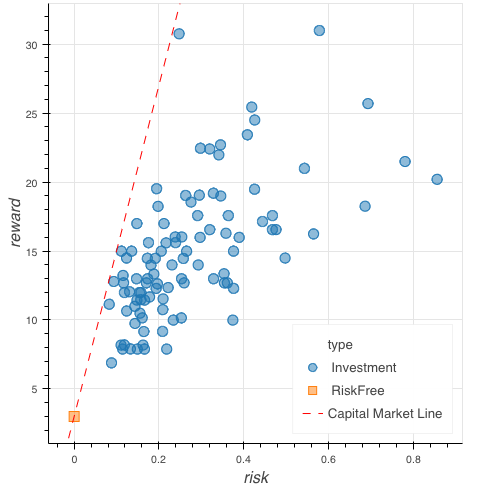

Traditional investing: risk vs reward

Data-Driven Decision Making for Business

Ted Kwartler

Data Dude

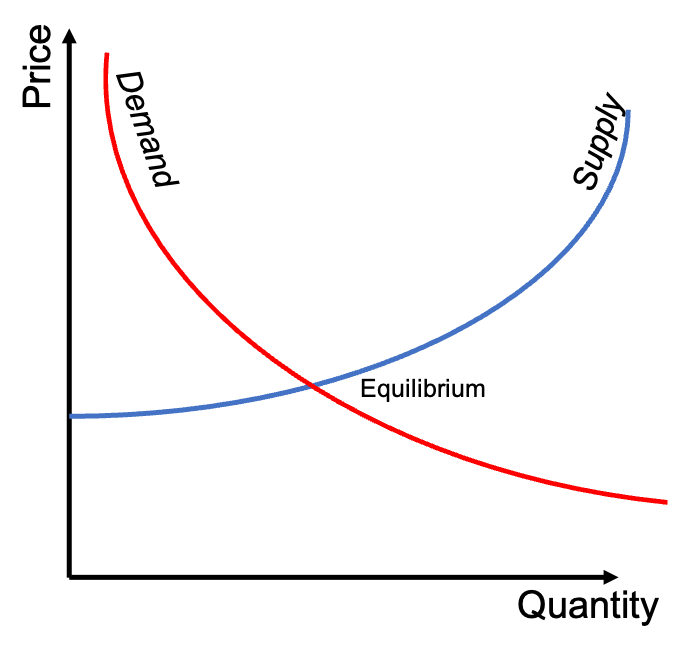

What is a market?

Traditional markets

Infrastructure where parties exchange goods

- Stock Markets

- Bond Markets

- Housing/Mortgages

- Commodities: gold/silver etc

- Crop Futures: corn/soybean

- Consumer Credit

Supply and demand

Investment strategies

- Belief-based investing

- High-frequency trading

- Financial fundamentals

- Technical trading rules

Belief-based investing

Buy the companies you believe will perform well or want to support

- "I bought stock in my favorite streaming service"

- "It was so busy last time I was there, I bought stock in my favorite fast food restaurant"

- "I won't buy stocks that produce tobacco"

High-frequency trading (HFT)

Providing liquidity or taking advantage?

- Highly automated

- No human in the loop

- Need speed, volume, and volatility to succeed

- Jump you in line and make money on your stock order

- Requires servers close to the market's data centers

Financial fundamentals

Buy the companies demonstrating financial indicator strength

- "I bought stock X because they have excellent revenue growth"

- "I don't care if they are gun manufacturer, their dividend is high."

Technical trading rules (TTR)

Trade based on mathematical indications

- "The MACD crossover is positive for this stock so I bought it"

- "The relative strength indicator shows a stock is overbought, so I decided to sell"

Capital Asset Pricing Model (CAPM)

Expected return of investment (ER) =

Risk free rate + (Beta * (Expected market return - Risk free rate))

- Beta (risk of the investment): how a stock moves with respect to the market

- Beta between 0-1: stock is less volatile than the market

- Beta > 1: stock is more volatile than the market

- Risk free rate: rate of return for an investment that never defaults

- In practice: 3-month US Treasury bill's interest rate minus inflation

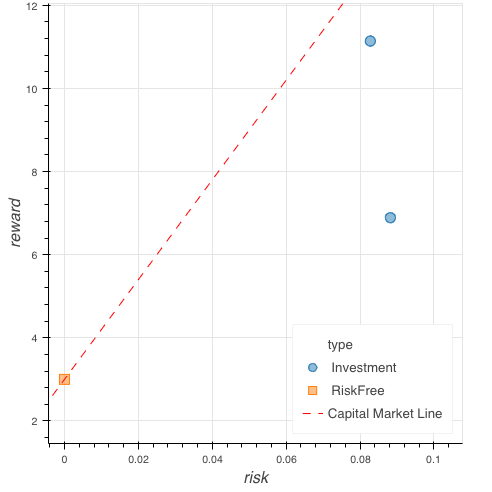

Capital Asset Pricing Model (CAPM)

Expected return of investment (ER) =

Risk free rate + (Beta * (Expected market return - Risk free rate))

Example

- Risk free rate =0.03

- Expected market return = 0.09

- Beta of stock X = 0.5

ER = .03 + .5(.09 - .03)

ER = .03 + .5(.06)

ER = .03 + .03 = 0.06

Interpreting a CAPM chart

1 https://www.investopedia.com/terms/c/capm.asp

Data-driven investing!

Data-Driven Decision Making for Business