Weibull model with covariates

Survival Analysis in Python

Shae Wang

Senior Data Scientist

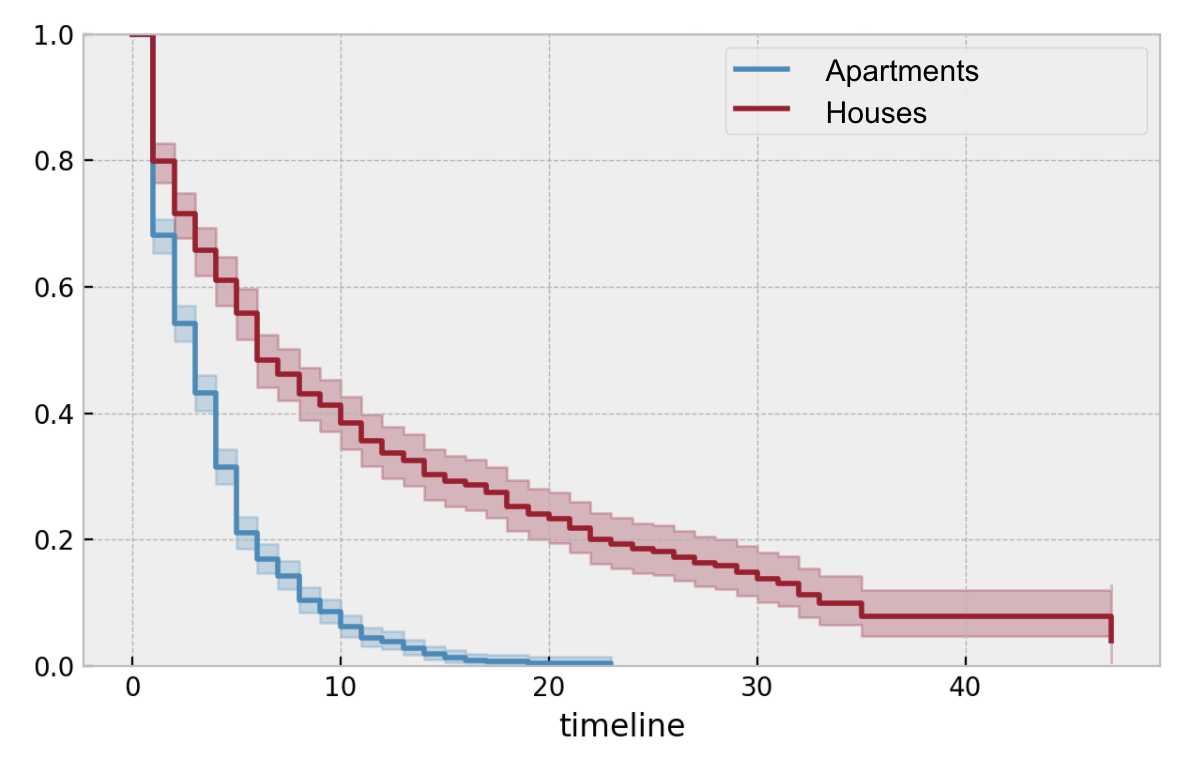

Comparing survival functions

Compare groups using the Kaplan-Meier estimator:

Compare groups using the log-rank test:

<lifelines.StatisticalResult: logrank_test>

null_distribution = chi squared

degrees_of_freedom = 1

test_name = logrank_test

test_statistic p -log2(p)

0.09 0.77 0.38

Q: How do we assess if/how one or multiple continuous variables affect the survival function?

Survival regression

- A method that models survival functions with covariates

- Quantifies how each covariate affects the survival function

$$Y_i=f(X_i,\beta)$$

$$Y_i: \text{durations}, X_i: \text{covariates}$$

- Example covariates: age, weight, country

The Accelerated Failure Time (AFT) model

$$\text{Population A}: S_A(t)$$

$$\text{Population B}: S_B(t)$$

$$S_A(t)=S_B(t*\lambda)$$

$S_B(t)$ is speeding up (accelerating) or slowing down (decelerating) along $S_A(t)$ by a factor of $\lambda$.

AFT models this acceleration/deceleration relationship based on model covariates.

- When a covariate changes from $a$ to $b$, time-to-event speeds up or slows down by the accelerated failure rate $\lambda$.

- Example: $S_{dog}(t)=S_{human}(t*7)$

Data for survival regression

DataFrame example: mortgage_df

| id | property_type | principal | interest | property_tax | credit_score | duration | paid_off |

|---|---|---|---|---|---|---|---|

| 1 | house | 1275 | 0.035 | 0.019 | 780 | 25 | 0 |

| 2 | apartment | 756 | 0.028 | 0.020 | 695 | 17 | 1 |

| 3 | apartment | 968 | 0.029 | 0.017 | 810 | 5 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 1000 | house | 1505 | 0.041 | 0.023 | 750 | 30 | 1 |

Combining Weibull with AFT: the Weibull AFT model

- DataFrame:

mortgage_df - Covariates:

property_typeis replaced with a dummy variable:house: 1 if "house", 0 if "apartment"

principalinterestproperty_taxcredit_score

- Import and instantiate the

WeibullAFTFitterclassfrom lifelines import WeibullAFTFitter aft = WeibullAFTFitter() - Call

.fit()to fit the estimator to the dataaft.fit(df=mortgage_df, duration_col="duration", event_col="paid_off")

Interpreting model output

print(aft.summary)

<lifelines.WeibullAFTFitter: fitted with 1808 observations, 340 censored>

coef exp(coef) se(coef) z p

lambda_ house 0.04 1.04 0.01 0.99 0.32

principal -0.03 0.97 0.22 -1.04 0.30

interest 0.11 1.11 0.15 1.96 0.05

property_tax 0.31 1.36 0.27 1.15 0.25

credit_score -0.16 0.85 0.14 -2.33 0.02

Intercept 3.99 54.06 0.41 9.52 <0.0005

rho_ Intercept 0.34 1.40 0.08 3.80 <0.0005

WeibullAFTFitter with custom formula

Using formula to handle custom model covariates:

aft.fit(df=mortgage_df,

duration_col="duration",

event_col="paid_off",

formula="principal + interest * house")

Analogous to the linear model with interaction term:

$\beta_1$principal$+\beta_2$interest$+\beta_3$house$+\beta_4$interest$\cdot$house

Interpreting model output

print(aft.summary)

<lifelines.WeibullAFTFitter: fitted with 1808 observations, 340 censored>

coef exp(coef) se(coef) z p

lambda_ principal -0.03 0.97 0.22 -1.04 0.30

interest 0.11 1.11 0.15 1.96 0.05

house 0.04 1.04 0.01 0.99 0.32

interest:house 0.06 1.06 0.14 0.42 0.64

Intercept 3.99 54.06 0.41 9.52 <0.0005

rho_ Intercept 0.34 1.40 0.08 3.80 <0.0005

Let's practice!

Survival Analysis in Python