Factors affecting duration

Bond Valuation and Analysis in Python

Joshua Mayhew

Options Trader

Duration as an 'average' time

The 'average' time taken to get your money back

Waiting longer = more exposed to interest rates

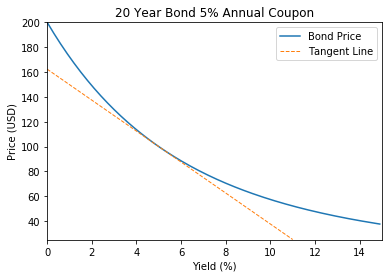

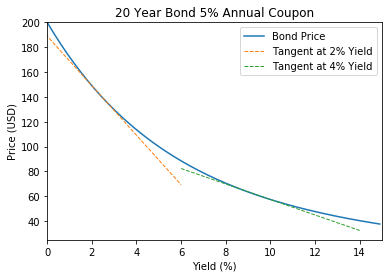

Duration as the slope of the tangent line

Duration is the derivative (rate of change) of price with respect to yield

The slope of the tangent line is the duration

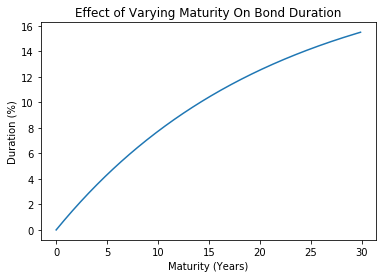

Maturity vs. duration

- Longer maturity = wait longer to get money back

- Wait longer = more exposed to interest rate changes

- Longer maturity = higher duration

Coupon rate vs. duration

- Higher coupon = shorter wait to get money back 'on average'

- So less exposed to interest rate changes

- Therefore higher coupon = lower duration

- Zero coupon bonds have higher duration than coupon bonds

Bond yield vs. duration

- Bond price curve is steeper for lower yields

- Lower yields = higher sensitivity to interest rates = higher duration

Ways of investigating duration

We can investigate the different factors affecting duration by:

- Varying one factor and directly calculating the duration

- Plotting a price/yield graph and seeing where it is most steep

- Plotting a duration/factor graph

Plotting bond maturity against duration

import numpy as np

import numpy_financial as npf

import pandas as pd

import matplotlib.pyplot as plt

bond_maturity = np.arange(0, 30, 0.1)bond = pd.DataFrame(bond_maturity, columns=['bond_maturity'])bond['price'] = -npf.pv(rate=0.05, nper=bond['bond_maturity'], pmt=5, fv=100)bond['price_up'] = -npf.pv(rate=0.05 + 0.01, nper=bond['bond_maturity'], pmt=5, fv=100)bond['price_down'] = -npf.pv(rate=0.05 - 0.01, nper=bond['bond_maturity'], pmt=5, fv=100)bond['duration'] = (bond['price_down'] - bond['price_up']) / (2 * bond['price'] * 0.01)

Plotting bond maturity against duration

plt.plot(bond['bond_maturity'], bond['duration'])plt.xlabel('Maturity (Years)')plt.ylabel('Duration (%)')plt.title("Effect of Varying Maturity On Bond Duration")plt.show()

Summary

The duration of a bond will increase for a:

- Higher maturity

- Lower coupon rate

- Lower level of yields

Let's practice!

Bond Valuation and Analysis in Python