Factors affecting convexity

Bond Valuation and Analysis in Python

Joshua Mayhew

Options Trader

Convexity is a benefit

- Bond prices rise more when yields decrease, fall less when yields increase

Investigating convexity

- Compare the convexity of two bonds directly

- Plot a graph of factor against convexity

- Directly examine the curvature of the price/yield relationship

Coupon vs. convexity

- 10 year bonds with 5% yield, first pays no coupon, second pays 10% coupon

price_1 = -npf.pv(rate=0.05, nper=10, pmt=0, fv=100)price_up_1 = -npf.pv(rate=0.06, nper=10, pmt=0, fv=100)price_down_1 = -npf.pv(rate=0.04, nper=10, pmt=0, fv=100)convexity_1 = (price_down_1 + price_up_1 - 2 * price_1) / (price_1 * 0.01 ** 2)

price_2 = -npf.pv(rate=0.05, nper=10, pmt=10, fv=100)

price_up_2 = -npf.pv(rate=0.06, nper=10, pmt=10, fv=100)

price_down_2 = -npf.pv(rate=0.04, nper=10, pmt=10, fv=100)

convexity_2 = (price_down_2 + price_up_2 - 2 * price_2) / (price_2 * 0.01 ** 2)

print("Low Coupon Bond Convexity: ", convexity_1)

print("High Coupon Bond Convexity: ", convexity_2)

Low Coupon Bond Convexity: 99.89

High Coupon Bond Convexity: 64.09

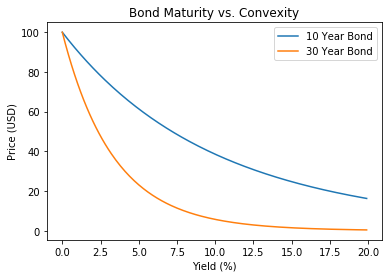

Maturity vs. convexity

bond_yields = np.arange(0, 20, 0.1)

bond = pd.DataFrame(bond_yields, columns=['yield'])

bond['price_10y'] = -npf.pv(rate=bond['yield'] / 100,

nper=10, pmt=0, fv=100)

bond['price_30y'] = -npf.pv(rate=bond['yield'] / 100,

nper=30, pmt=0, fv=100)

plt.plot(bond['yield'], bond['price_10y'])

plt.plot(bond['yield'], bond['price_30y'])

plt.xlabel('Yield (%)')

plt.ylabel('Price (USD)')

plt.title('Bond Maturity vs. Convexity')

plt.legend(["10 Year Bond", "30 Year Bond"])

plt.show()

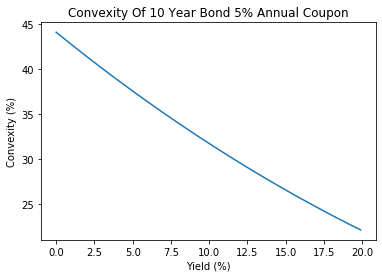

Yield vs. convexity

bond_yields = np.arange(0, 20, 0.1) bond = pd.DataFrame(bond_yields, columns=['bond_yield'])bond['price'] = -npf.pv(rate=bond['bond_yield'] / 100, nper=10, pmt=5, fv=100)

bond['price_up'] = -npf.pv(rate=bond['bond_yield'] / 100

+ 0.01, nper=10, pmt=5, fv=100)

bond['price_down'] = -npf.pv(rate=bond['bond_yield'] / 100

- 0.01, nper=10, pmt=5, fv=100)

bond['convexity'] = (bond['price_down'] + bond['price_up']

- 2 * bond['price']) / (bond['price'] * 0.01 ** 2)

plt.plot(bond['bond_yield'], bond['convexity'])

plt.xlabel('Yield (%)')

plt.ylabel('Convexity (%)')

plt.title("Convexity Of 10 Year Bond 5% Annual Coupon")

plt.show()

Summary

- Positive convexity is a benefit:

- Lose less when yields rise, make more when yields fall

- Convexity increases when a bond has a:

- Higher maturity

- Lower coupon

- Lower yield

Let's practice!

Bond Valuation and Analysis in Python