Present value & zero coupon bonds

Bond Valuation and Analysis in Python

Joshua Mayhew

Options Trader

Present Value

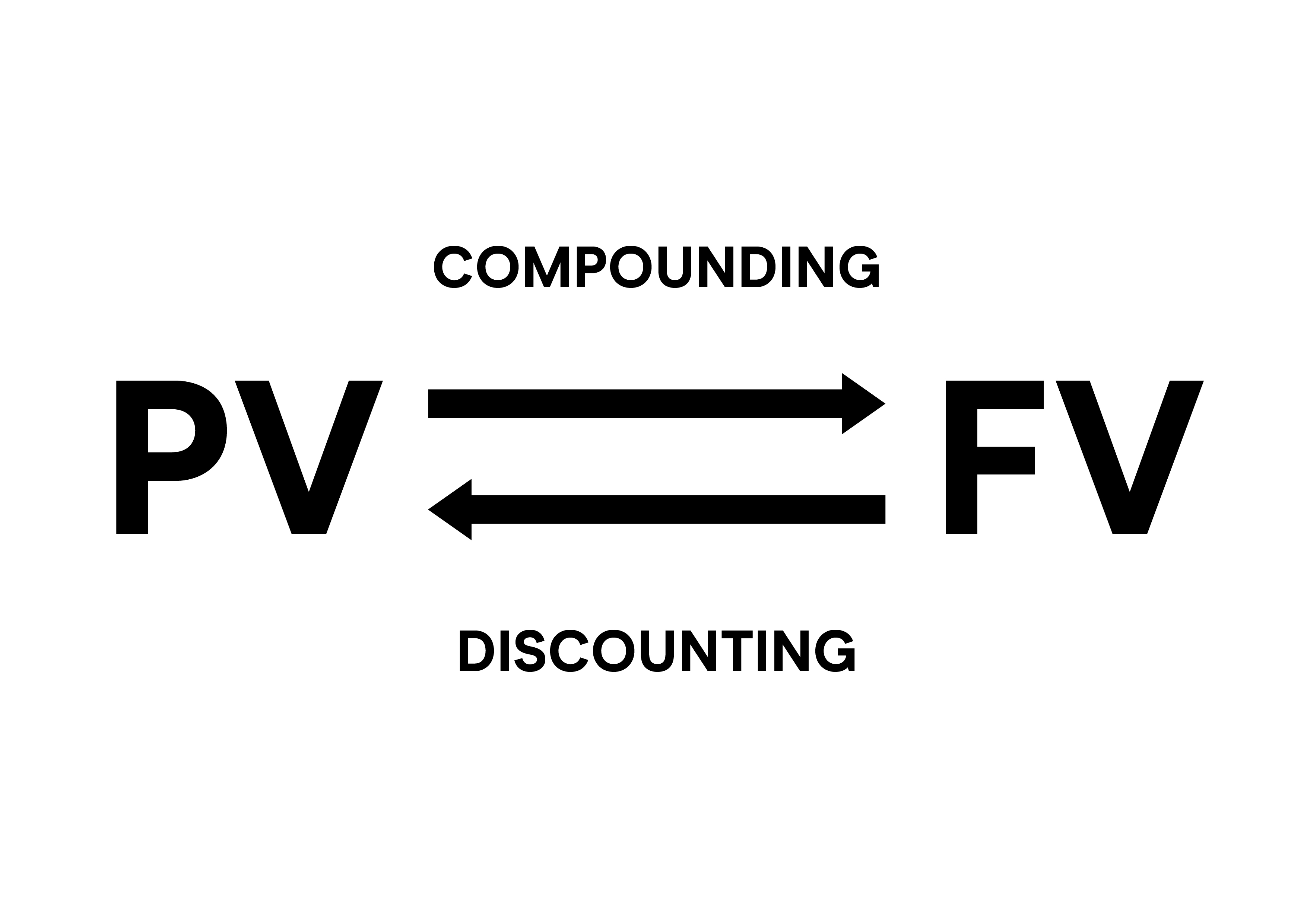

- Money compounds from its value today to its value in the future

- This process also works in reverse

Present Value

- We can rearrange our compound interest equation from earlier:

$FV = PV \times (1 + r)^n$

$PV = \frac{FV}{(1 + r)^n}$

- Called "discounting to present value" or just "discounting"

Present Value

- To move from present value to future value, we compound

- To move from future value to present value, we discount

Present Value

A higher interest rate or longer time period increases the FV

So a higher interest rate or longer time period must decrease the PV

The pv() function

import numpy_financial as npf

?npf.pv

Signature: npf.pv(rate, nper, pmt, fv=0) Docstring: Compute the present value.Given: * a future value, `fv`* an interest `rate` compounded once per period, of which there are* `nper` total* a (fixed) payment, `pmt`Return: the value now

The pv() function

- How much should we invest now at 5% per year to have USD 10,000 in 10 years?

import numpy_financial as npf

npf.pv(rate=0.05, nper=10, pmt=0, fv=10000)

-6139.13

-npf.pv(rate=0.05, nper=10, pmt=0, fv=10000)

6139.13

The pv() function

- Or, by rearranging our compound interest equation from earlier:

pv = 10000 / (1 + 0.05) ** 10

print(pv)

6139.13

Bonds introduction

- Debt instrument, issued by governments and companies

- Investors buy bonds in exchange for interest

- Provide relatively safe and consistent returns

- Are usually less risky and volatile than stocks

Zero coupon bonds

- Pays a single cash-flow called the face value

- Paid at a single point in time called the maturity

- No intermediate cash-flows (called coupons) paid until maturity, hence the name

- Their price is the PV of the single cash-flow

Zero coupon bonds

- Usually issued at a discount to their face value

- This difference is called the yield (measured in percent)

Zero coupon bonds

Let's look at an example of a zero coupon bond that:

- Has a 3 year maturity

- A face value of USD 100

- A yield of 3.5%

What is the price of this bond?

Zero coupon bonds

- Zero coupon bond with a 3 year maturity that yields 3.5% and has a face value of USD 100:

import numpy_financial as npf

-npf.pv(rate=0.035, nper=3, pmt=0, fv=100)

90.19

- Or, again by rearranging our compound interest equation from earlier:

pv = 100 / (1 + 0.035) ** 3

print(pv)

90.19

Let's practice!

Bond Valuation and Analysis in Python