Bond prices vs. bond yields

Bond Valuation and Analysis in Python

Joshua Mayhew

Options Trader

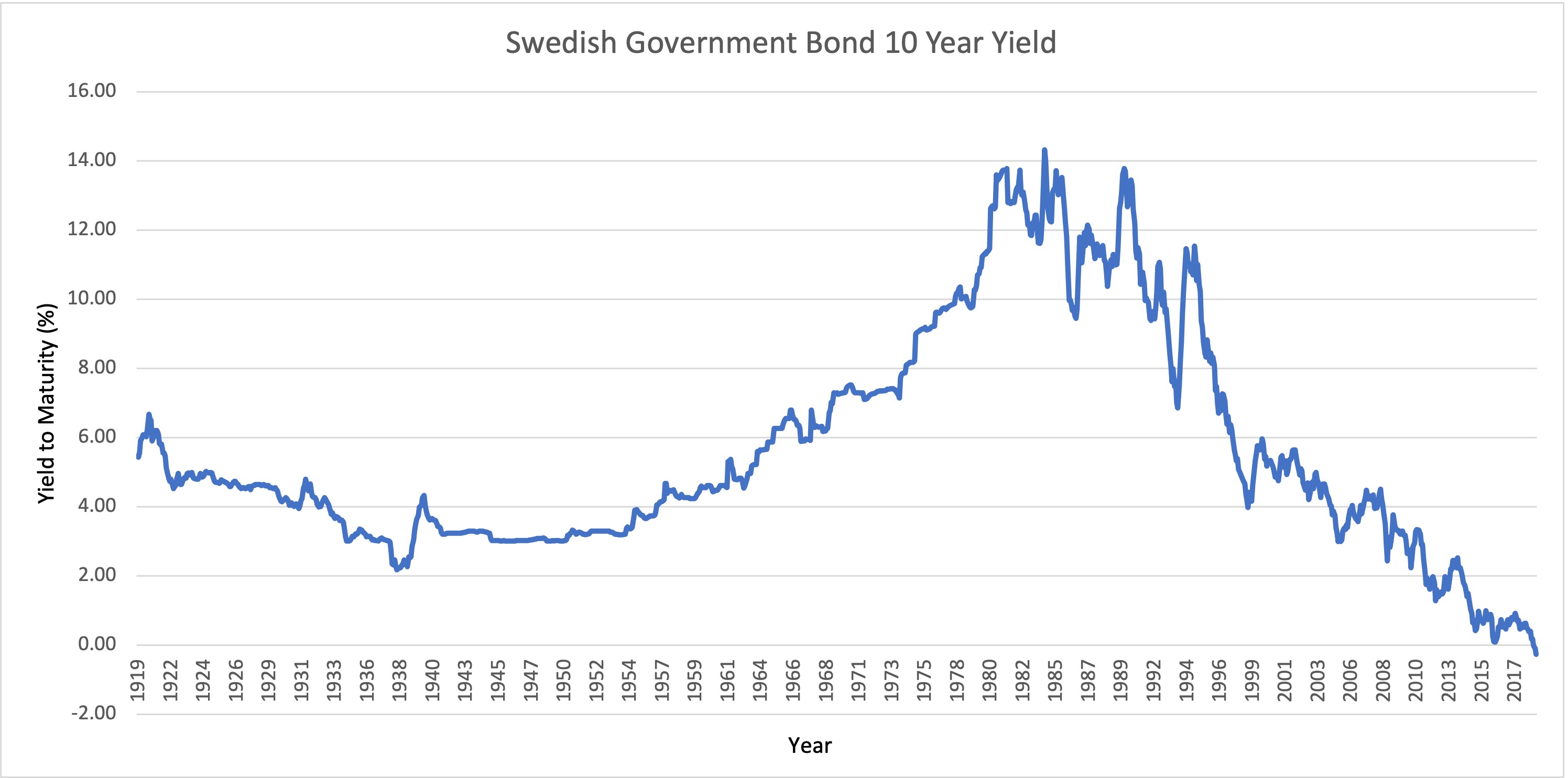

Historical government bond yields

Plotting bond prices vs. yields

import numpy as np

import numpy_financial as npf

import pandas as pd

import matplotlib.pyplot as plt

bond_yields = np.arange(0, 20, 0.1)

print(bond_yields)

[0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 1.1 1.2 1.3

...

18.5 18.6 18.7 18.8 18.9 19.0 19.1 19.2 19.3 19.4 19.5 19.6 19.7 19.8 19.9]

Plotting bond prices vs. yields

bond = pd.DataFrame(bond_yields, columns=['bond_yield'])

print(bond)

bond_yield

0 0.0

1 0.1

.. ...

198 19.8

199 19.9

[200 rows x 1 columns]

Plotting bond prices vs. yields

bond['bond_price'] = -npf.pv(rate=bond['bond_yield'] / 100, nper=10, pmt=5, fv=100)

print(bond)

bond_yield bond_price

0 0.0 150.000000

1 0.1 148.731575

.. ... ...

198 19.8 37.527719

199 19.9 37.319493

[200 rows x 2 columns]

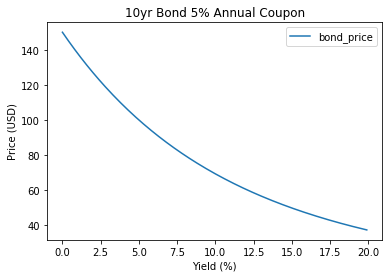

Plotting bond prices vs. yields

plt.plot(bond['bond_yield'], bond['bond_price'])plt.xlabel('Yield (%)')plt.ylabel('Bond Price (USD)')plt.title("10 Year Bond 5% Annual Coupon")plt.show()

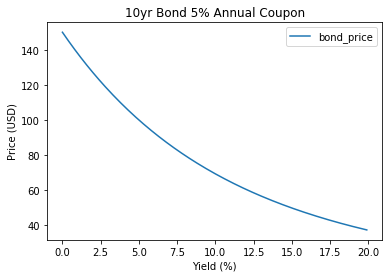

The relationship between price and yield

Prices move inversely to yields

Higher yield = higher discount rate = lower PV

Higher price lowers the return on investment (yield)

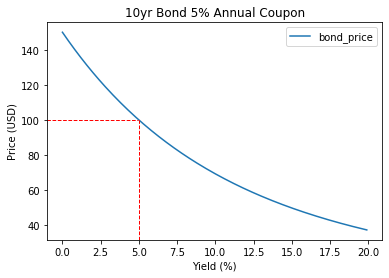

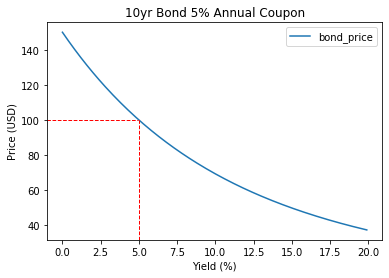

The relationship between price and yield

Bond premium vs. bond discount

Premium: Price > 100, Yield < Coupon

Discount: Price < 100, Yield > Coupon

Par: Price = 100, Yield = Coupon

The relationship between price and yield

Price/yield relationship is non-linear

The line we have plotted is not a straight line

This is due to something called convexity

The relationship between price and yield

Summary of key points:

- Prices and yields move inversely

- Premium: Price > 100, Yield < Coupon

- Discount: Price < 100, Yield > Coupon

- Par: Price = 100, Yield = Coupon

- The price/yield relationship is non-linear

Let's practice!

Bond Valuation and Analysis in Python