International equity portfolio

Quantitative Risk Management in R

Alexander McNeil

Instructor

International equity portfolio

- Imagine a UK investor who has invested her wealth:

- 30% FTSE, 40% S&P 500, 30% SMI

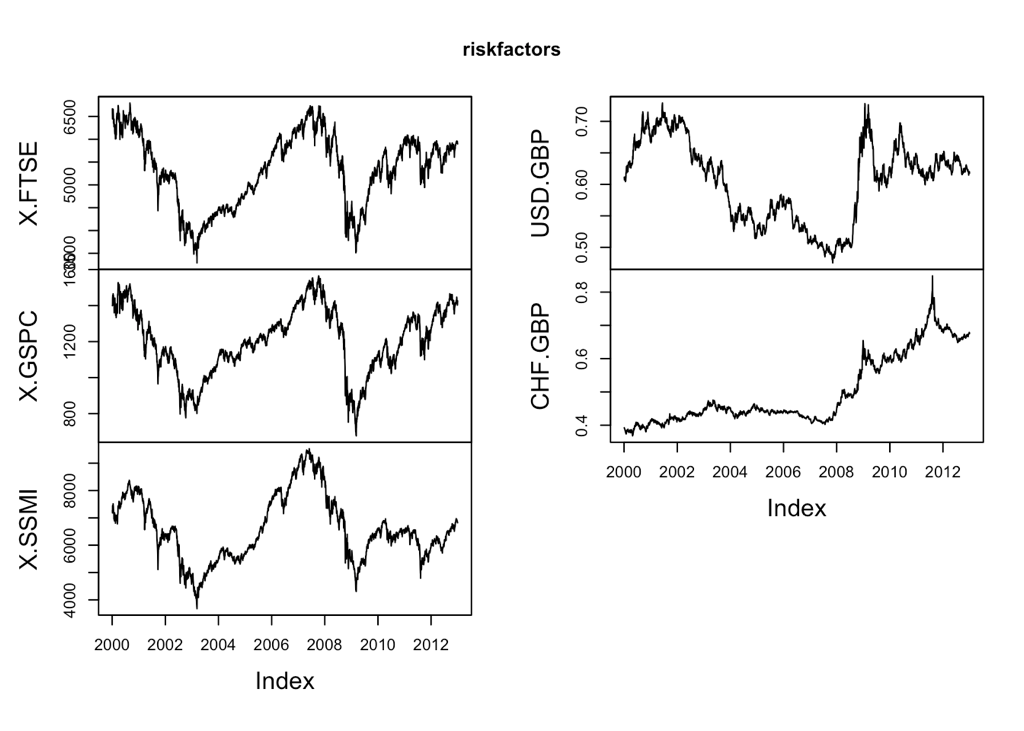

- 5 risk factors: FTSE, S&P 500 and SMI indexes, GBP/USD and GBP/CHF exchange rate

riskfactors <- merge(FTSE, SP500, SMI, USD_GBP, CHF_GBP, all = FALSE)["/2012-12-31", ]

Displaying the risk factors

plot.zoo(riskfactors)

Historical simulation

- Simple method that is widely used in financial industry

- Resample historical risk-factor returns and examine their effect on current portfolio

- Loss operator shows effect of different risk-factor returns on the portfolio

- Loss operator functions will be provided in the exercises

Empirical estimates of VaR and ES

losses <- rnorm(100)

losses_o <- sort(losses, decreasing = TRUE)

head(losses_o, n = 8)

1.836163 1.775163 1.745427 1.614479 1.602120 1.590034 1.483691 1.408354

quantile(losses, 0.95)

95%

1.590638

qnorm(0.95)

1.644854

Empirical estimates of VaR and ES

mean(losses[losses > quantile(losses, 0.95)])

1.714671

ESnorm(0.95)

2.062713

Let's practice!

Quantitative Risk Management in R