Risk-factor returns

Quantitative Risk Management in R

Alexander McNeil

Professor, University of York

Risk-factor returns

- Changes in risk factors are risk-factor returns or returns

- Let ($Z_t$) denote a time series of risk factor values

Common definitions of returns ($X_t$)

$X_t = Z_t - Z_{t-1}$ (simple returns)

$X_t = \dfrac{Z_t - Z_{t-1}}{Z_{t-1}}$ (relative returns)

- 0.02 = 2% gain, -0.03 = 3% loss

- $X_t = \ln(Z_t) - \ln(Z_{t-1})$ (log-returns)

Properties of log-returns

- Resulting risk factors cannot become negative

Very close to relative returns for small changes:

- $\ln(Z_t) - \ln(Z_{t-1}) \approx \dfrac{Z_t-Z_{t-1}}{Z_{t-1}}$

- Easy to aggregate by summation to obtain longer-interval log-returns

- Independent normal if risk factors follow geometric Brownian motion (GBM)

Log-returns in R

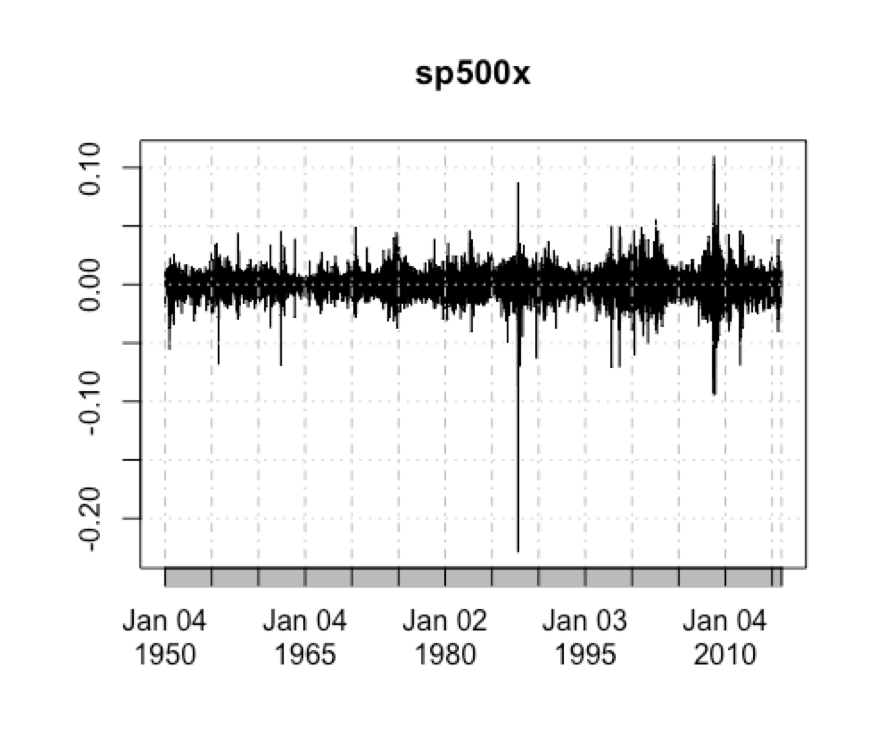

sp500x <- diff(log(SP500))

head(sp500x, n = 3) # note the NA in first position

^GSPC

1950-01-03 NA

1950-01-04 0.011340020

1950-01-05 0.004736539

sp500x <- diff(log(SP500))[-1]

head(sp500x)

^GSPC

1950-01-04 0.011340020

1950-01-05 0.004736539

1950-01-06 0.002948985

1950-01-09 0.005872007

1950-01-10 -0.002931635

1950-01-11 0.003516944

Log-returns in R (2)

plot(sp500x)

Let's practice!

Quantitative Risk Management in R