Skewness, kurtosis and the Jarque-Bera test

Quantitative Risk Management in R

Alexander McNeil

Professor, University of York

Skewness and kurtosis

- Skewness (b) is a measure of asymmetry

- Kurtosis (k) is a measure of heavy-tailedness

- Skewness and kurtosis of normal are 0 and 3, respectively

$$ = {1 \over n}\sum_{t=1}^n(X_t-\hat{\mu})^3 \over \hat{\sigma}^3 $$

$$ = {1 \over n}\sum_{t=1}^n(X_t-\hat{\mu})^4 \over \hat{\sigma}^4 $$

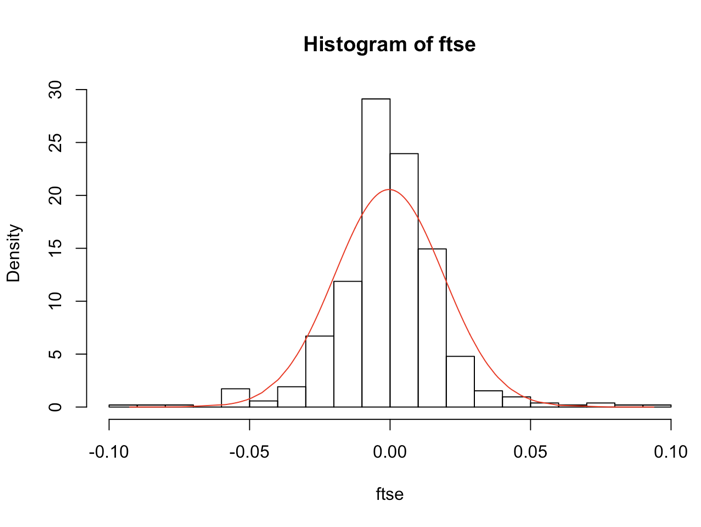

Skewness and kurtosis (II)

library(moments)

skewness(ftse)

-0.01187921

kurtosis(ftse)

7.437121

The Jarque-Bera test

- Compares skewness and kurtosis of data with theoretical normal values (0 and 3)

- Detects skewness, heavy tails, or both

$$ T = {1 \over 6}n\left(b^2 + \frac{1}{4}(k - 3)^2\right) $$

jarque.test(ftse)

Jarque-Bera Normality Test

data: ftse

JB = 428.23, p-value < 2.2e-16

alternative hypothesis: greater

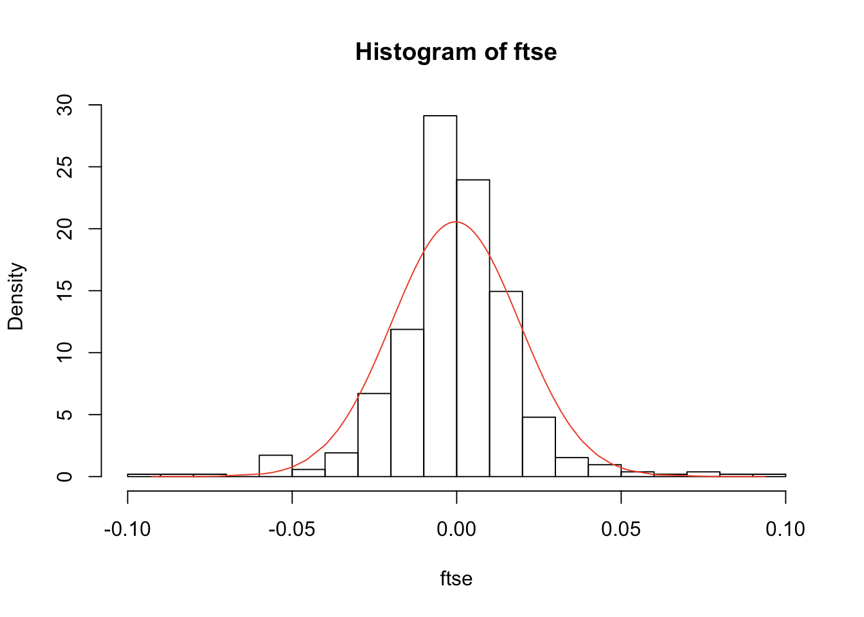

Longer-interval and overlapping returns

- Daily returns are usually very non-normal

- What about longer-intervals returns?

- Weekly, monthly, quarterly returns obtained by summation

- Recall CLT - suggests they may be more normal

- Reduce quantity of data so tests are weaker

- Can also analyze overlapping or moving sums of returns

Let's practice!

Quantitative Risk Management in R