Welcome to the course!

Quantitative Risk Management in R

Alexander McNeil

Professor, University of York

About me

- Professor in mathematical statistics, actuarial science, and quantitative finance

- Author of Quantitative Risk Management: Concepts, Techniques & Tools with R. Frey and P. Embrechts

- Creator of qrmtutorial.org with M. Hofert

- Contributor to R packages including qrmdata and qrmtools

The objective of QRM

- In quantitative risk management (QRM), we quantify the risk of a portfolio

- Measuring risk is first step towards managing risk

- Managing risk:

- Selling assets, diversifying portfolios, implementing hedging with derivatives

- Maintaining sufficient capital to withstand losses

- Value-at-risk (VaR) is a well-known measure of risk

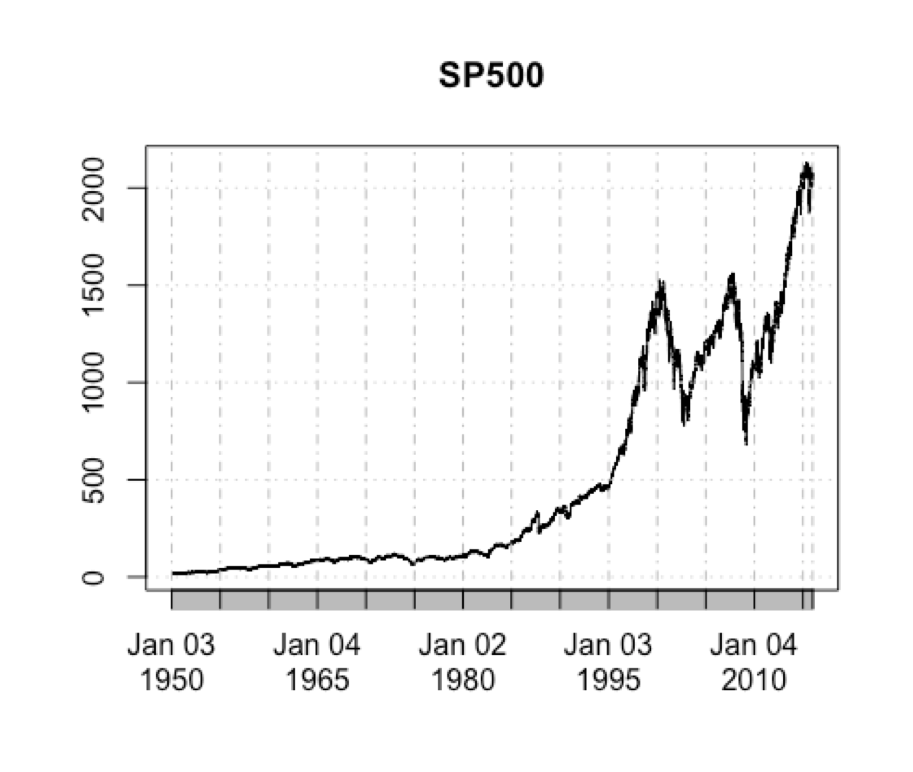

Risk factors

- Value of a portfolio depends on many risk factors

- Examples: equity indexes/prices, FX rates, interest rates

- Let's look at the S&P 500 index

Analyzing risk factors with R

library(qrmdata)

data(SP500)

head(SP500, n = 3)

^GSPC

1950-01-03 16.66

1950-01-04 16.85

1950-01-05 16.93

> tail(SP500, n = 3)

^GSPC

2015-12-29 2078.36

2015-12-30 2063.36

2015-12-31 2043.94

Plotting risk factors

plot(SP500)

Let's practice!

Quantitative Risk Management in R