Value-at-risk and expected shortfall

Quantitative Risk Management in R

Alexander McNeil

Professor, University of York

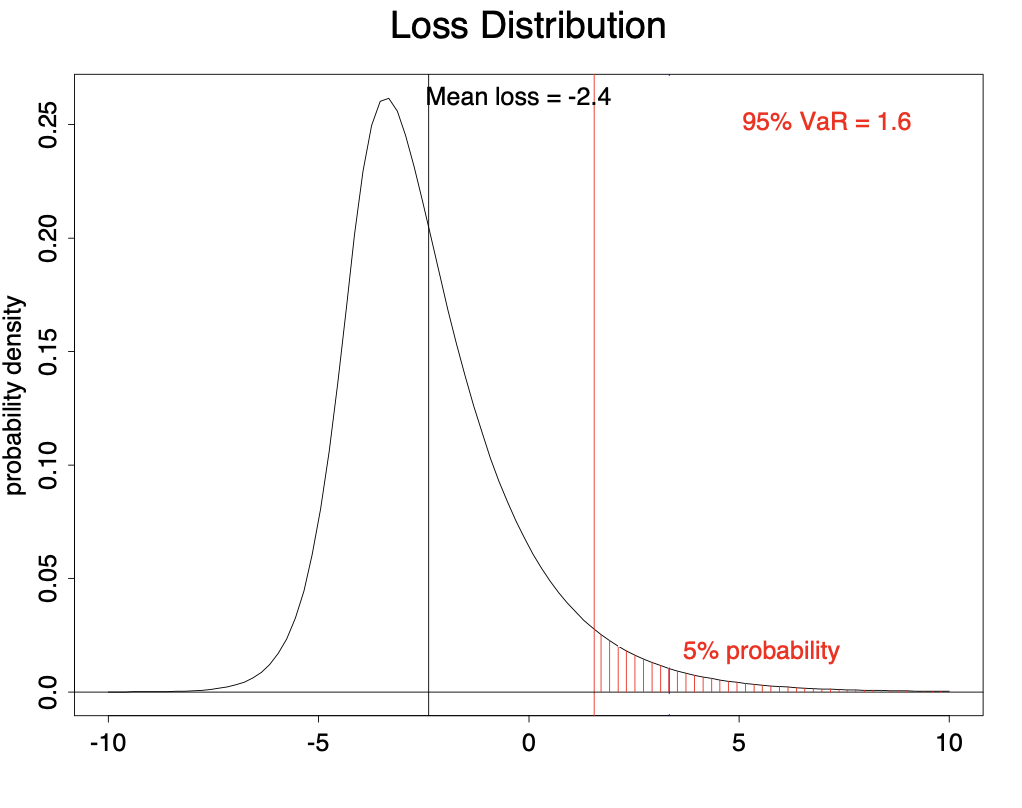

Value-at-risk (VaR)

- Consider the distribution of losses over a fixed time period (day, week, etc.)

- $\alpha$-VaR is the $\alpha$-quantile of the loss distribution

- $\alpha$ known as confidence level (e.g. 95%, 99%)

- Should lose no more than $\alpha$-VaR with probability $\alpha$

95% VaR illustrated

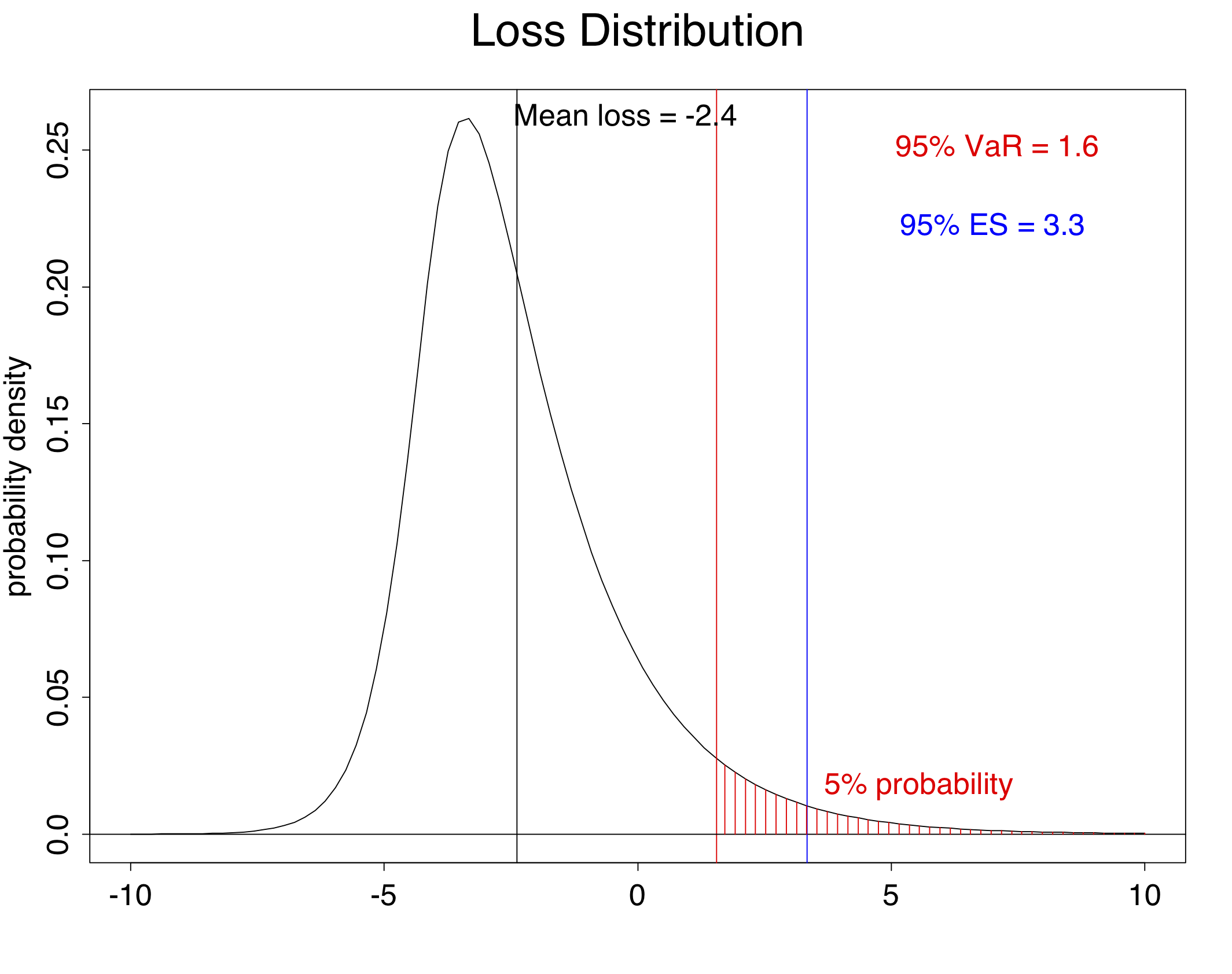

Expected shortfall (ES)

- Increasingly important in banking regulation

- Tail VaR (TVaR), conditional VaR (CVaR) or expected shortfall (ES)

- $\alpha$-ES is expected loss given that loss exceeds $\alpha$-VaR

- Expectation of tail of distribution

95% of ES illustrated

Let's practice!

Quantitative Risk Management in R