Option portfolio and Black Scholes

Quantitative Risk Management in R

Alexander McNeil

Instructor

European options and Black-Scholes

- European call option: gives right but not obligation to buy stock for price K at time T

- European put option: gives right but not obligation to sell stock for price K at T

- Value at time t < T depends on:

- Stock price S, time to maturity T-t, interest rate r, annualized volatility $\sigma$ or sigma

- Pricing by Black-Scholes formula

Pricing a first call option

K <- 50T <- 2t <- 0S <- 40r <- 0.005sigma <- 0.25Black_Scholes(t, S, r, sigma, K, T, "call")

2.619183

Black_Scholes(t, S, r, sigma*1.2, K, T, "call")

3.677901

- Price increases with volatility

- Option above is out-of-the-money

Implied volatility X needs change

- Volatility not directly observable

- Market participants use implied volatility, the value of volatility implied by quoted option price

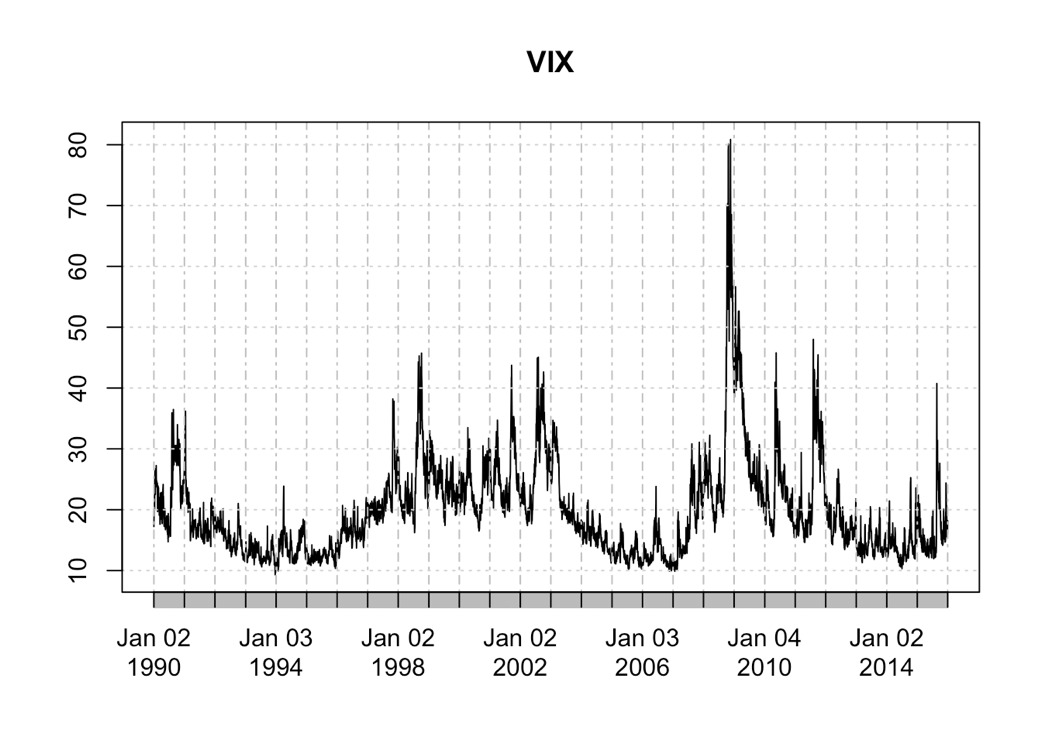

The VIX index

plot(VIX)

Let's practice!

Quantitative Risk Management in R