Computing financial ratios using pandas

Analyzing Financial Statements in Python

Rohan Chatterjee

Risk Modeler

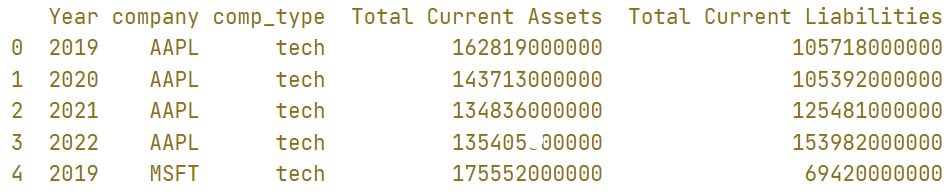

Structure of balance sheet data

- Balance sheet data loaded in

pandasDataFrame calledbalance_sheet.

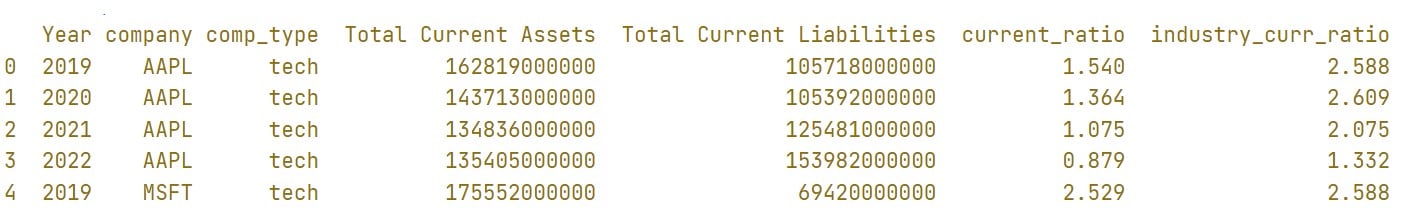

print(balance_sheet.head())

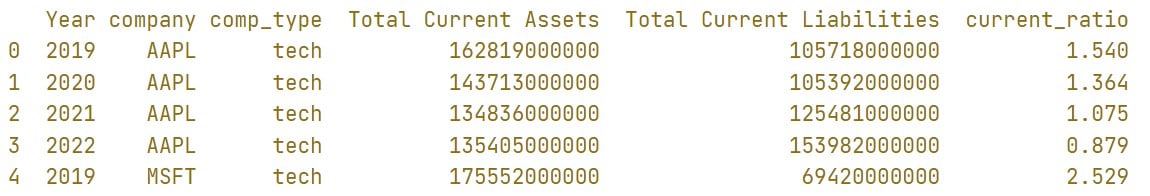

Computing current ratio

balance_sheet["current_ratio"] = balance_sheet["Total Current Assets"] /

balance_sheet["Total Current Liabilities"]

print(balance_sheet.head())

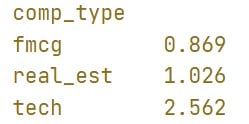

Using .groupby() to get results by group

- To get the average current ratio by industry:

balance_sheet.groupby("comp_type")["current_ratio"].mean()

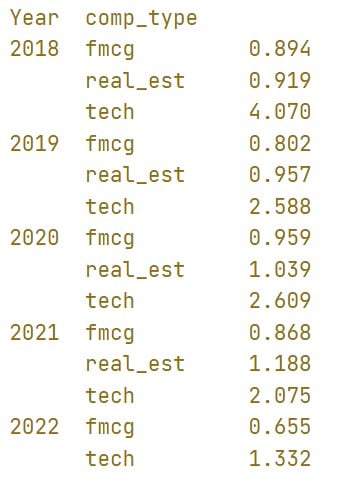

Using .groupby() to get results by group

balance_sheet.groupby(["Year","comp_type"])["current_ratio"].mean()

Using groupby().transform()

.transform()can be used after.groupby()to append the groupby result to rows according to the group each row belongs to.balance_sheet["industry_curr_ratio"] = balance_sheet.groupby([ "Year","comp_type"])["current_ratio"].transform("mean") print(balance_sheet.head())

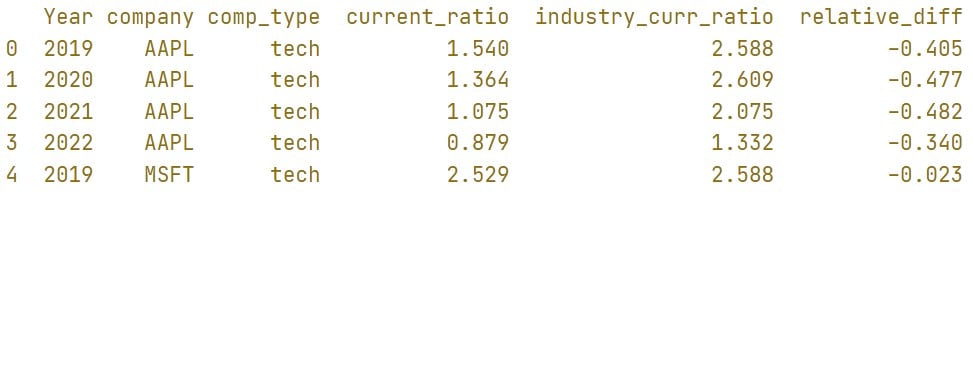

Using .groupby().transform()

balance_sheet["relative_diff"] =

(balance_sheet["current_ratio"] /

balance_sheet["industry_curr_ratio"]) - 1

Using .isin()

.isin()used to subset data for analysis.- Example: subset a DataFrame to show

fmcgandtechcompanies in the year 2019 and 2020:

fmcg_2019 = balance_sheet.loc[

(balance_sheet["Year"].isin([2019,2020])) &

(balance_sheet["comp_type"].isin(["tech","fmcg"]))

]

Let's practice!

Analyzing Financial Statements in Python