What is a mortgage?

Case Study: Mortgage Trading Analysis in Power BI

Nick Edwards

Capital Markets Analyst at Mynd

What is a loan agreement?

A loan agreement is the borrower's promise to repay the money to the lender.

- Essentially a repayment plan

What is a loan agreement?

Parts of a loan agreement:

- Loan amount

- Payment

- Principal

- Interest

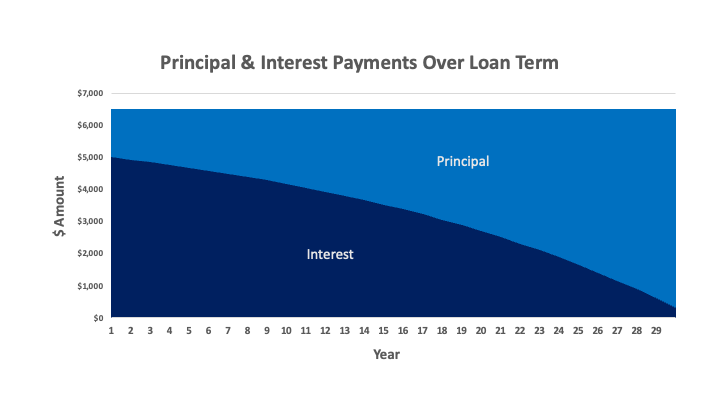

Principal

- Principal is the current balance on the loan

Interest

- The interest rate is the proportion of interest owed on the principal balance each period.

- Quoted as an annual rate

Interest

- The interest rate is the proportion of interest owed on the principal balance each period.

- Quoted as an annual rate

Example

What is the interest due this month on a principal balance of $100,000 at a 5% annual rate?

| Interest rate | Monthly interest rate | Principal Balance | Interest owed |

|---|---|---|---|

| 5% | $100,000 |

Interest

- The interest rate is the proportion of interest owed on the principal balance each period.

- Quoted as an annual rate

Example

What is the interest due this month on a principal balance of $100,000 at a 5% annual rate?

| Interest rate | Monthly interest rate | Principal Balance | Interest owed |

|---|---|---|---|

| 5% | 5% ÷ 12 = 0.417% | $100,000 |

Interest

- The interest rate is the proportion of interest owed on the principal balance each period.

- Quoted as an annual rate

Example

What is the interest due this month on a principal balance of $100,000 at a 5% annual rate?

| Interest rate | Monthly interest rate | Principal Balance | Interest owed |

|---|---|---|---|

| 5% | 5% ÷ 12 = 0.417% | $100,000 | 0.417% x 100,000 = $417 |

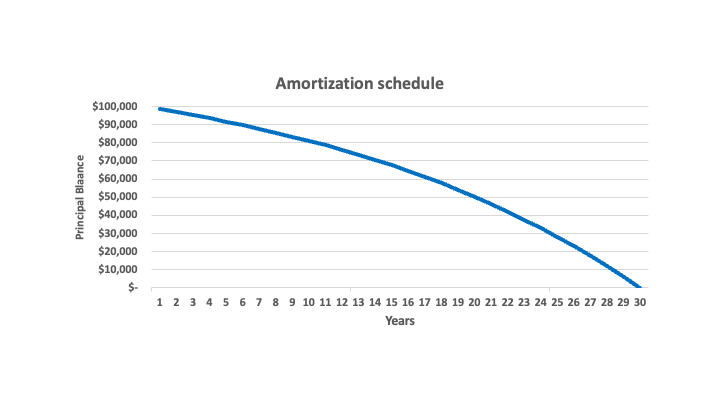

Amortizing

Amortizing in Power BI

Syntax

PPMT(<rate>, <per>, <nper>, <pv>[,<fv>,<type>])

- This produces a negative value!

- The rate needs to be adjusted!

Example: Find the principal amount on the first payment of a loan with a balance of $100,000 with a 5% annual interest rate and a 360 month term.

PPMT(.05/12, 1, 360, 100000) = ($-120.15)

Click here to review the syntax in further detail

Amortizing in Power BI

2 Steps to Amortize:

- Use

PPMT()to find the principal portion of a payment - Subtract the principal amount from the current loan balance

Example continue...

[Principal Balance] + [PPMT]

[$100,000] + [-$120.15]

$99,879.85

Mortgage qualification

- Credit score

- Missed payments reduce score as they show risk

- Ranges from 300 (lowest) to 850 (perfect)

- Debt-to-income (DTI) ratio

[Monthly debt payments] ÷ [Monthly income]- Generally needs to be under 50%

- Loan-to-value (LTV) ratio

[Loan amount] ÷ [Propert value]- The lender needs to know they can get their money back in case of foreclosure

- The lower, the better

Let's continue!

Case Study: Mortgage Trading Analysis in Power BI