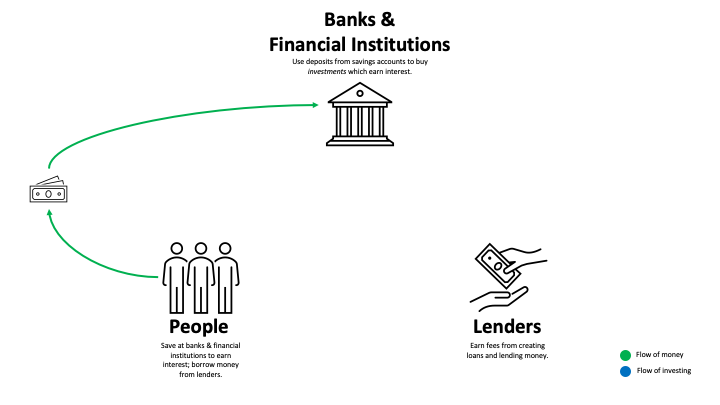

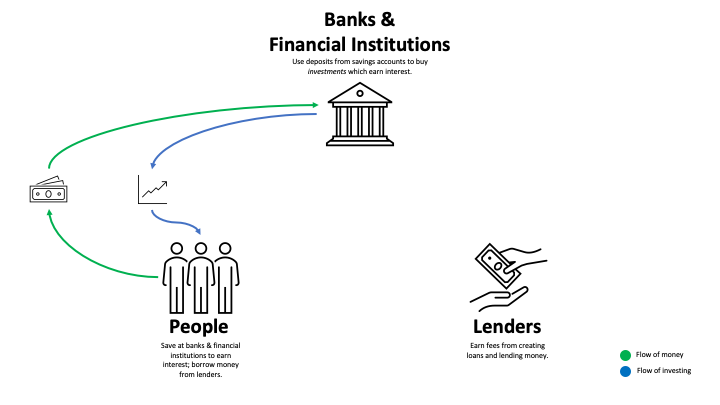

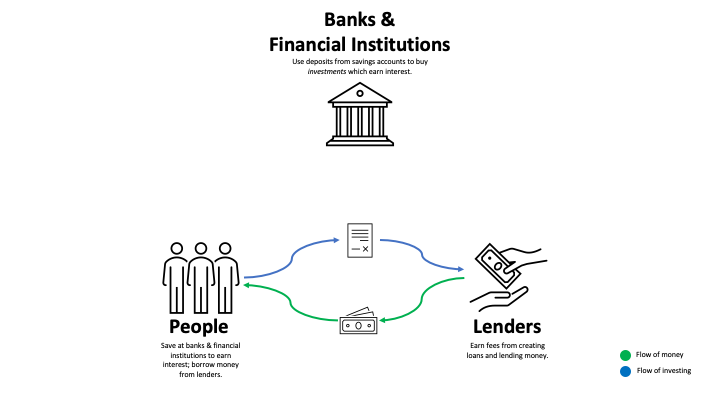

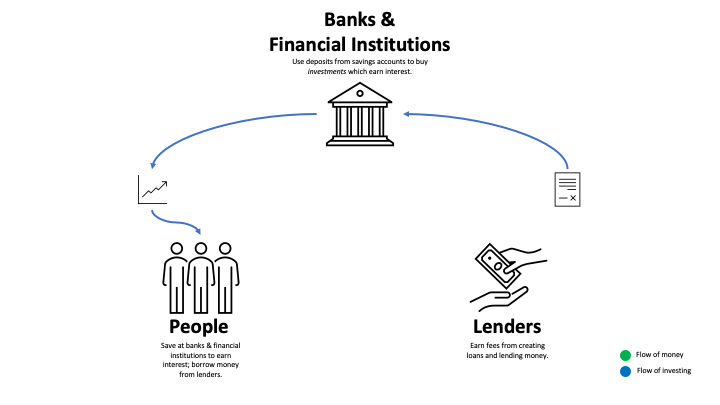

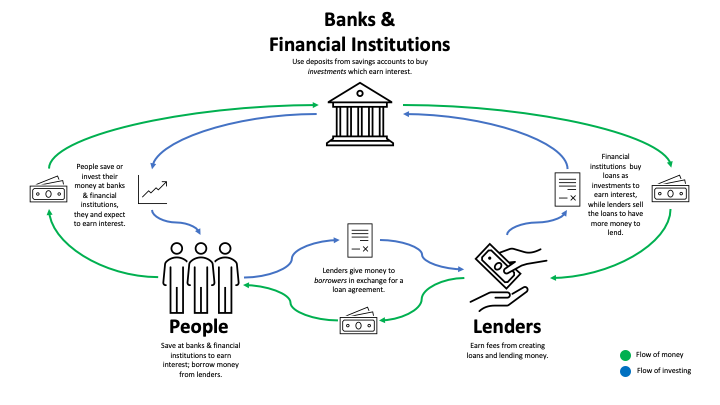

Introduction to the financial system

Case Study: Mortgage Trading Analysis in Power BI

Nick Edwards

Capital Markets Analyst at Mynd

Welcome!

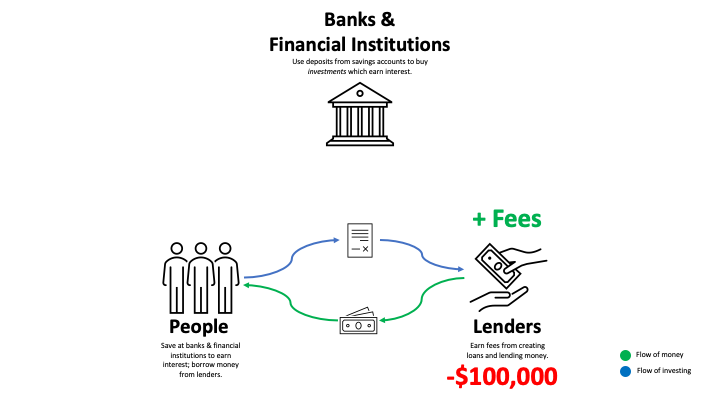

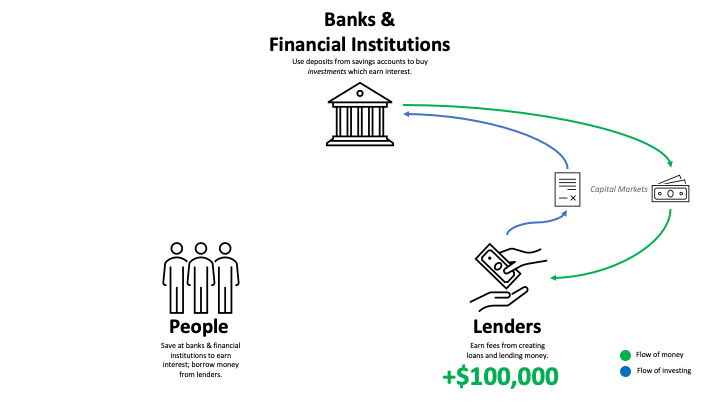

- Learn about the financial system

- You play the part of a Junior Trader at Sooper Mortgage

- Fictional non-bank lender

- United States based

- Execute a trade of mortgages in the capital markets

- The date is September 21, 2021

- Settlement date is October 13, 2021

- Multiple datasets that describe a population of over 5,000 mortgages!

- Derived from real mortgage data

- Derived from real market data

Prerequisites

- Test your skills and apply them to complex problems

- Build confidence with new skills and strategies

- Comfortable with DAX, a bit of M, and the Power Query Editor

- Recommended courses:

- No banking or finance skills needed

- Example:

- A 30YR loan for

$100,000at 5% annually pays$95,000in interest over the full term.

- A 30YR loan for

Let's practice!

Case Study: Mortgage Trading Analysis in Power BI