Pricing in profit

Case Study: Mortgage Trading Analysis in Power BI

Nick Edwards

Capital Markets Analyst at Mynd

Competitive markets

- A competitive market is a market where there are many buyers and sellers for an identical or very similar product

- 4,338 lenders and 23.3mm loan applications in 2021 (U.S.)

- No single buyer or seller can set a price

1 https://www.consumerfinance.gov/data-research/hmda/summary-of-2021-data-on-mortgage-lending/

Competitive markets: lenders

- Highly competitive markets are price sensitive!

- Lenders are constantly repricing to be competitive

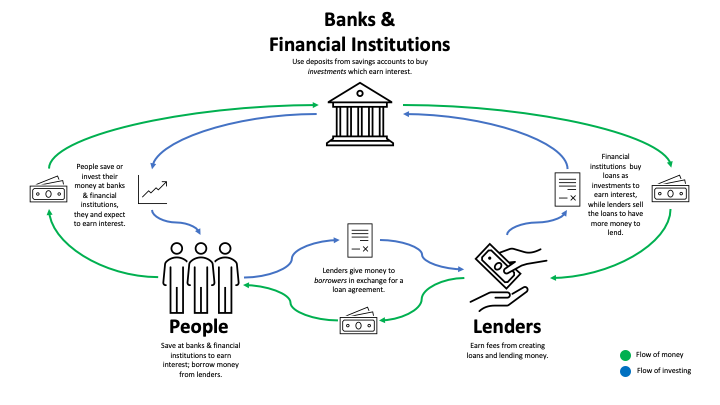

What is profit?

- Profit money made after all expenses have been paid.

Revenue - Expenses

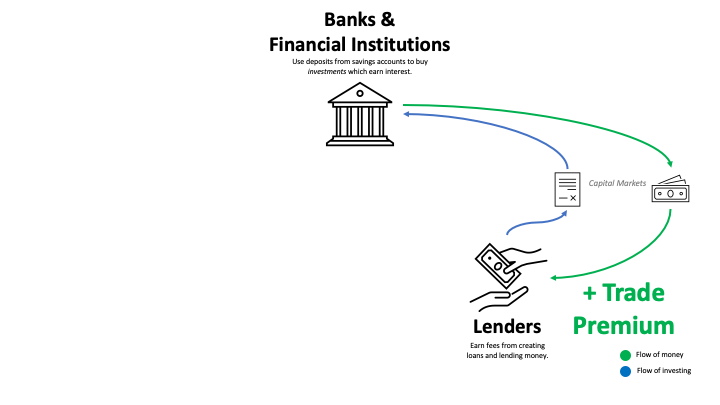

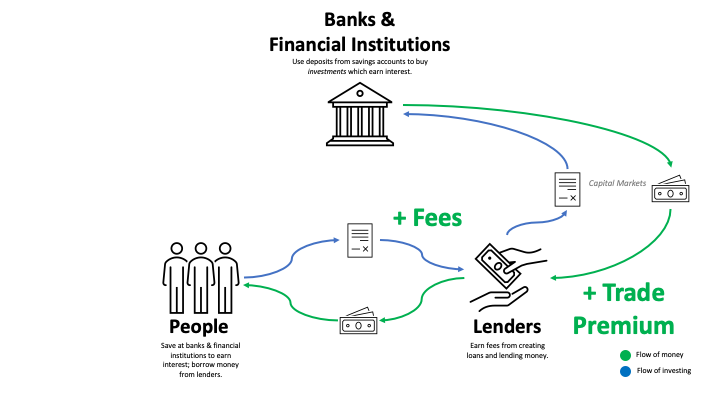

- Revenue is the total money made from doing business

- i.e., fees, trade premium

- Expenses are the costs of doing business

- i.e., paying the mortgage banker, office expenses, discounts

Example: If revenue is 50,000 and expenses are 30,000 - what is the profit?

Profit = 50,000 - 30,000 = 20,000

What is loan margin?

Loan profit margin is the percent of the profit earned per dollar lent

Profit ÷ Loan Amount

Example: What is the loan profit margin of a loan with 14,000 in profit and a loan amount of 100,000?

14,000 ÷ 100,000 = 14%

Pricing and target profit

- Business set margin targets

- Analyze costs and predict revenue

Pricing and target profit

- Business set margin targets

- Analyze costs and predict revenue

- Higher than expected margins

- Not always good in a competitive market

- Losing market share/customers to competition due to high pricing

- Need to charge less

Pricing and target profit

- Business set margin targets

- Analyze costs and predict revenue

- Higher than expected margins

- Not always good in a competitive market

- Losing market share/customers to competition due to high pricing

- Need to charge less

- Lower than expected margins

- Risks going out of business!

- Need to charge more

- Financial markets impact lenders' profit!

Let's analyze!

Case Study: Mortgage Trading Analysis in Power BI