The time value of money

Financial Modeling in Excel

Nick Edwards

Analyst at Mynd

What is the time value of money?

Time value of money is the concept that money is worth more now than in the future due to its earnings potential.

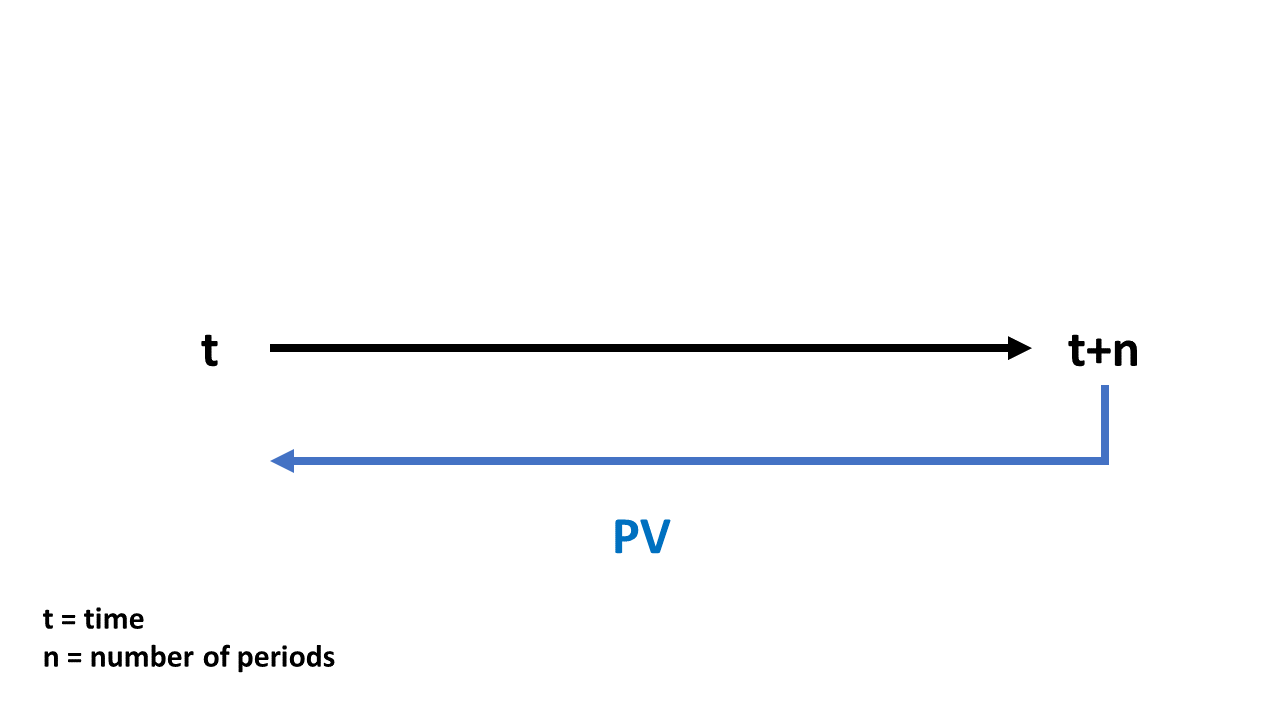

Like a timeline...

Like a timeline...

Like a timeline...

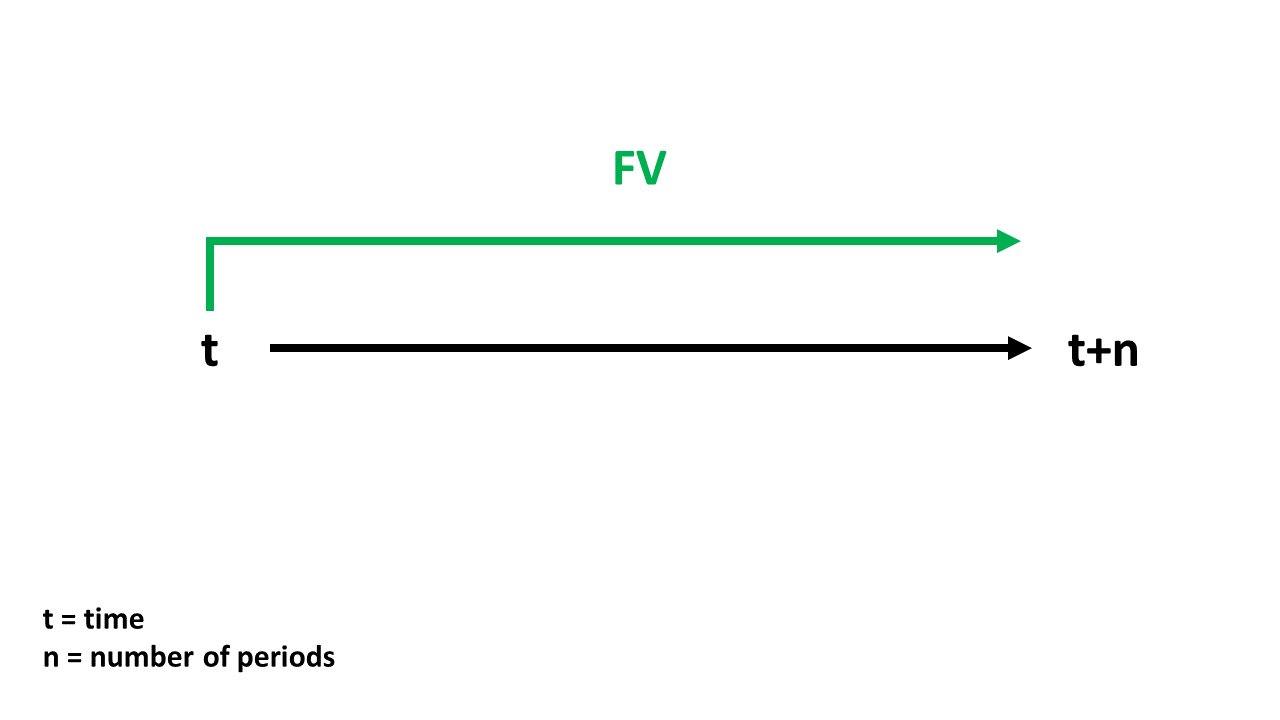

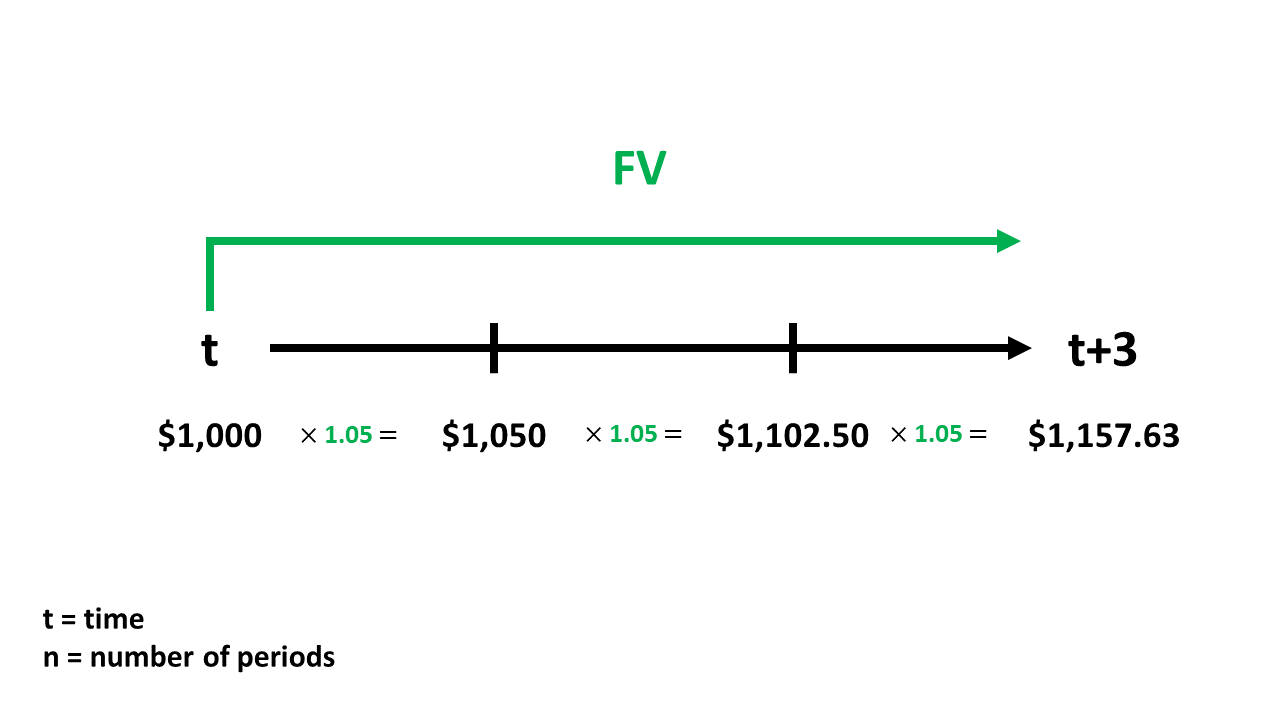

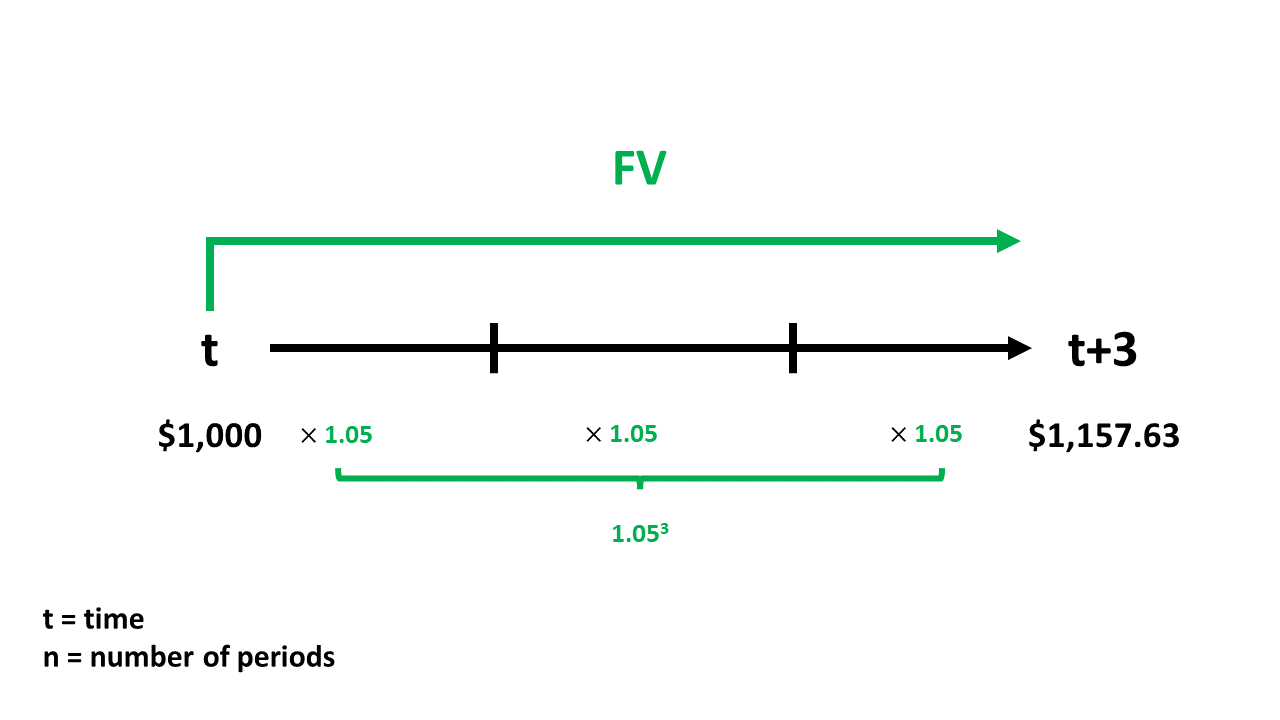

Future value

Future value is what your investment will be worth in the future, based on a rate of return and length of time.

Future value

Future value is what your investment will be worth in the future, based on a rate of return and length of time.

Future value

Future value is what your investment will be worth in the future, based on a rate of return and length of time.

Future value

Future value is what your investment will be worth in the future, based on a rate of return and length of time.

Future value

Future value is what your investment will be worth in the future, based on a rate of return and length of time.

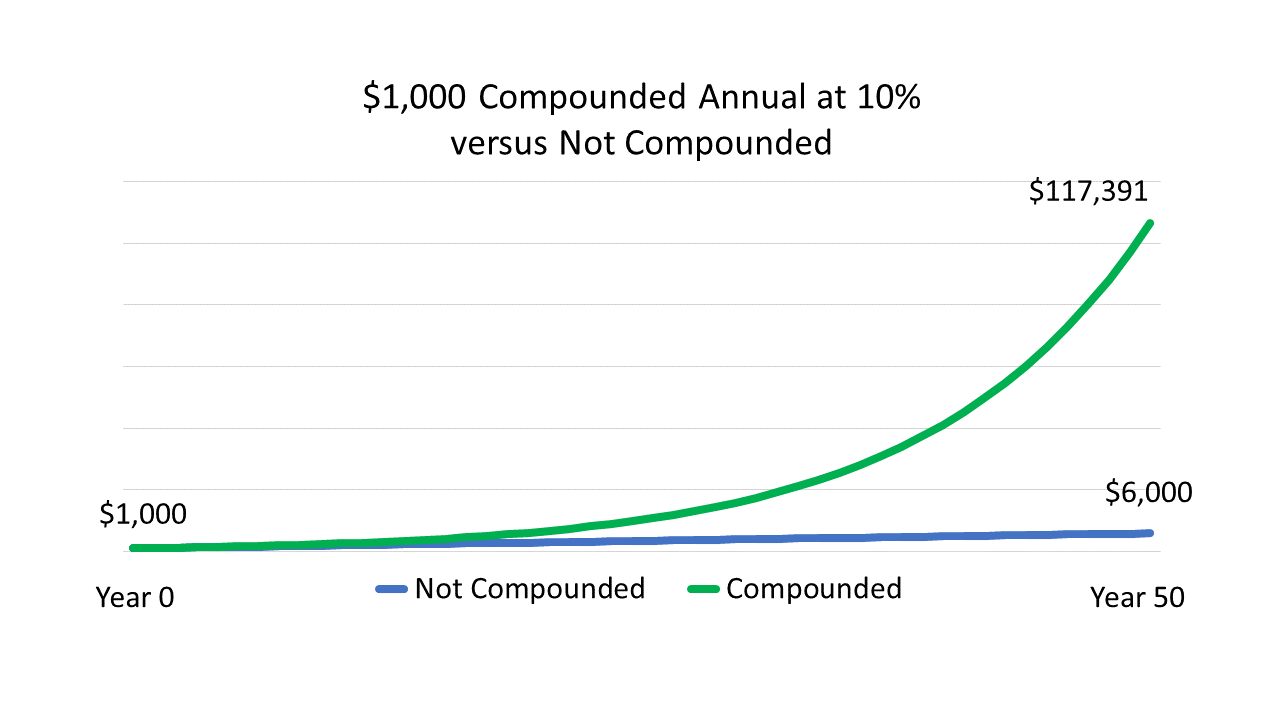

The power of compounding

Compounding is the process where an investment's earnings are reinvested to generate more earnings.

The power of compounding

Compounding is the process where an investment's earnings are reinvested to generate more earnings.

"Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn't pays it." - Albert Einstein

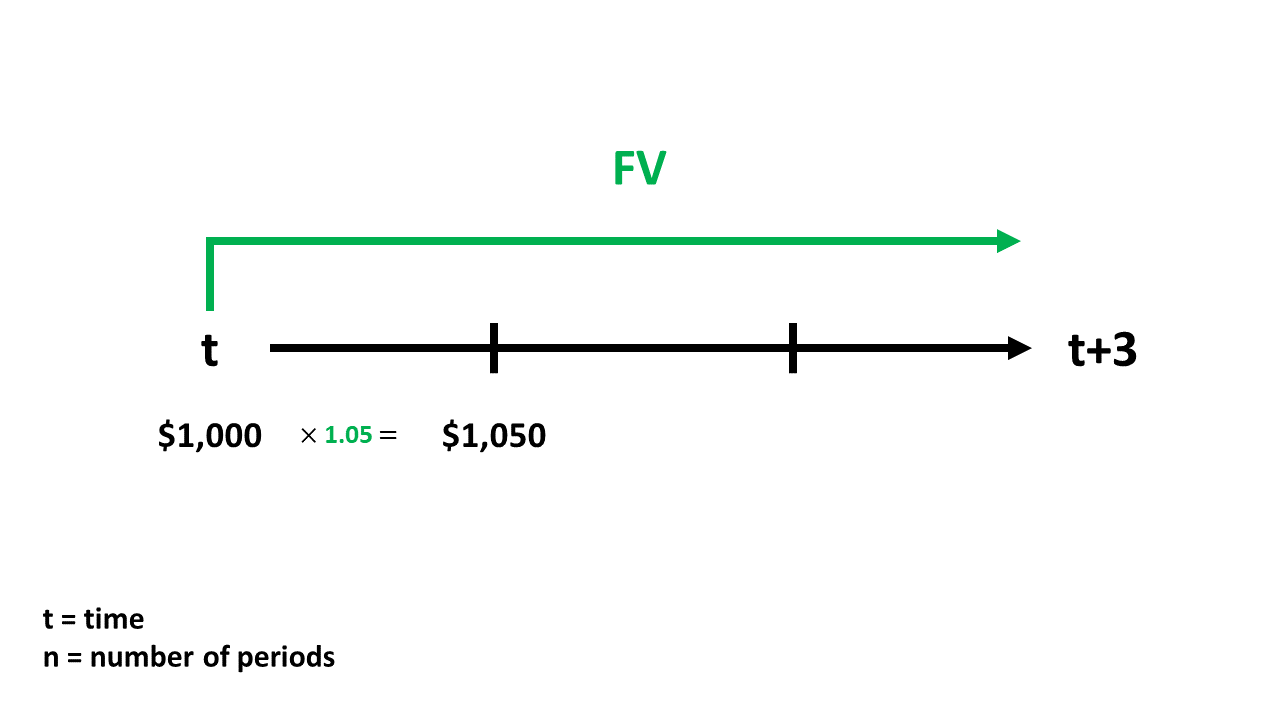

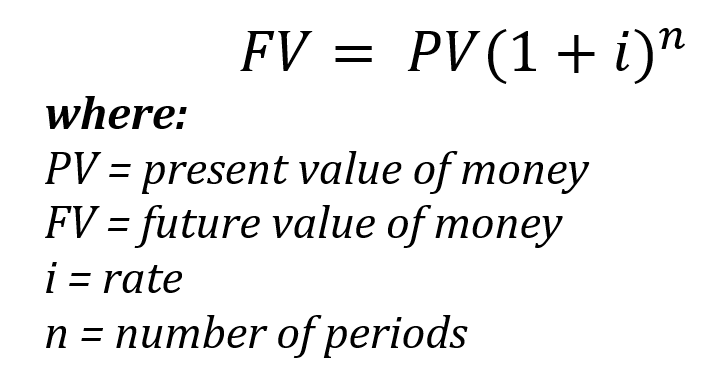

Future value formula

Example: Find the value of $1,000 3 years from now at a 5% interest rate.

FV = PV(1+i)^n

FV = $1,000(1+0.05)^3

FV = $1,000(1.157625)

FV = $1,157.63

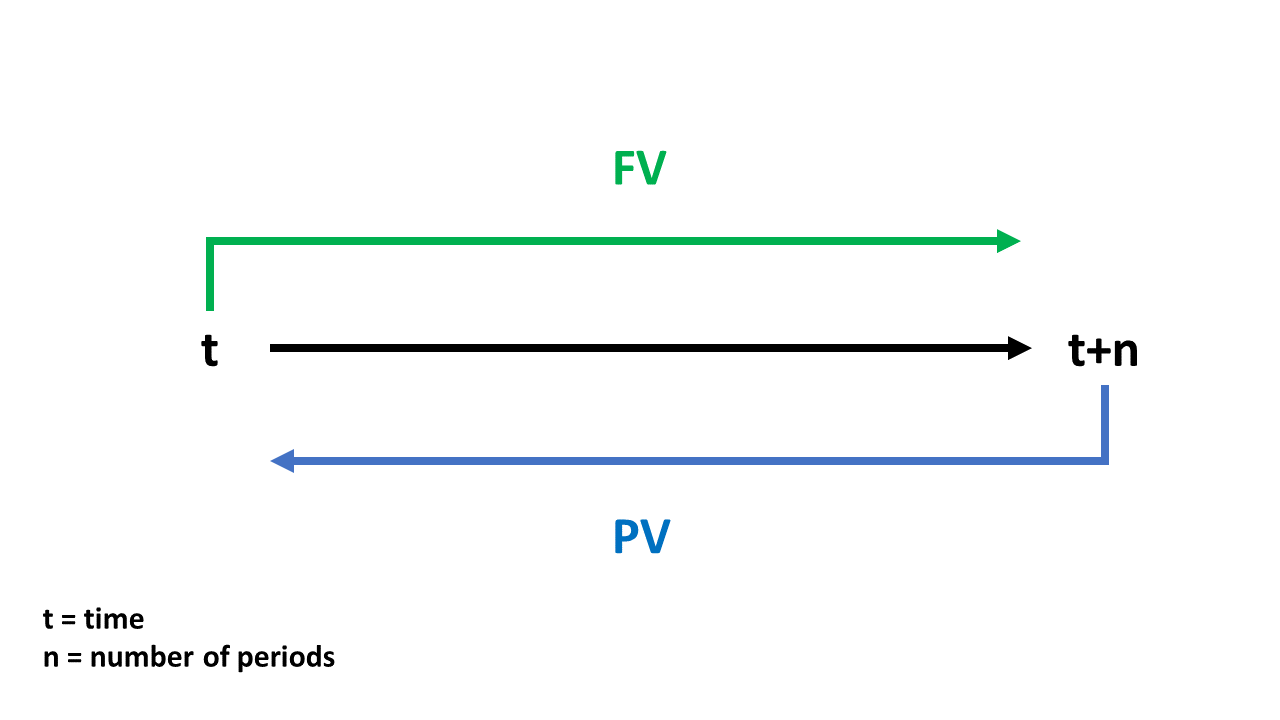

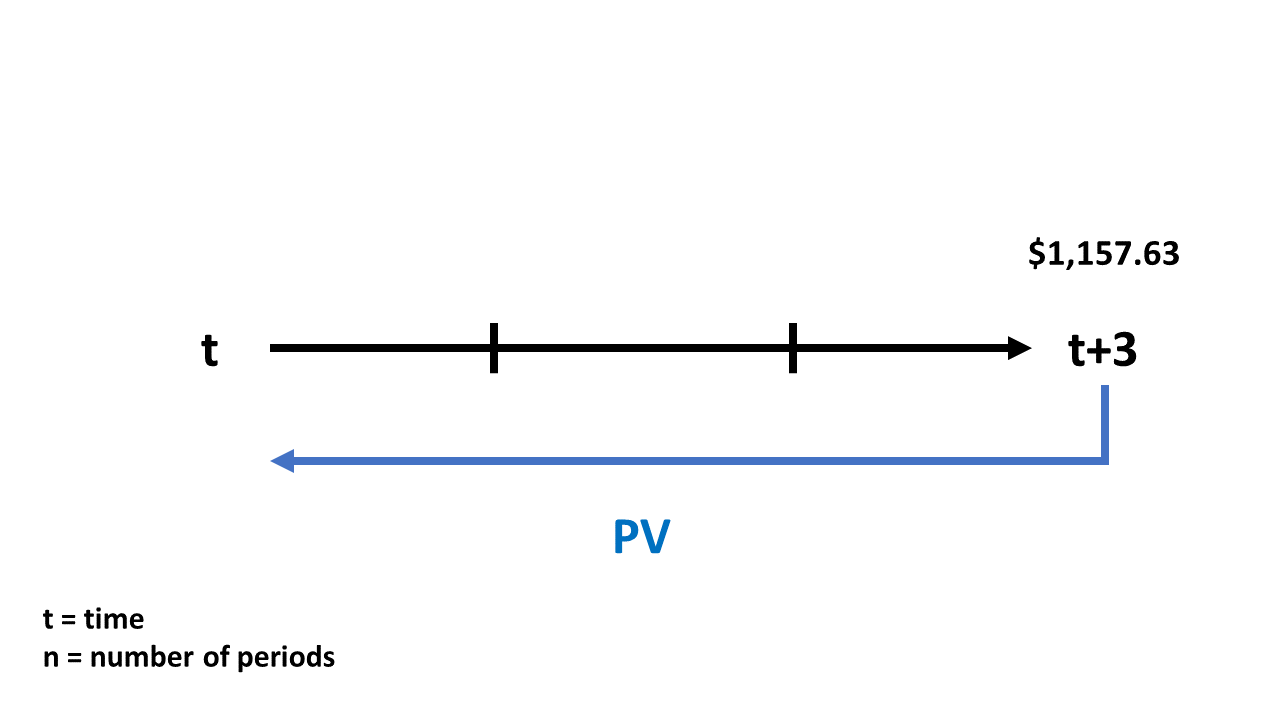

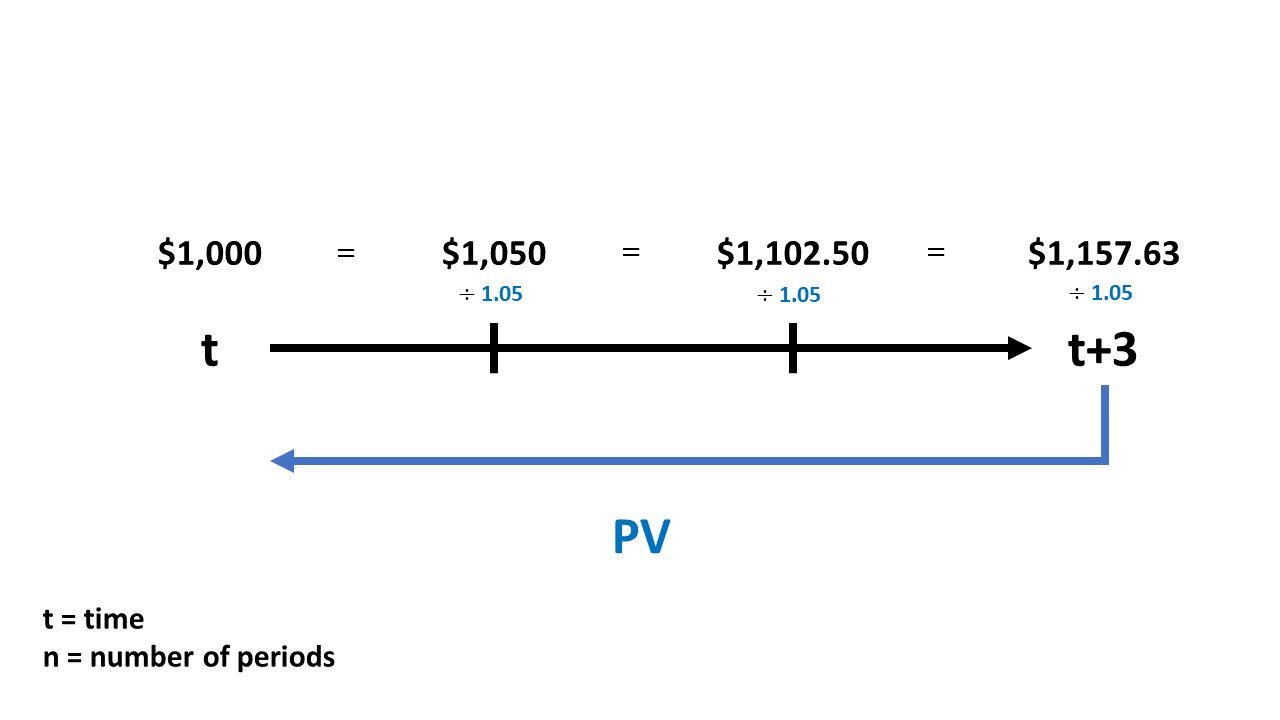

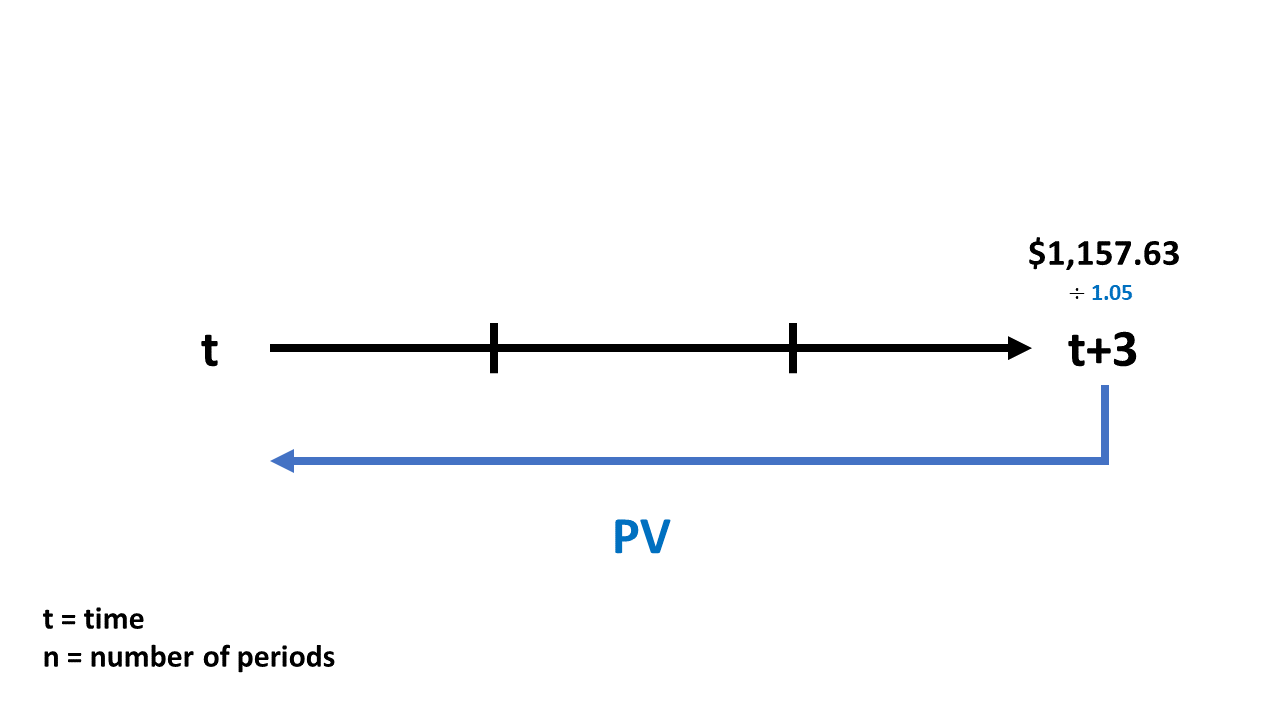

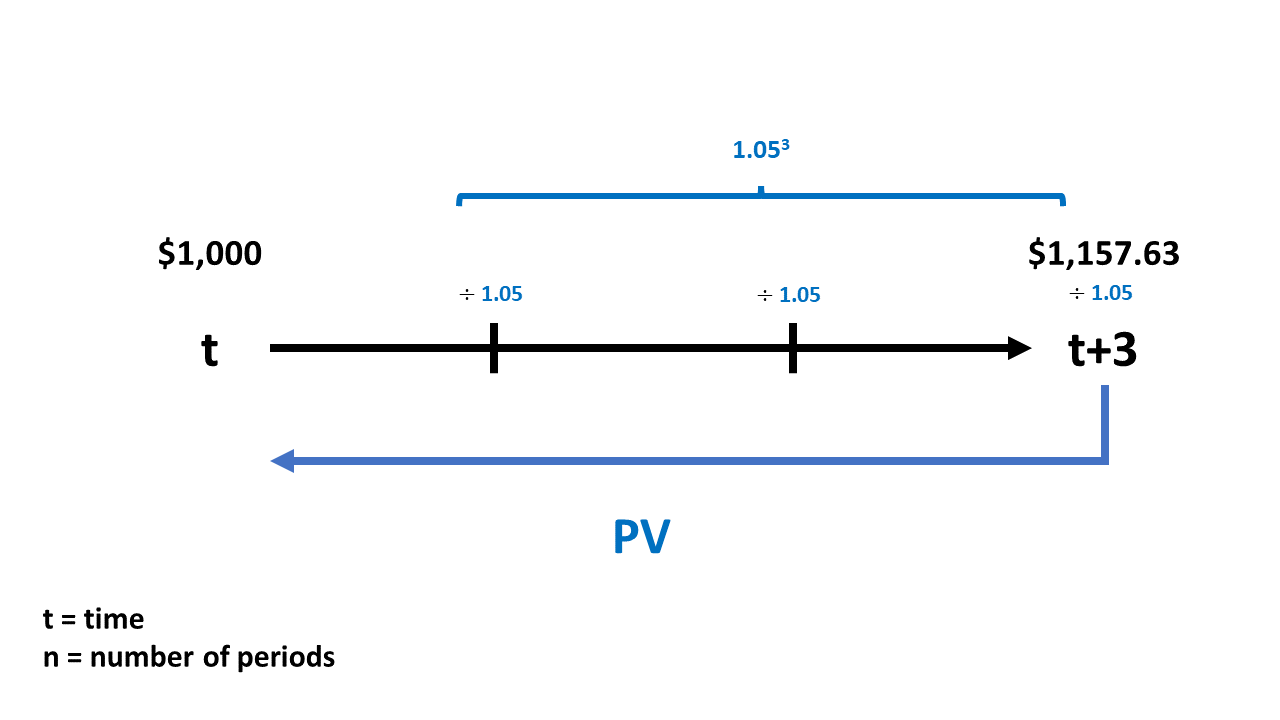

Present value

Present value is the current value of money that will be received in the future.

Present value

Present value is the current value of money that will be received in the future.

Present value

Present value is the current value of money that will be received in the future.

Present value

Present value is the current value of money that will be received in the future.

Present value

Present value is the current value of money that will be received in the future.

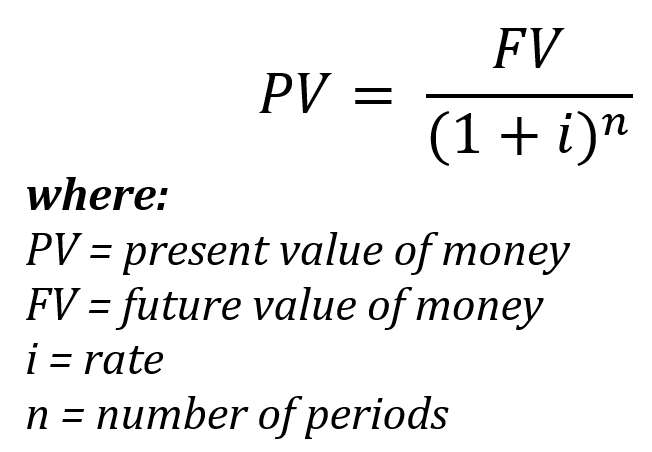

Present value formula

Example: Find the present value of receiving $1,157.6 3 years from now at a 5% discount rate.

PV = FV/(1+i)^n

PV = $1,157.63/(1+0.05)^3

PV = $1,157.63/(1.157625)

PV = $1,000

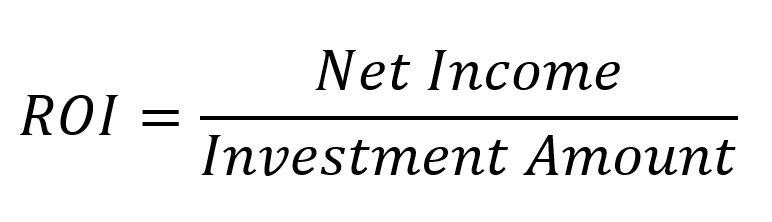

Return on investment (ROI)

Return on investment (ROI) is a ratio of the profit earned for each dollar invested.

Example: What is the ROI of an investment of $15,000 that earned $5,000?

ROI = $5,000/ $15,000

ROI = 33%

Benchmarks

Benchmarks are a point of reference to compare an investment's performance.

- Gives context on investment performance

- Used in time value of money calculations

Let's practice!

Financial Modeling in Excel