Case study: report on credit risk

Data Communication Concepts

Hadrien Lacroix

Curriculum Manager

Credit risk

- Credit risk: probability of defaulting

- Loanme bank wants to predict if a customer is likely to default

- Raw data available

- Data Exploration Analysis

- Model training and evaluation

Audience

- Non-technical stakeholders

- Bank decision-makers

Story

- Background:

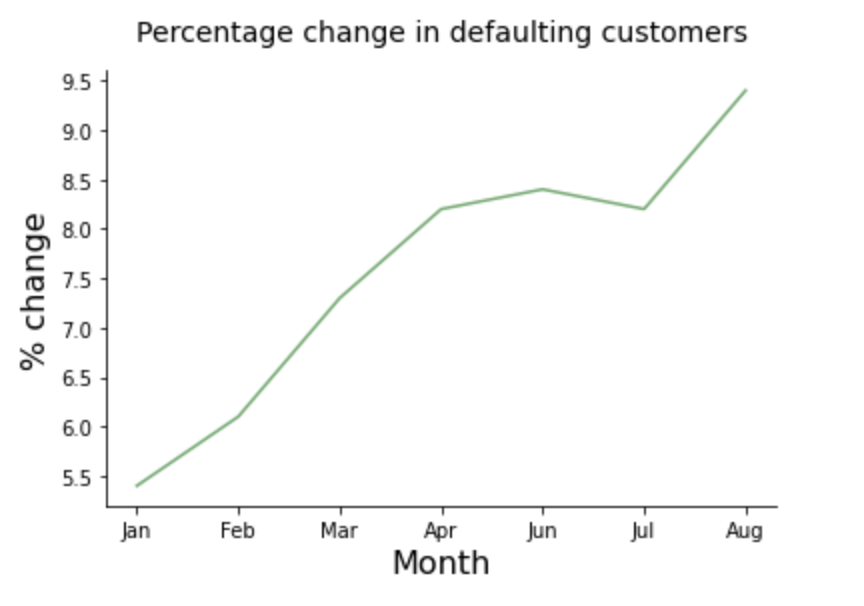

- Increase in defaulting percentage over last 5 years.

- Predicting which customers had a high probability of default.

- Insight: People with more unemployment periods tends to default more

- Insight: People with lower income tend to default more

- Climax: Possible to predict which people is more likely to default with an accuracy of 95%

- Next steps: Run a trial on a control population

Tech or non-tech

- Translate technical results

The right data

- Audience persona

- Role: Financing Department Director

- Interest: Decision on implementing an automated loan rejection system

- Appropriate data:

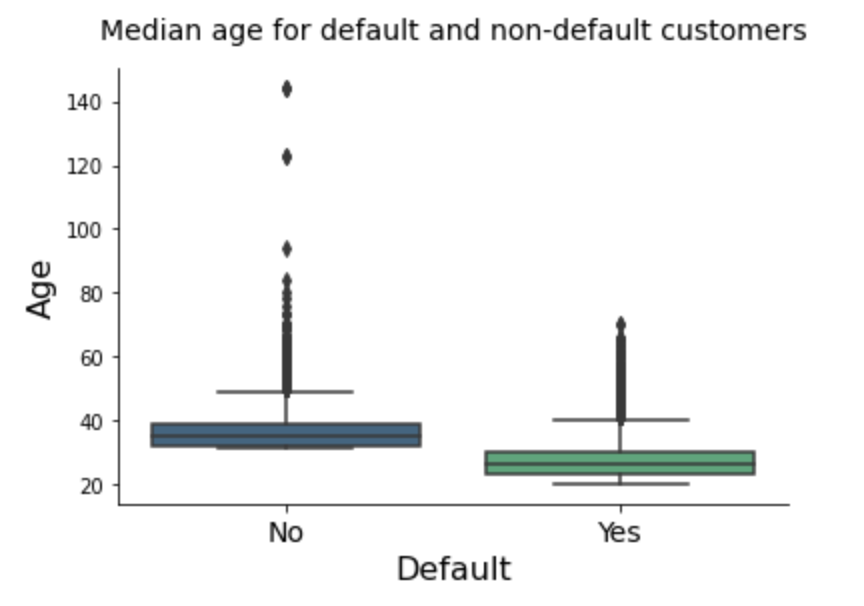

- Relationship between age or income and loan default

- Percentage customer defaulting over the next months

Statistics

- Median age and income

- Percentage of change

Visuals

- Boxplot with age vs. default condition

Visuals

- Boxplot with age vs. default condition

- Lineplot with % change defaulting customers

Correct format

- Who? Financial Department director

- Why? Important decisions ahead

- Content: Key findings and recommendations

- Channel: Send the results before the meeting

Report

- Written report

- Summary report or final report?

Report

- Summary report

- Informational report vs. analytical report?

Report

- Summary report

- Analytical report

Summary report structure

- Introduction

- Purpose

- Contextual information

- Question of analysis

- Body

- Data

- Results: Key findings

- Conclusions

- Restate question

- Central insight

- Add recommendations

Let's practice!

Data Communication Concepts