Congratulations!

Financial Modeling in Excel

Nick Edwards

Analyst at Mynd

Chapter 1: Financial models

- Created a financial model!

- Formatted input cells per financial modeling standards.

- Used

SUM()to calculate subtotals and net income on a financial statement. - Used growth rates to forecast income.

- Created and used named ranges in formulas.

- Used

HLOOKUP()to make the financial model dynamic.

Chapter 2: Scenario analysis

- Practiced scenario analysis with What-if tools.

- Used the Scenario Manager to create scenarios and easily change between them.

- Used Goal Seek to find inputs.

- Performed sensitivity analysis with Data Tables.

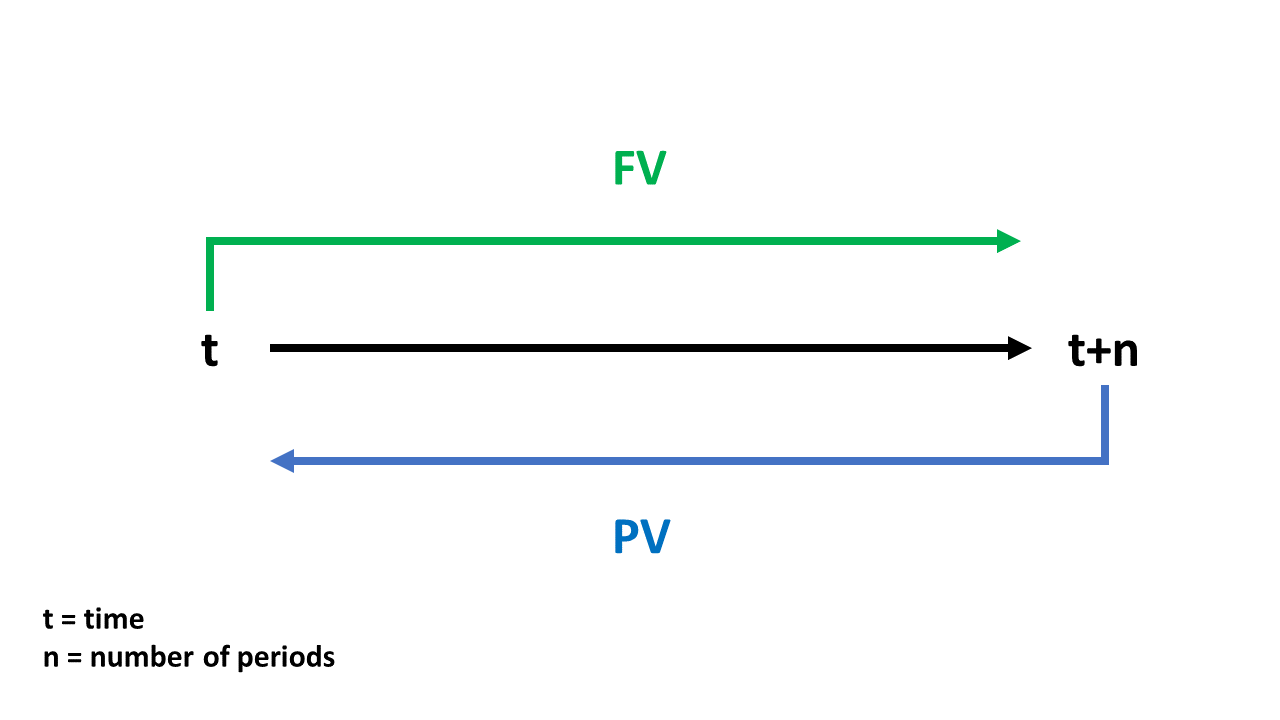

Chapter 3: Time value of money

- Calculated return on investment (ROI).

- You used

FV()to find the future value of the initial investment. - You used

PV()to find the present value of the total return.

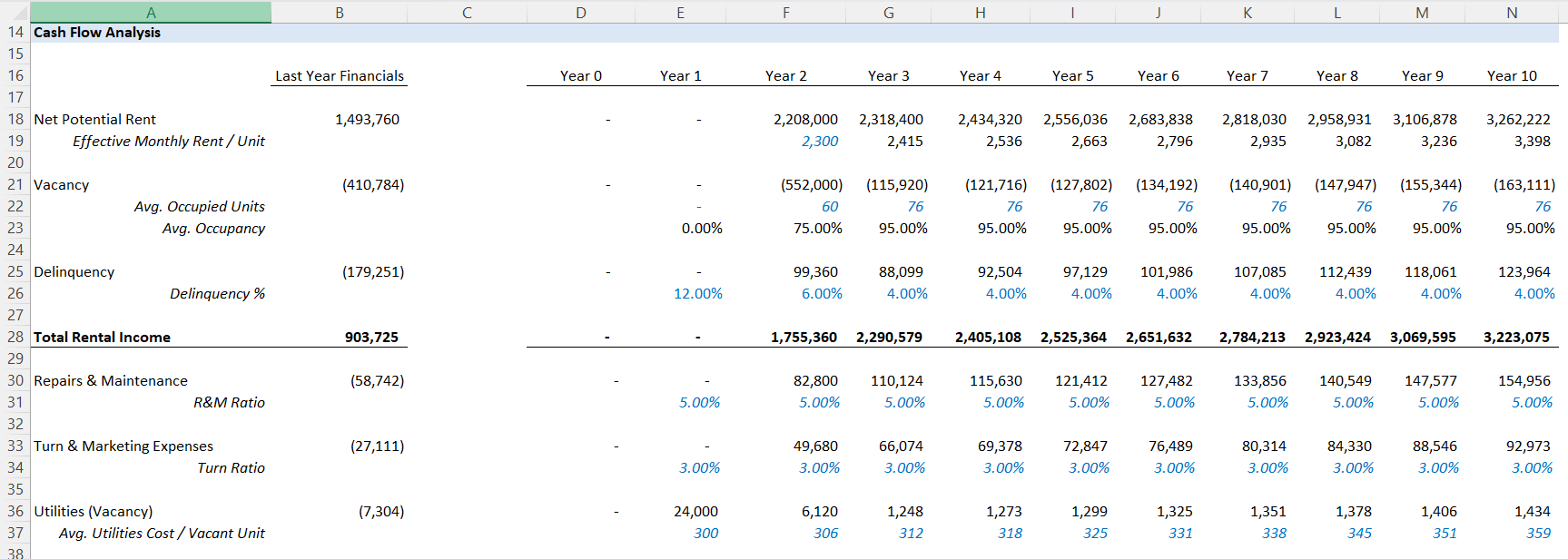

Chapter 4: Capital budgeting

- Calculated net present value (NPV) using

NPV()andXNPV(). - Calculated internal rate of return (IRR) using

IRR()andXIRR(). - Used

EOMONTH()to create a date range. - Time series data with

XNPV()andXIRR(). - Used capital budgeting concepts to pick between two mutually exclusive projects.

Best of luck!

Financial Modeling in Excel