Introduction to Capital Budgeting

Financial Modeling in Excel

Nick Edwards

Analyst at Mynd

What is capital budgeting?

- Capital budgeting is the process of allocating money to new projects that generate cash flows.

- Prioritize mutually exclusive projects

1 https://www.investopedia.com/terms/c/capitalbudgeting.asp

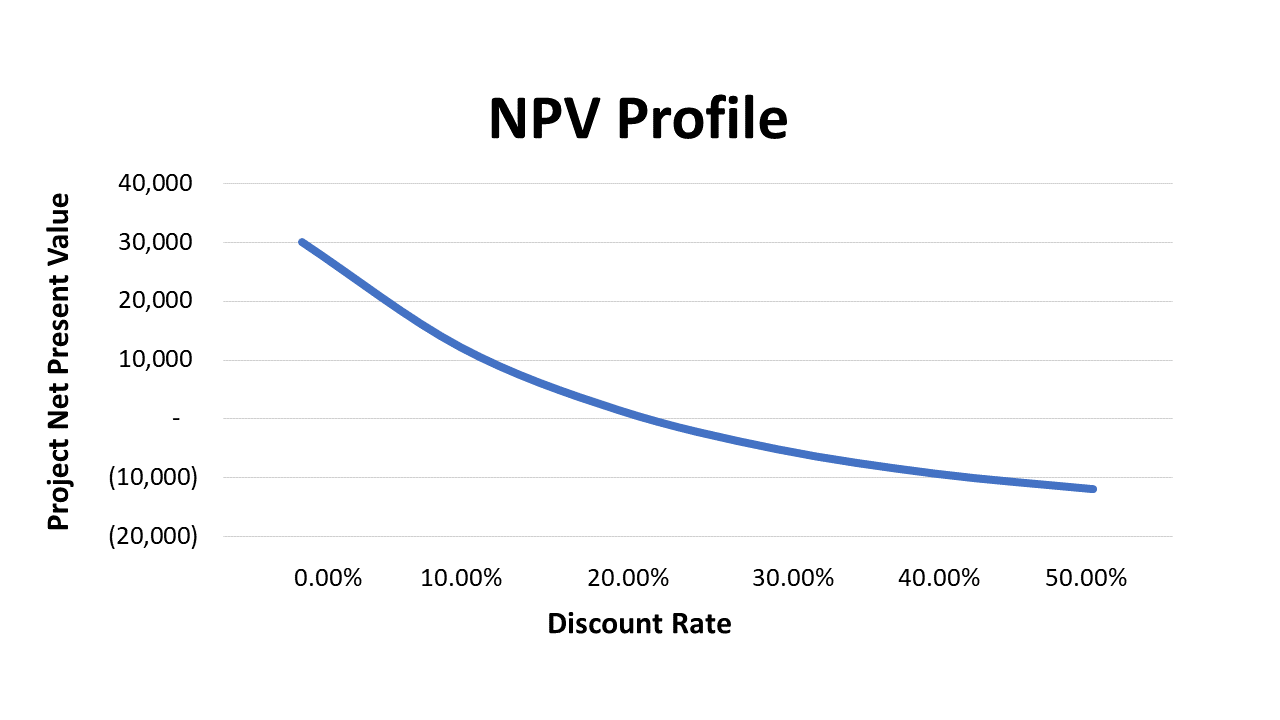

Net present value (NPV)

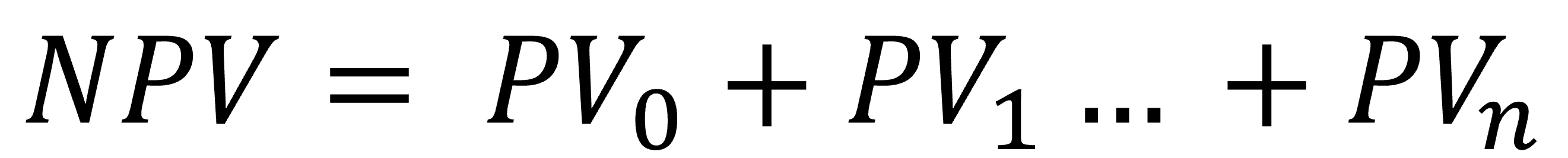

- Net present value (NPV) is the sum of all present value cash flows.

- Invest if

NPV > 0

1 https://www.investopedia.com/terms/n/npv.asp

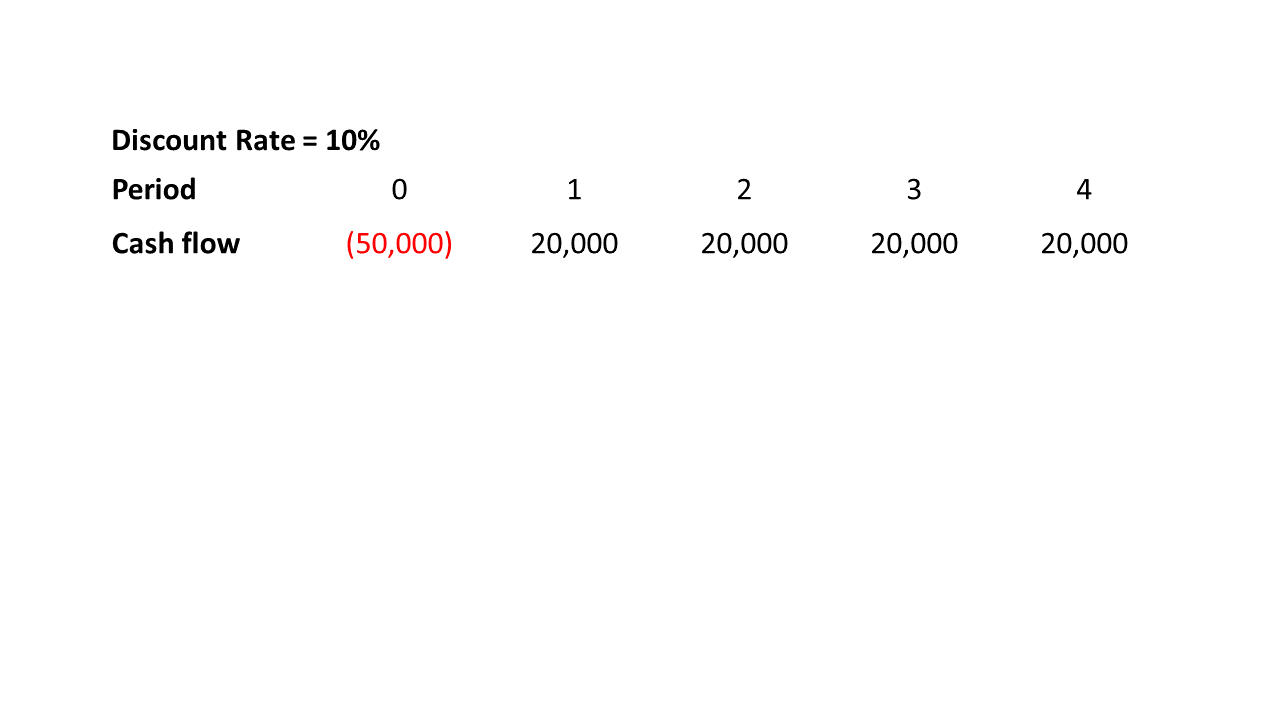

Net present value (NPV)

Example: Should a company invest in this project at a 10% discount rate?

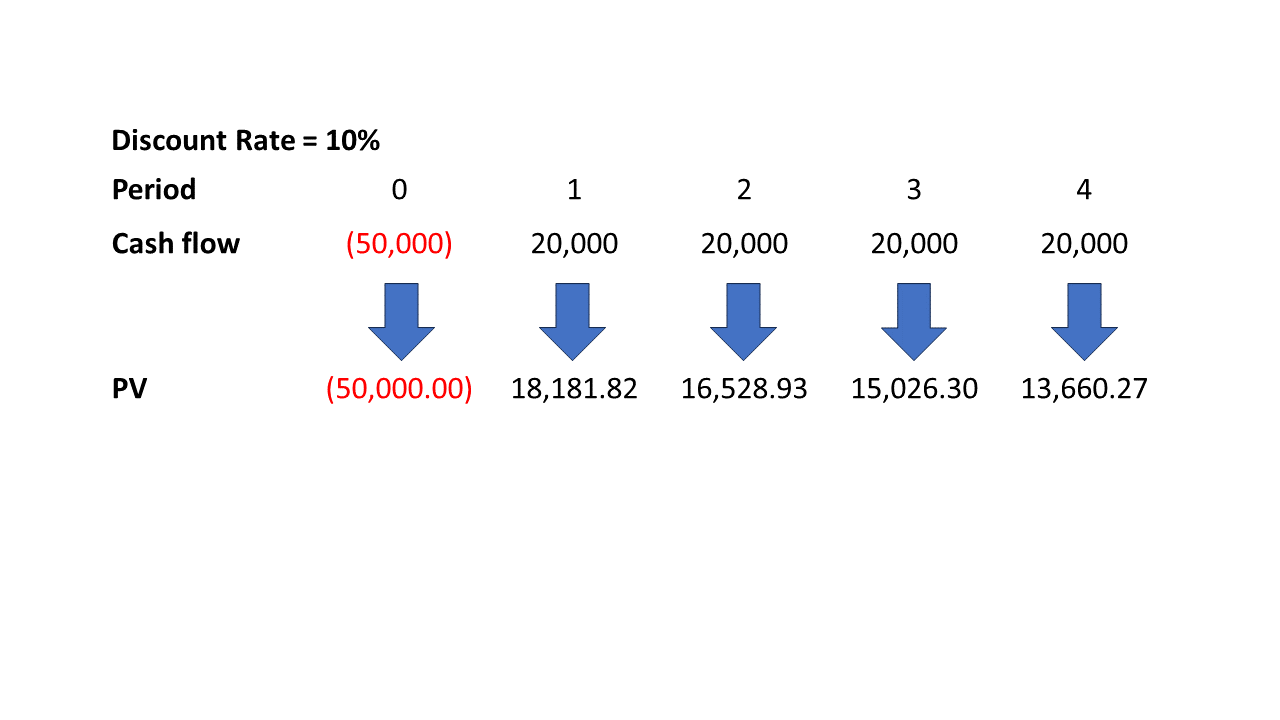

Net present value (NPV)

Example: Should a company invest in this project at a 10% discount rate?

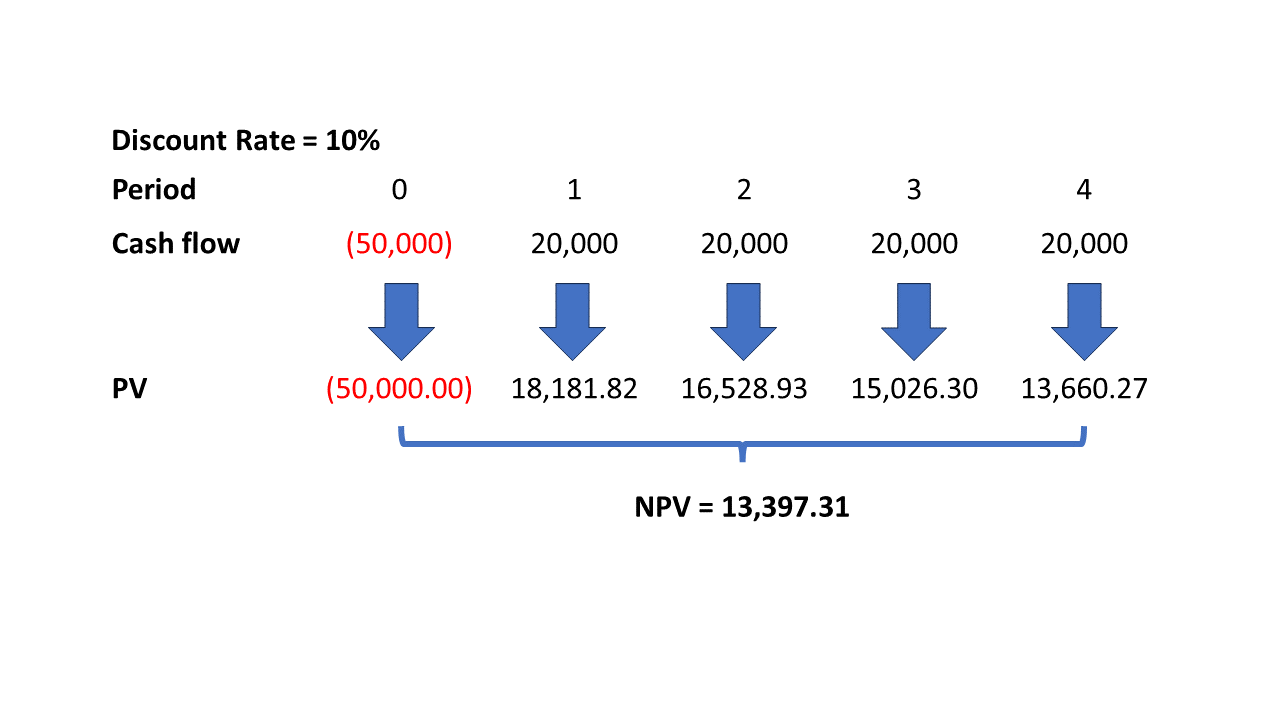

Net present value (NPV)

Example: Should a company invest in this project at a 10% discount rate?

Where do discount rates come from?

Opportunity cost

- The next best alternative result that was given up to pursue the project

- i.e. stocks, bonds, other investments

Cost of capital

- The cost of raising money for the project

- i.e. Issuing stocks or borrowing debt

1 https://www.investopedia.com/terms/c/costofcapital.asp

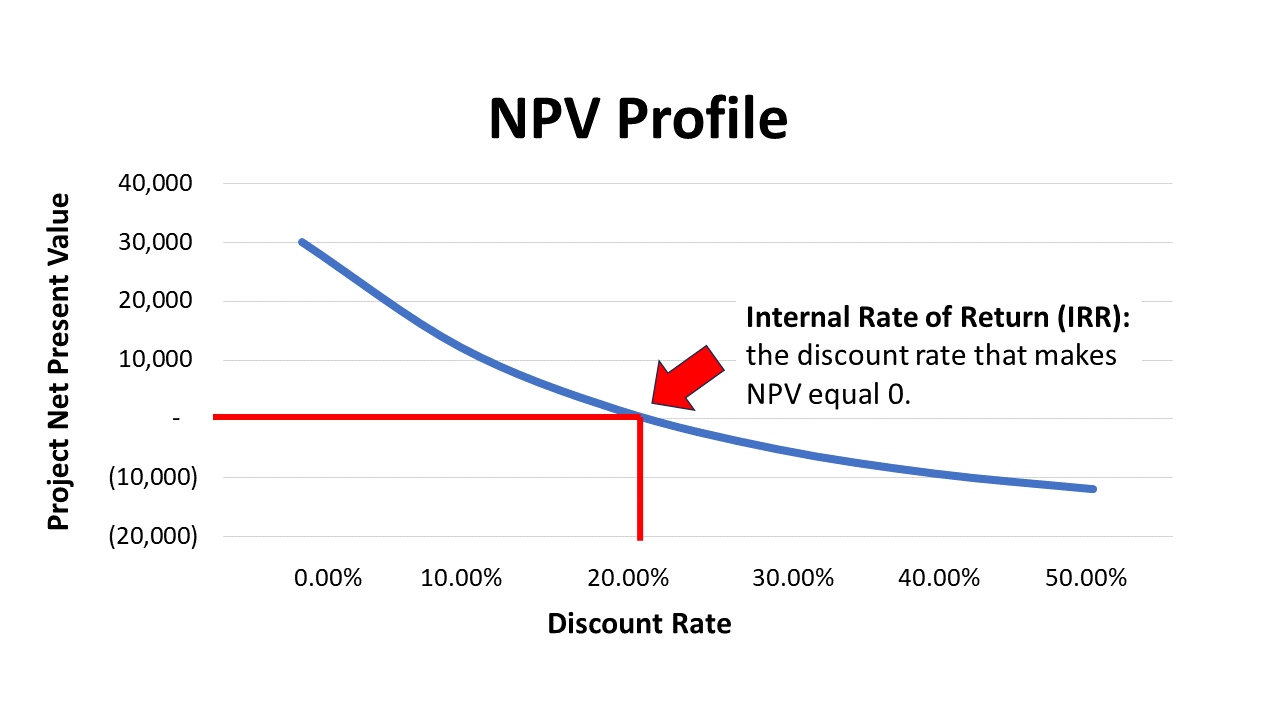

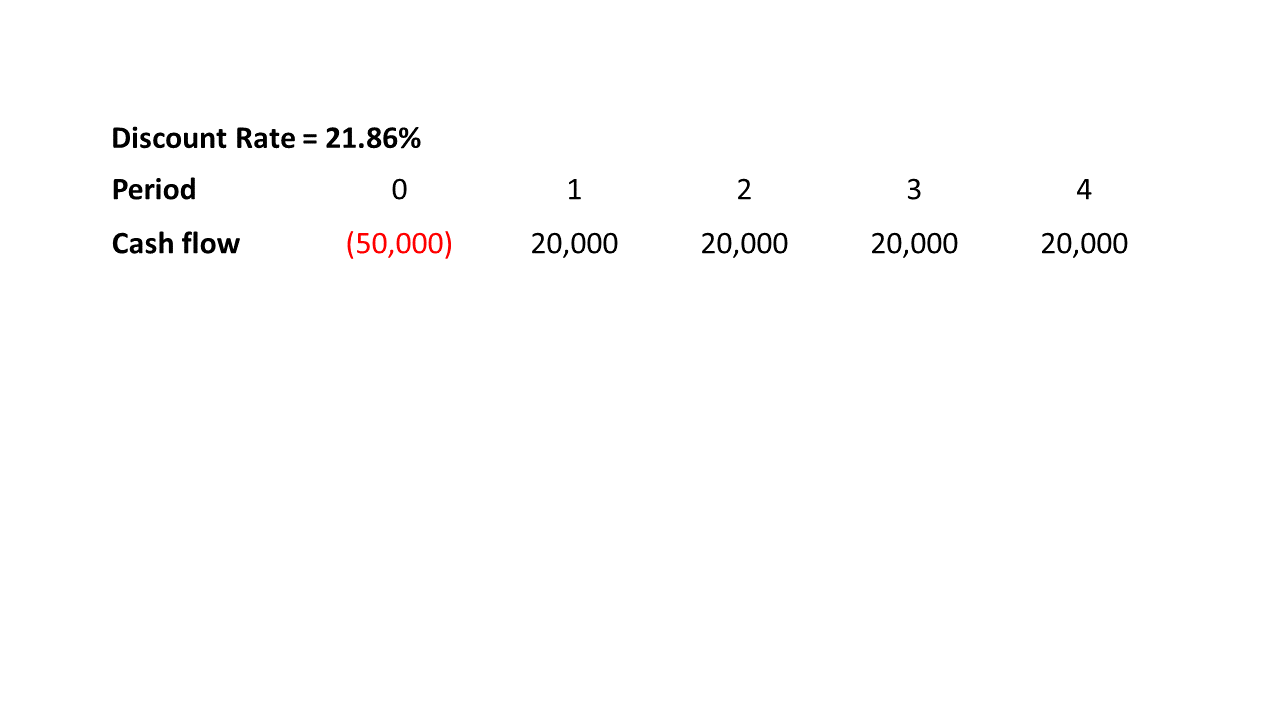

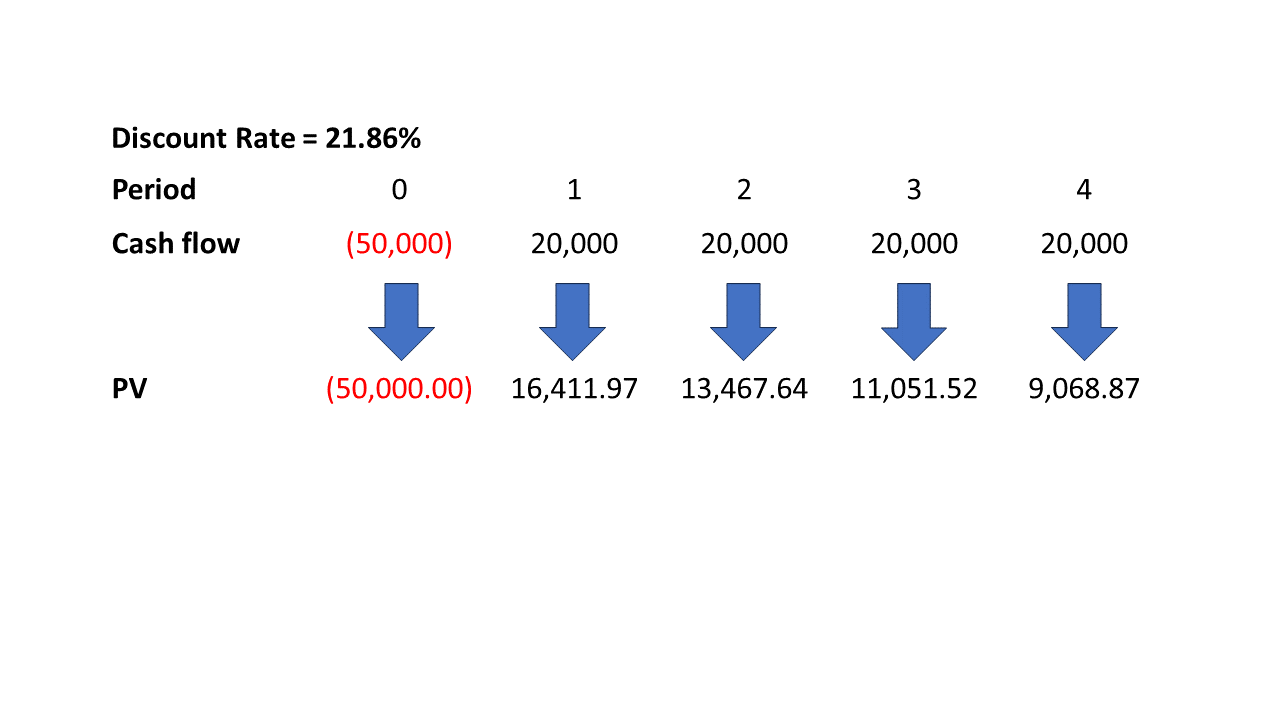

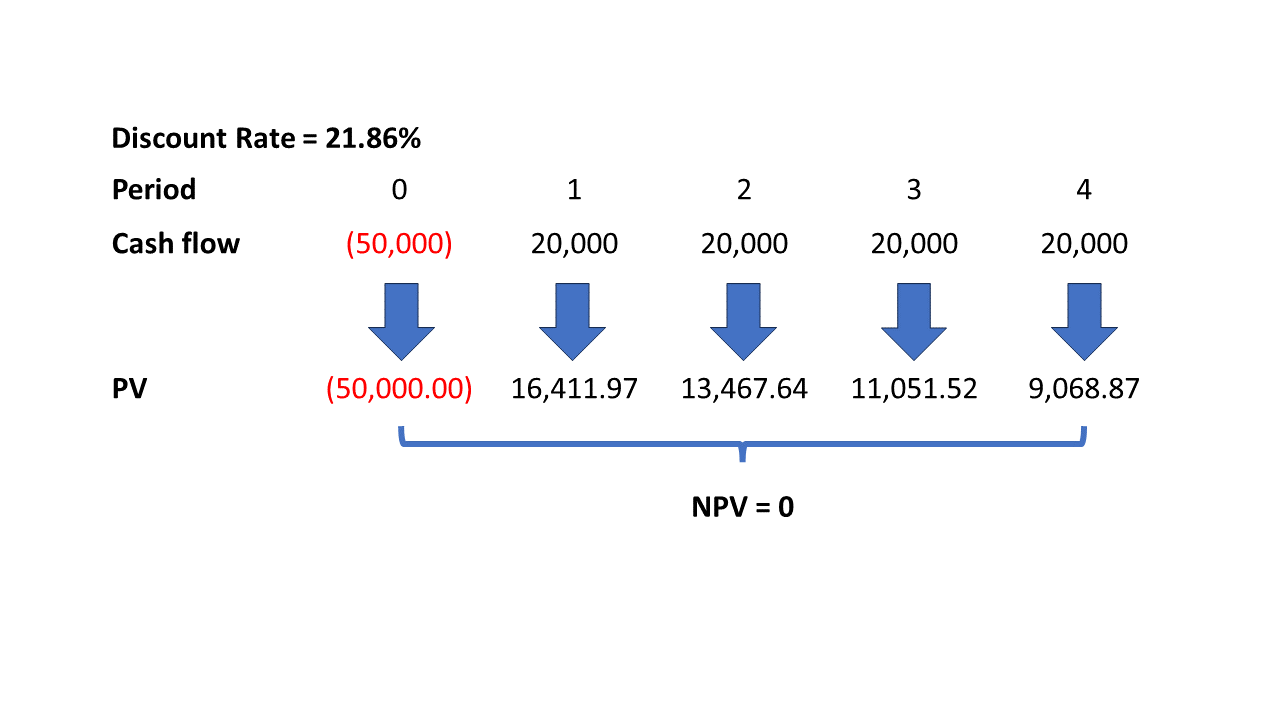

Testing the IRR

Testing the IRR

Testing the IRR

Using IRR in capital budgeting

- Multiple projects: the project with the higher IRR should be selected.

- Benchmark rate: IRR must be higher than the target return.

The Golden Rule

Always choose the project with the highest positive NPV.

- NPV represents a real dollar amount

Let's practice!

Financial Modeling in Excel