Part I: Checking the Data

Equity Valuation in R

Cliff Ang

Senior Vice President, Compass Lexecon

Importance of Checking Projections

- Garbage-In $\rightarrow$ Garbage-Out

- You have to get comfortable with all elements of the projections

- Most elements are modeled as a percentage of revenues or percentage of change in revenues

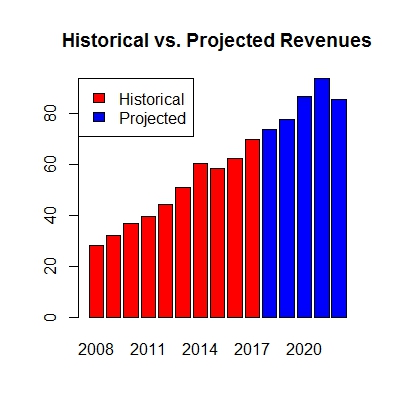

Visually Inspecting the Data

# Create two vectors: one for historical (hist) revenues # and another for projected (proj) revenues hist <- c(28.4, 32.2, 36.8, 39.8, 44.3, 51.1, 60.4, 58.4, 62.5, 69.9, rep(0, 5)) proj <- c(rep(0,10), 73.7, 77.8, 86.8, 93.6, 85.3)rev_all <- rbind(hist, proj) colnames(rev_all) <- seq(2008, 2022, 1)# Create bar plot of revenues data barplot(rev_all, col = c("red", "blue"), main = "Historical vs. Projected Revenues")legend("topleft", legend = c("Historical", "Projected"), fill = c("red", "blue"))

Bar Plot

Using Trend Analysis

# Create one vector of historical and projected revenues rev <- data.frame(c(28.4, 32.2, 36.8, 39.8, 44.3, 51.1, 60.4, 58.4, 62.5, 69.9, 73.7, 77.8, 86.8, 93.6, 85.3)) rownames(rev) <- seq(2008, 2022, 1) names(rev) <- "rev"# Add trend and shift variables rev$trend <- seq(1, 15, 1)rev$shift <- c(rep(0, 10), rep(1, 5))

reg <- lm(rev ~ trend + shift, data = rev)

summary(reg)

# Call:

# lm(formula = rev ~ trend + shift, data = rev)

#

# Residuals:

# Min 1Q Median 3Q Max

# -7.2232 -1.5508 -0.2843 0.7700 5.6184

#

# Coefficients:

# Estimate Std. Error t value Pr(>|t|)

# (Intercept) 23.4011 2.2066 10.61 1.89e-07 ***

# trend 4.5416 0.3511 12.94 2.09e-08 ***

# shift 0.9978 3.2179 0.31 0.762

# ---

# Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

#

# Residual standard error: 3.377 on 12 degrees of freedom

# Multiple R-squared: 0.9777, Adjusted R-squared: 0.974

# F-statistic: 263.3 on 2 and 12 DF, p-value: 1.222e-10

Let's practice!

Equity Valuation in R