Analyzing Determinants of Multiples

Equity Valuation in R

Cliff Ang

Vice President, Compass Lexecon

The Average of Median May Not Always Be Applicable

- Use average or median if firms are very "comparable"

- Approaches to determine comparability:

- Compare risk, growth, and profitability

- Relative position historically

Regression-Based Approach

- We can also use regression analysis to help us determine what the appropriate multiple is for our subject firm

- P/B vs. ROE. P/E vs. 5-Year EPS Growth, or multiple regression

- Less subjective to arrive at the appropriate valuation multiple

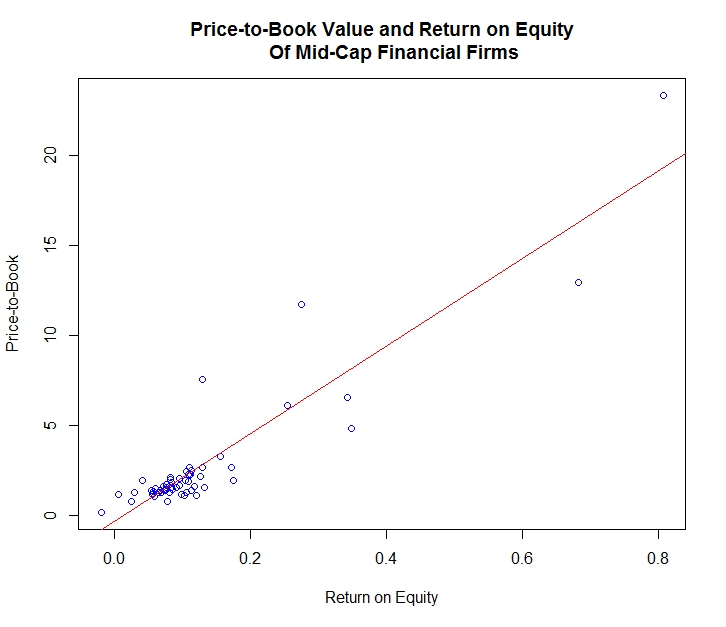

Example Using P/B vs. ROE

finl <- subset(midcap400, gics_sector == "Financials")finl$roe <- finl$ltm_eps / finl$bvpsfinl$p_bv <- ifelse(finl$bvps < 0, NA, finl$price / finl$bvps)finl <- finl[complete.cases(finl), ]

Example Using P/B vs. ROE

$$P/B = -0.365 + 24.37 * ROE$$ $$R-squared = 0.8462$$

Example Using P/B vs. ROE

reg <- lm(p_bv ~ roe, data = finl)a <- summary(reg)$coeff[1] a

-0.3654199

b <- summary(reg)$coeff[2]

b

24.37047

Assume an ROE of 10% and BVPS of $30, what is the Implied Price?

# Implied Price-to-Book

roe <- 0.10

implied_p_b <- a + b * roe

implied_p_b

2.071627

# Implied Price

bvps <- 30

implied_price <- implied_p_b * bvps

implied_price

62.14881

Let's practice!

Equity Valuation in R