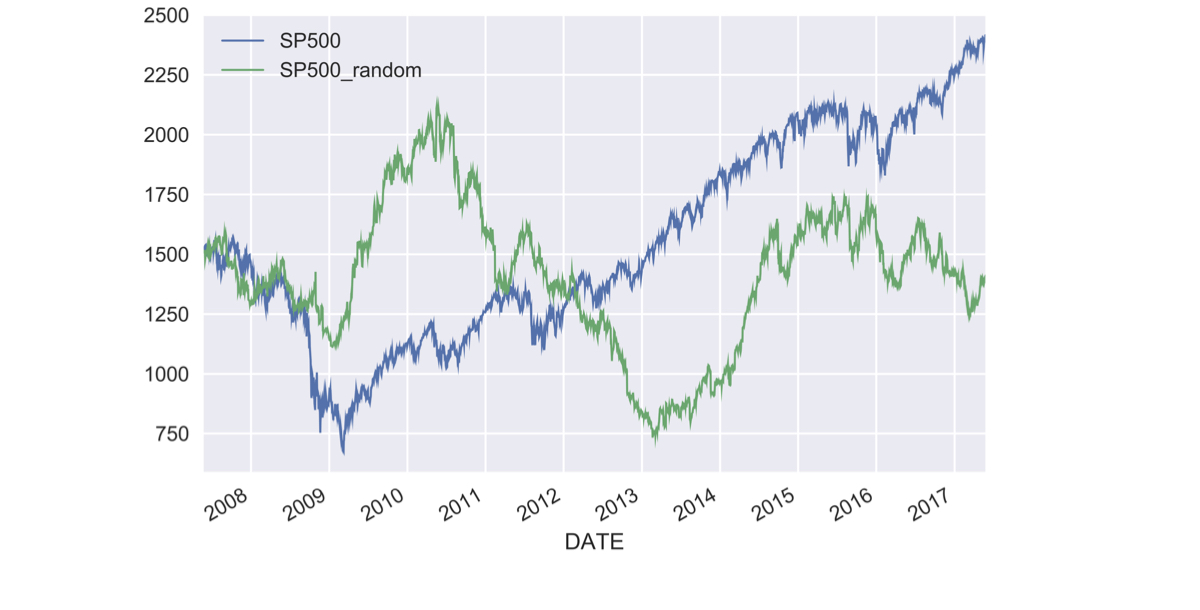

Case study: S&P500 price simulation

Manipulating Time Series Data in Python

Stefan Jansen

Founder & Lead Data Scientist at Applied Artificial Intelligence

Random walks & simulations

- Daily stock returns are hard to predict

- Models often assume they are random in nature

- Numpy allows you to generate random numbers

- From random returns to prices: use

.cumprod() - Two examples:

- Generate random returns

- Randomly selected actual SP500 returns

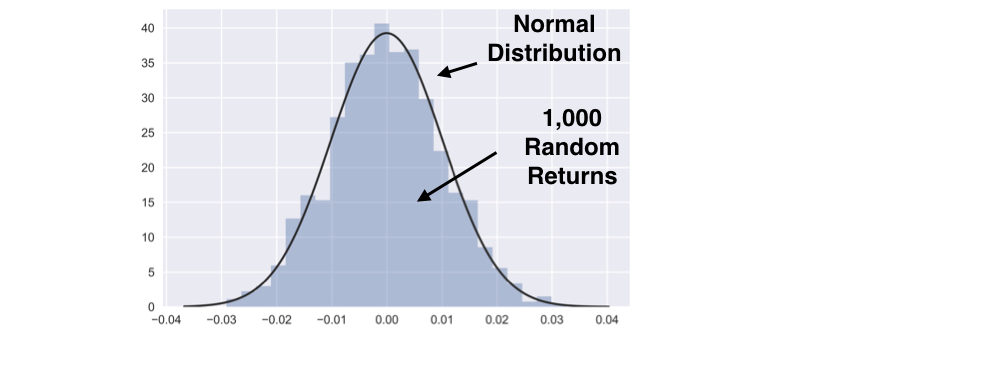

Generate random numbers

from numpy.random import normal, seedfrom scipy.stats import normseed(42)random_returns = normal(loc=0, scale=0.01, size=1000)sns.distplot(random_returns, fit=norm, kde=False)

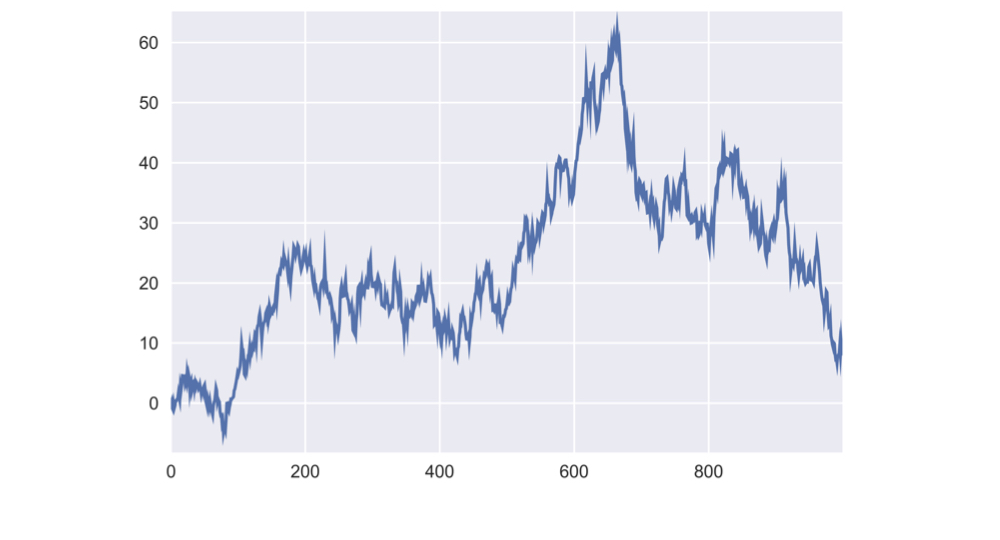

Create a random price path

return_series = pd.Series(random_returns)random_prices = return_series.add(1).cumprod().sub(1)random_prices.mul(100).plot()

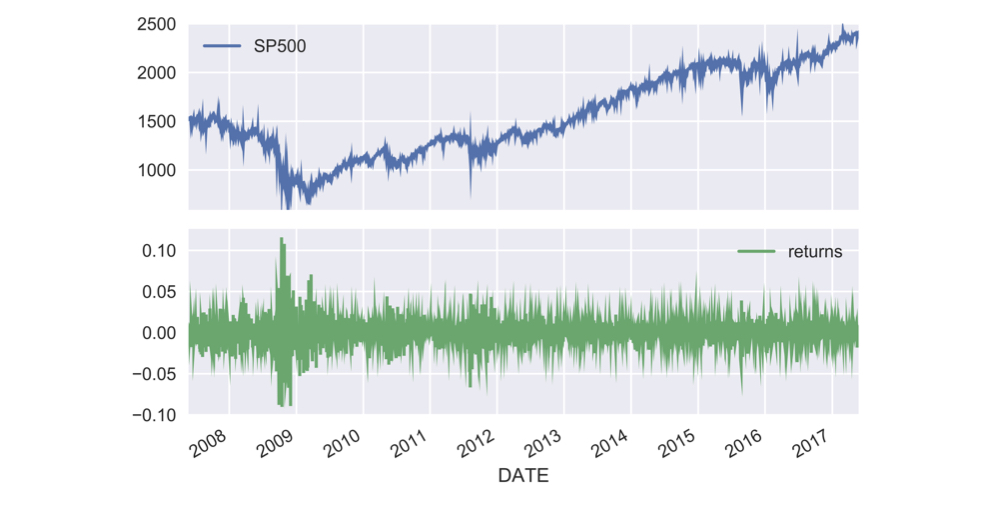

S&P 500 prices & returns

data = pd.read_csv('sp500.csv', parse_dates=['date'], index_col='date')data['returns'] = data.SP500.pct_change()data.plot(subplots=True)

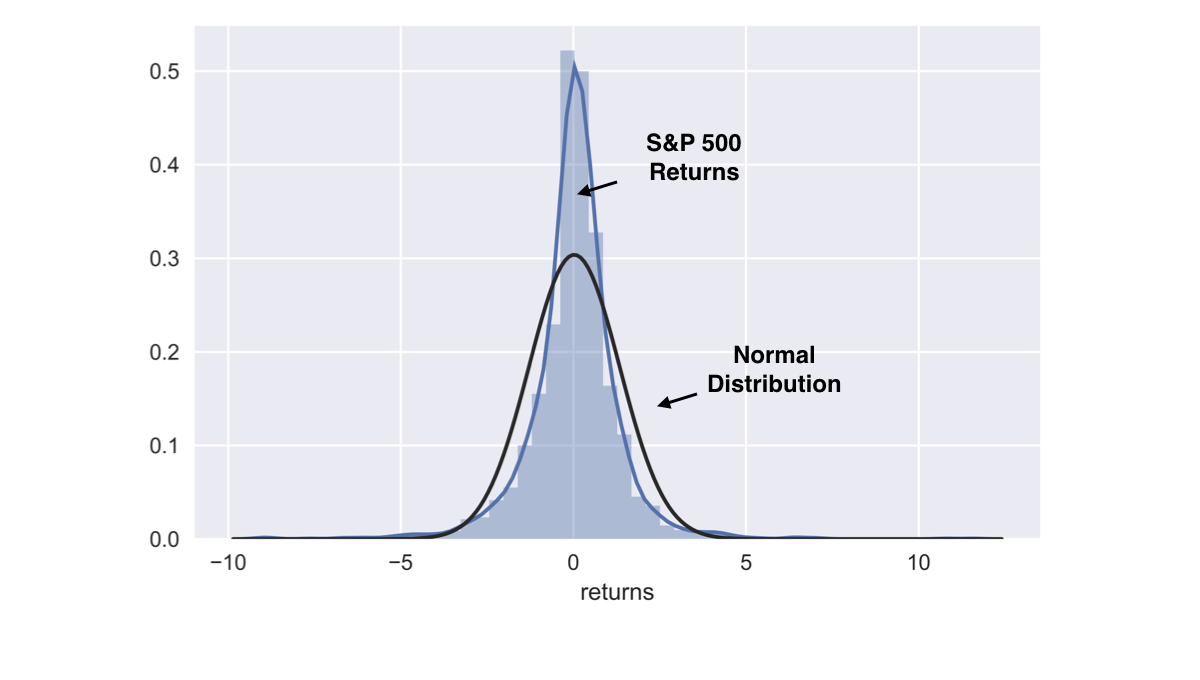

S&P return distribution

sns.distplot(data.returns.dropna().mul(100), fit=norm)

Generate random S&P 500 returns

from numpy.random import choicesample = data.returns.dropna()n_obs = data.returns.count()random_walk = choice(sample, size=n_obs)random_walk = pd.Series(random_walk, index=sample.index)random_walk.head()

DATE

2007-05-29 -0.008357

2007-05-30 0.003702

2007-05-31 -0.013990

2007-06-01 0.008096

2007-06-04 0.013120

Random S&P 500 prices (1)

start = data.SP500.first('D')

DATE

2007-05-25 1515.73

Name: SP500, dtype: float64

sp500_random = start.append(random_walk.add(1))sp500_random.head())

DATE

2007-05-25 1515.730000

2007-05-29 0.998290

2007-05-30 0.995190

2007-05-31 0.997787

2007-06-01 0.983853

dtype: float64

Random S&P 500 prices (2)

data['SP500_random'] = sp500_random.cumprod()data[['SP500', 'SP500_random']].plot()

Let's practice!

Manipulating Time Series Data in Python