Credit model performance

Credit Risk Modeling in Python

Michael Crabtree

Data Scientist, Ford Motor Company

Model accuracy scoring

- Calculate accuracy

- Use the

.score()method from scikit-learn

# Check the accuracy against the test data

clf_logistic1.score(X_test,y_test)

0.81

- 81% of values for

loan_statuspredicted correctly

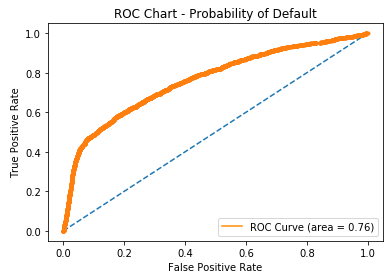

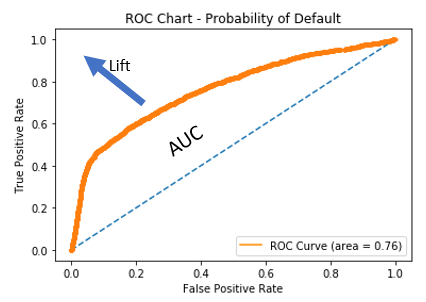

ROC curve charts

- Receiver Operating Characteristic curve

- Plots true positive rate (sensitivity) against false positive rate (fall-out)

fallout, sensitivity, thresholds = roc_curve(y_test, prob_default)

plt.plot(fallout, sensitivity, color = 'darkorange')

Analyzing ROC charts

- Area Under Curve (AUC): area between curve and random prediction

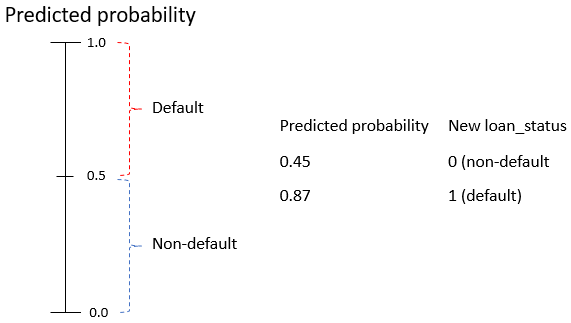

Default thresholds

- Threshold: at what point a probability is a default

Setting the threshold

- Relabel loans based on our threshold of

0.5

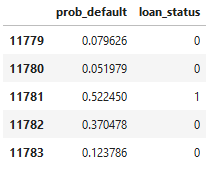

preds = clf_logistic.predict_proba(X_test)

preds_df = pd.DataFrame(preds[:,1], columns = ['prob_default'])

preds_df['loan_status'] = preds_df['prob_default'].apply(lambda x: 1 if x > 0.5 else 0)

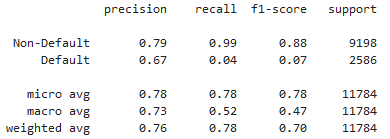

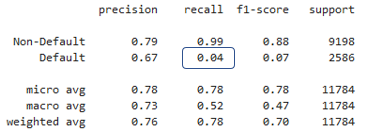

Credit classification reports

classification_report()within scikit-learn

from sklearn.metrics import classification_report

classification_report(y_test, preds_df['loan_status'], target_names=target_names)

Selecting classification metrics

- Select and store specific components from the

classification_report() - Use the

precision_recall_fscore_support()function from scikit-learn

from sklearn.metrics import precision_recall_fscore_support

precision_recall_fscore_support(y_test,preds_df['loan_status'])[1][1]

Let's practice!

Credit Risk Modeling in Python