Credit acceptance rates

Credit Risk Modeling in Python

Michael Crabtree

Data Scientist, Ford Motor Company

Thresholds and loan status

- Previously we set a threshold for a range of

prob_defaultvalues- This was used to change the predicted

loan_statusof the loan

- This was used to change the predicted

preds_df['loan_status'] = preds_df['prob_default'].apply(lambda x: 1 if x > 0.4 else 0)

| Loan | prob_default | threshold | loan_status |

|---|---|---|---|

| 1 | 0.25 | 0.4 | 0 |

| 2 | 0.42 | 0.4 | 1 |

| 3 | 0.75 | 0.4 | 1 |

Thresholds and acceptance rate

- Use model predictions to set better thresholds

- Can also be used to approve or deny new loans

- For all new loans, we want to deny probable defaults

- Use the test data as an example of new loans

- Acceptance rate: what percentage of new loans are accepted to keep the number of defaults in a portfolio low

- Accepted loans which are defaults have an impact similar to false negatives

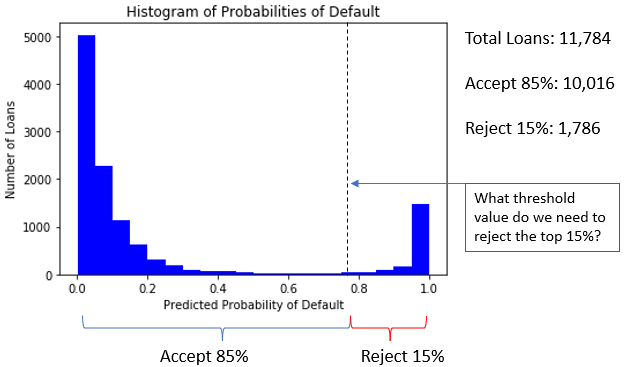

Understanding acceptance rate

- Example: Accept 85% of loans with the lowest

prob_default

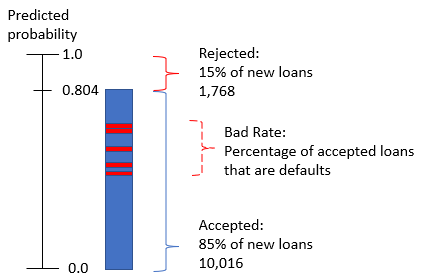

Calculating the threshold

- Calculate the threshold value for an 85% acceptance rate

import numpy as np

# Compute the threshold for 85% acceptance rate

threshold = np.quantile(prob_default, 0.85)

0.804

| Loan | prob_default |

Threshold | Predicted loan_status |

Accept or Reject |

|---|---|---|---|---|

| 1 | 0.65 | 0.804 | 0 | Accept |

| 2 | 0.85 | 0.804 | 1 | Reject |

Implementing the calculated threshold

- Reassign

loan_statusvalues using the new threshold

# Compute the quantile on the probabilities of default

preds_df['loan_status'] = preds_df['prob_default'].apply(lambda x: 1 if x > 0.804 else 0)

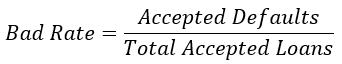

Bad Rate

- Even with a calculated threshold, some of the accepted loans will be defaults

- These are loans with

prob_defaultvalues around where our model is not well calibrated

Bad rate calculation

#Calculate the bad rate

np.sum(accepted_loans['true_loan_status']) / accepted_loans['true_loan_status'].count()

- If non-default is

0, and default is1then thesum()is the count of defaults - The

.count()of a single column is the same as the row count for the data frame

Let's practice!

Credit Risk Modeling in Python