Cross validation for credit models

Credit Risk Modeling in Python

Michael Crabtree

Data Scientist, Ford Motor Company

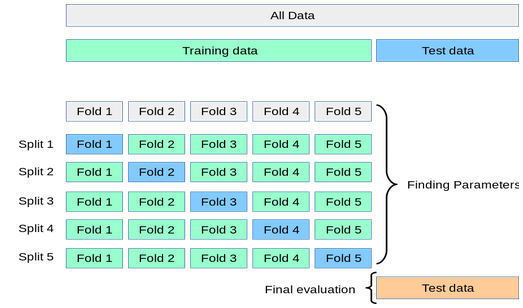

Cross validation basics

- Used to train and test the model in a way that simulates using the model on new data

- Segments training data into different pieces to estimate future performance

- Uses

DMatrix, an internal structure optimized forXGBoost - Early stopping tells cross validation to stop after a scoring metric has not improved after a number of iterations

How cross validation works

- Processes parts of training data as (called folds) and tests against unused part

- Final testing against the actual test set

1 https://scikit-learn.org/stable/modules/cross_validation.html

Setting up cross validation within XGBoost

# Set the number of folds

n_folds = 2

# Set early stopping number

early_stop = 5

# Set any specific parameters for cross validation

params = {'objective': 'binary:logistic',

'seed': 99, 'eval_metric':'auc'}

'binary':'logistic'is used to specify classification forloan_status'eval_metric':'auc'tells XGBoost to score the model's performance on AUC

Using cross validation within XGBoost

# Restructure the train data for xgboost

DTrain = xgb.DMatrix(X_train, label = y_train)

# Perform cross validation

xgb.cv(params, DTrain, num_boost_round = 5, nfold=n_folds,

early_stopping_rounds=early_stop)

DMatrix()creates a special object forxgboostoptimized for training

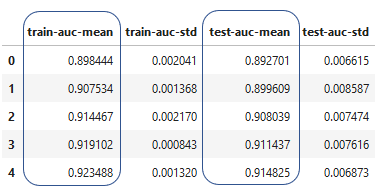

The results of cross validation

- Creates a data frame of the values from the cross validation

Cross validation scoring

- Uses cross validation and scoring metrics with

cross_val_score()function in scikit-learn

# Import the module

from sklearn.model_selection import cross_val_score

# Create a gbt model

xg = xgb.XGBClassifier(learning_rate = 0.4, max_depth = 10)

# Use cross valudation and accuracy scores 5 consecutive times

cross_val_score(gbt, X_train, y_train, cv = 5)

array([0.92748092, 0.92575308, 0.93975392, 0.93378608, 0.93336163])

Let's practice!

Credit Risk Modeling in Python