Volatility and extreme values

Quantitative Risk Management in Python

Jamsheed Shorish

Computational Economist

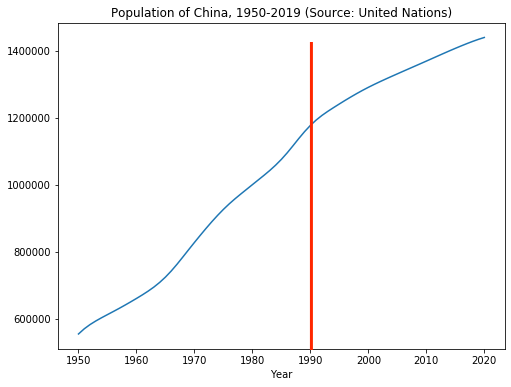

Chow test assumptions

- Chow test: identify statistical significance of possible structural break

- Requires: pre-specified point of structural break

- Requires: linear relation (e.g. factor model) $$ \log(\text{Population}_t) = \alpha + \beta * \text{Year}_t + u_t $$

Structural break indications

- Visualization of trend may not indicate break point

- Alternative: examine volatility rather than trend

- Structural change often accompanied by greater uncertainty => volatility

- Allows richer models to be considered (e.g. stochastic volatility models)

Rolling window volatility

- Rolling window: compute volatility over time and detect changes

Recall: 30-day rolling window

- Create rolling window from ".rolling()" method

- Compute the volatility of the rolling window (drop unavailable dates)

- Compute summary statistic of interest, e.g.

.mean(),.min(), etc.

rolling = portfolio_returns.rolling(30)volatility = rolling.std().dropna()vol_mean = volatility.resample("M").mean()

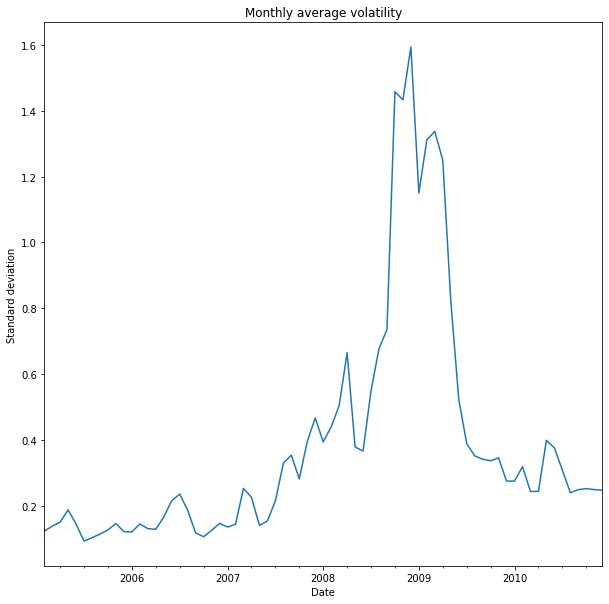

Rolling window volatility

- Visualize resulting volatility (variance or standard deviation)

import matplotlib.pyplot as plt

vol_mean.plot(

title="Monthly average volatility"

).set_ylabel("Standard deviation")

plt.show()

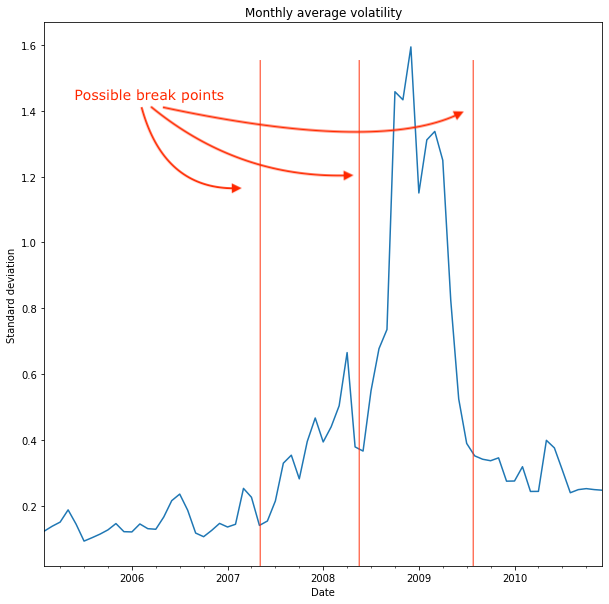

Rolling window volatility

- Visualize resulting volatility (variance or standard deviation)

- Large changes in volatility => possible structural break point(s)

- Use proposed break points in linear model of volatility

- Variant of Chow Test

- Guidance for applying e.g. ARCH, stochastic volatility models

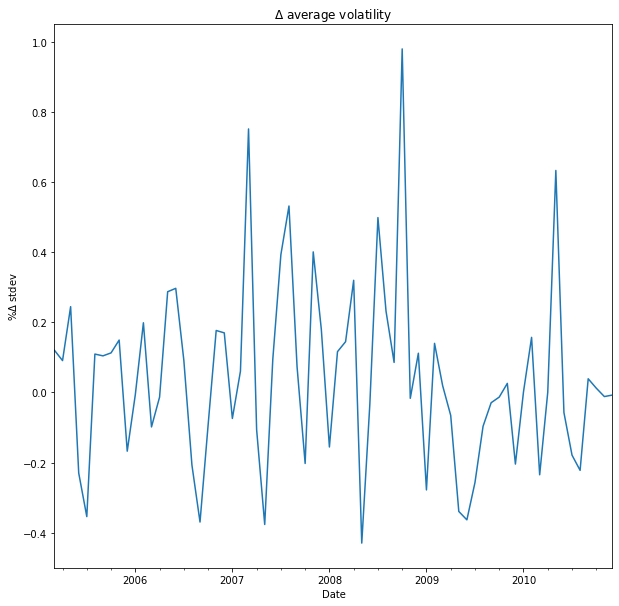

vol_mean.pct_change().plot(

title="$\Delta$ average volatility"

).set_ylabel("% $\Delta$ stdev")

plt.show()

Extreme values

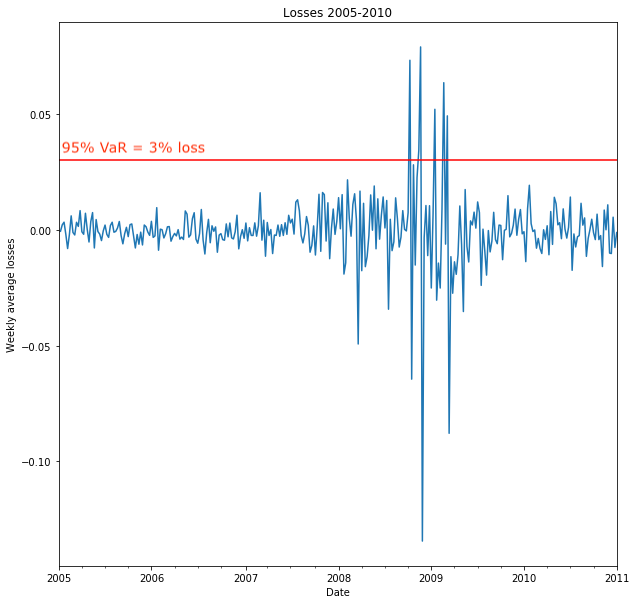

- VaR, CVaR: maximum loss, expected shortfall at particular confidence level

- Visualize changes in maximum loss by plotting VaR?

- Useful for large datasets

- Small datasets: not enough information

- Alternative: find losses exceeding some threshold

- Example: $\text{VaR}_{95}$ is maximum loss 95% of the time

- So 5% of the time, losses can be expected to exceed $\text{VaR}_{95}$

- Backtesting: use previous data ex-post to see how risk estimate performs

- Used extensively in enterprise risk management

Backtesting

- Suppose $\text{VaR}_{95} = 0.03$

- Losses exceeding 3% are then extreme values

- Backtesting: around 5% (100% - 95%) of previous losses should exceed 3%

- More than 5%: distribution with wider ("fatter") tails

- Less than 5%: distribution with narrower tails

- CVaR for backtesting: accounts for tail better than VaR

Let's practice!

Quantitative Risk Management in Python