Kernel density estimation

Quantitative Risk Management in Python

Jamsheed Shorish

Computational Economist

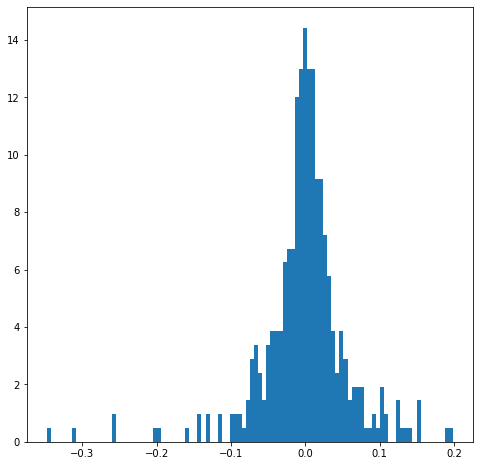

The histogram revisited

- Risk factor distributions

- Assumed (e.g. Normal, T, etc.)

- Fitted (parametric estimation, Monte Carlo simulation)

- Ignored (historical simulation)

- Actual data: histogram

- How to represent histogram by probability distribution?

- Smooth data using filtering

- Non-parametric estimation

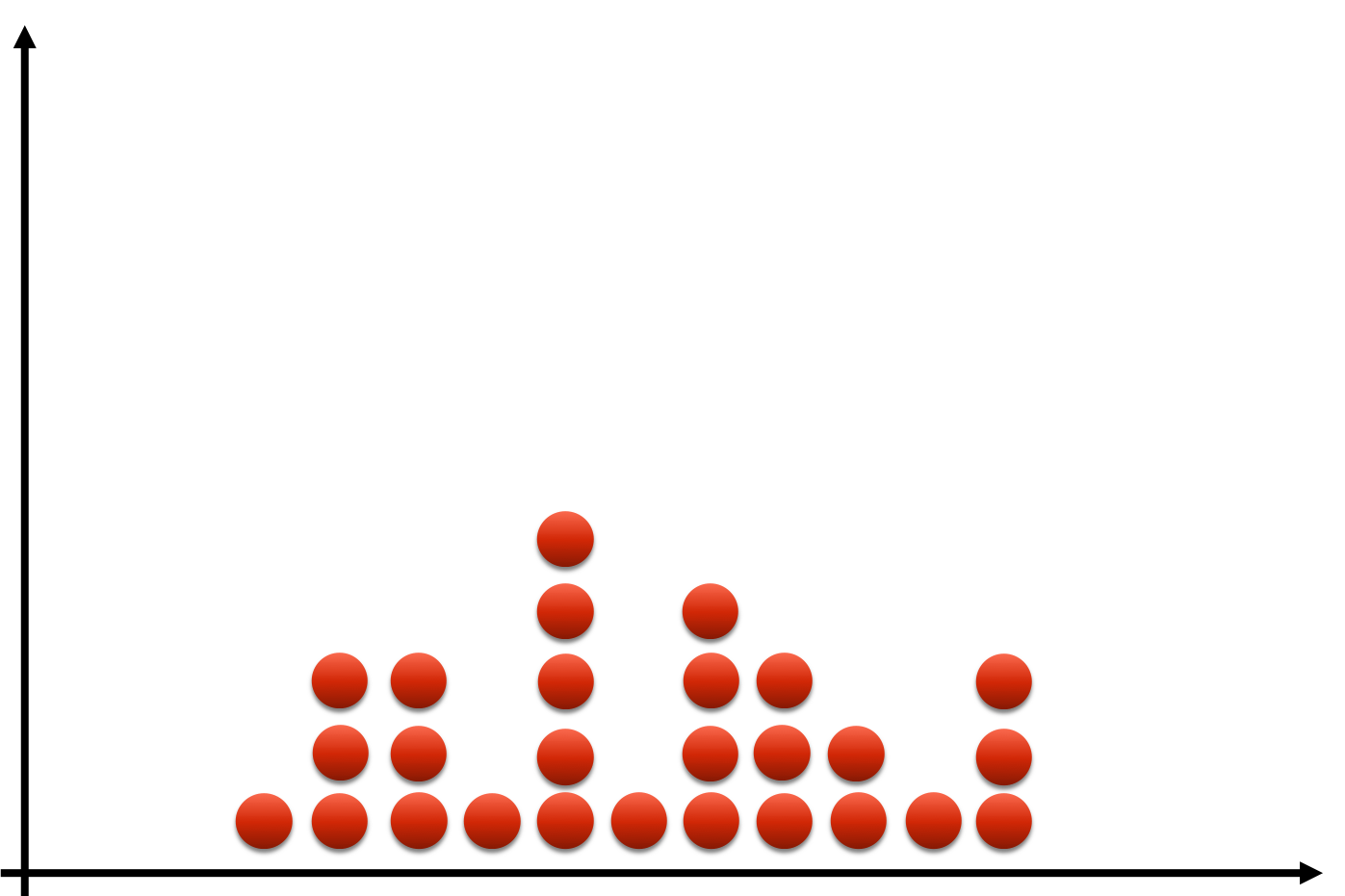

Data smoothing

- Filter: smoothen out 'bumps' of histogram

Data smoothing

- Filter: smoothen out 'bumps' of histogram

- Observations accumulate in over time

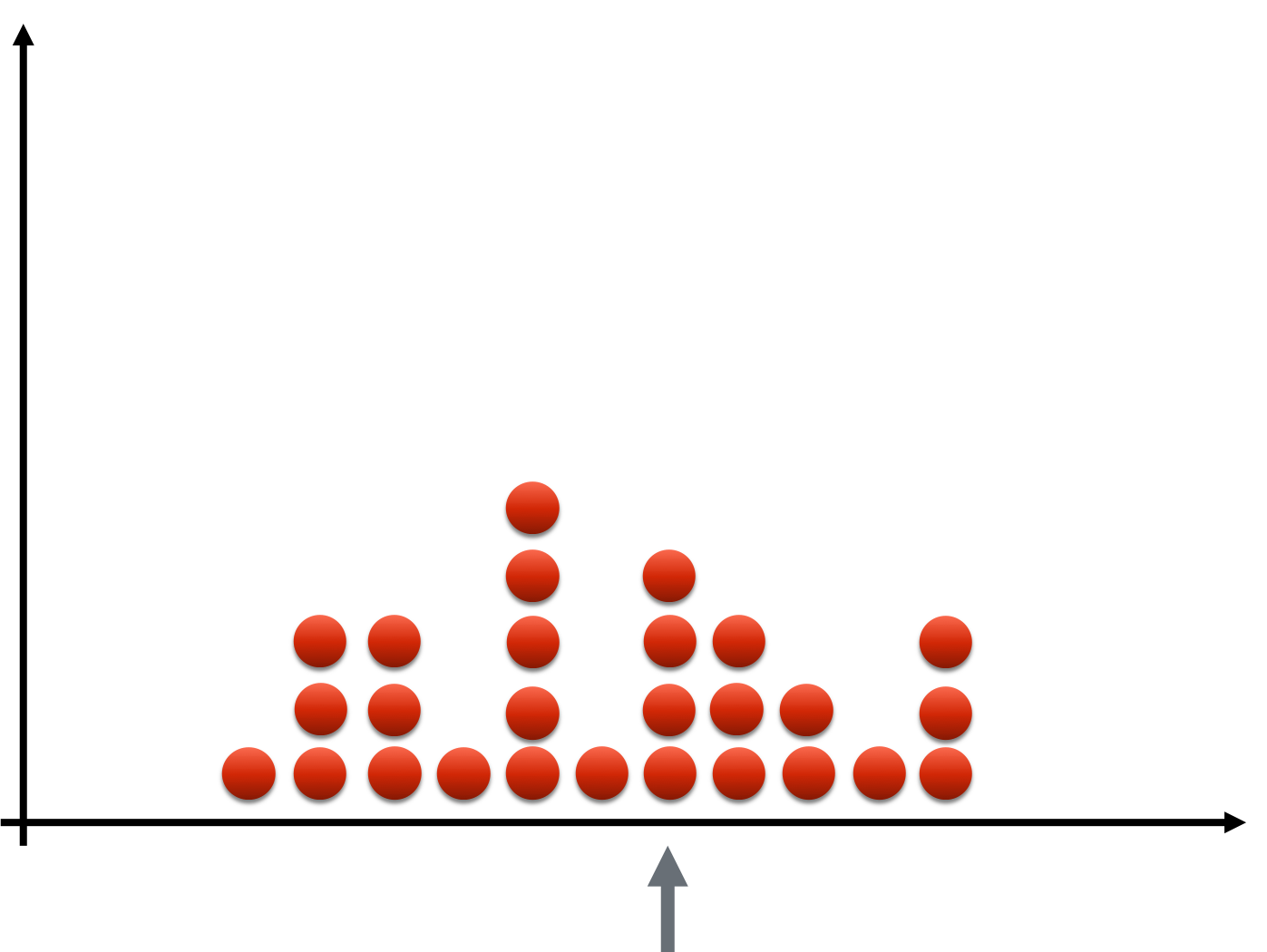

Data smoothing

- Filter: smoothen out 'bumps' of histogram

- Observations accumulate in over time

Data smoothing

- Filter: smoothen out 'bumps' of histogram

- Observations accumulate in over time

Data smoothing

- Filter: smoothen out 'bumps' of histogram

- Observations accumulate in over time

- Pick particular portfolio loss

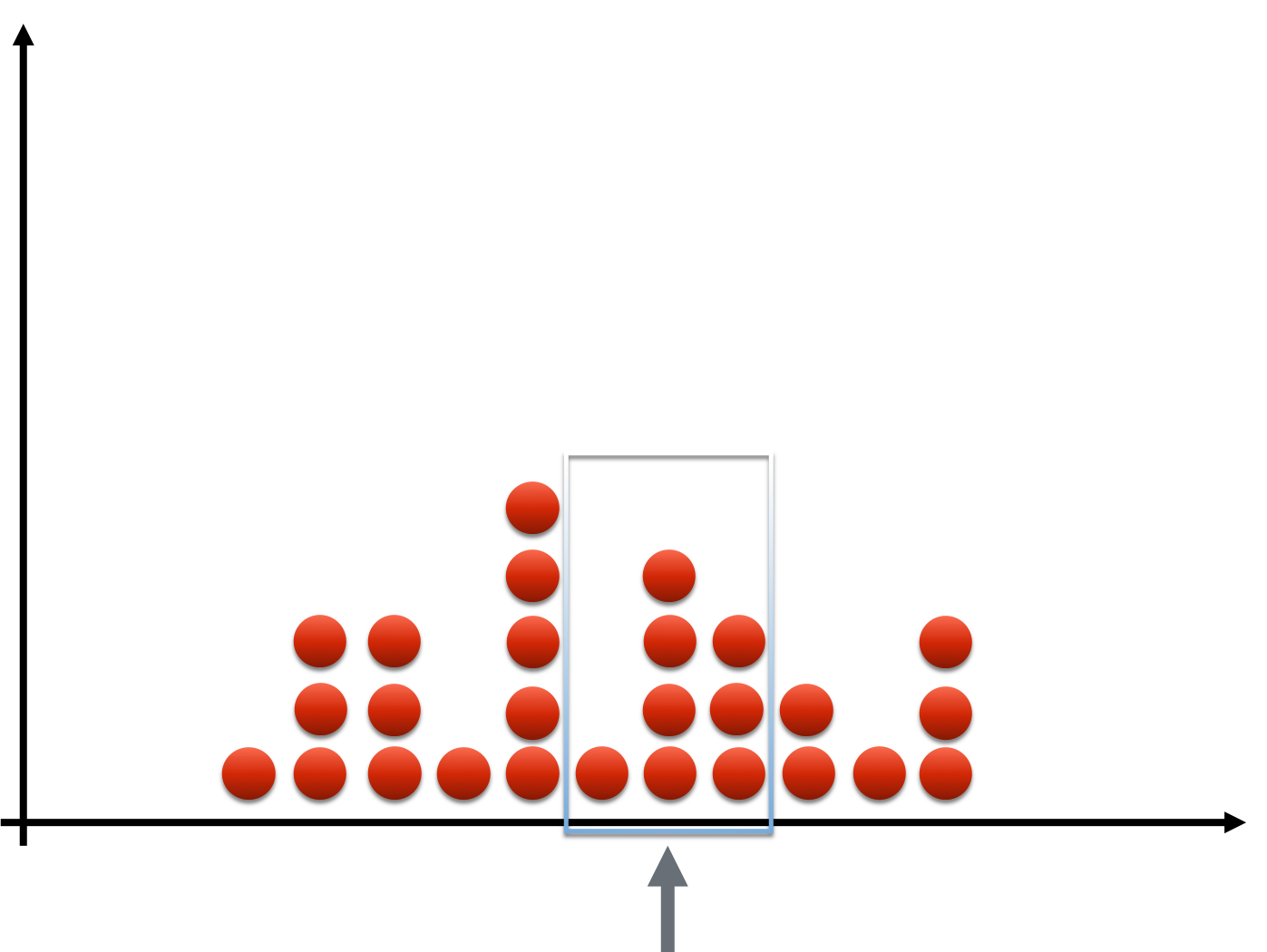

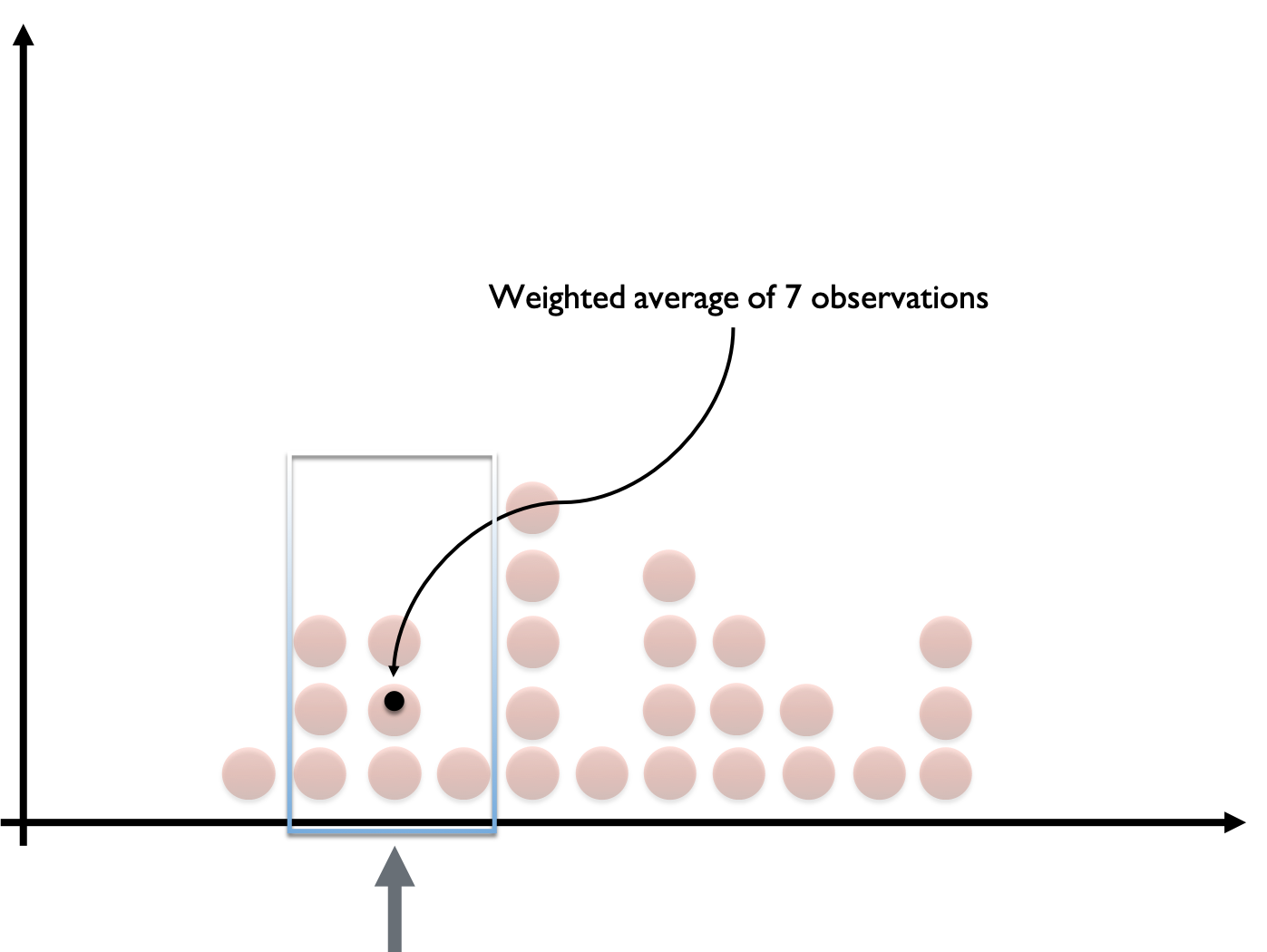

Data smoothing

- Filter: smoothen out 'bumps' of histogram

- Observations accumulate in over time

- Pick particular portfolio loss

- Examine nearby losses

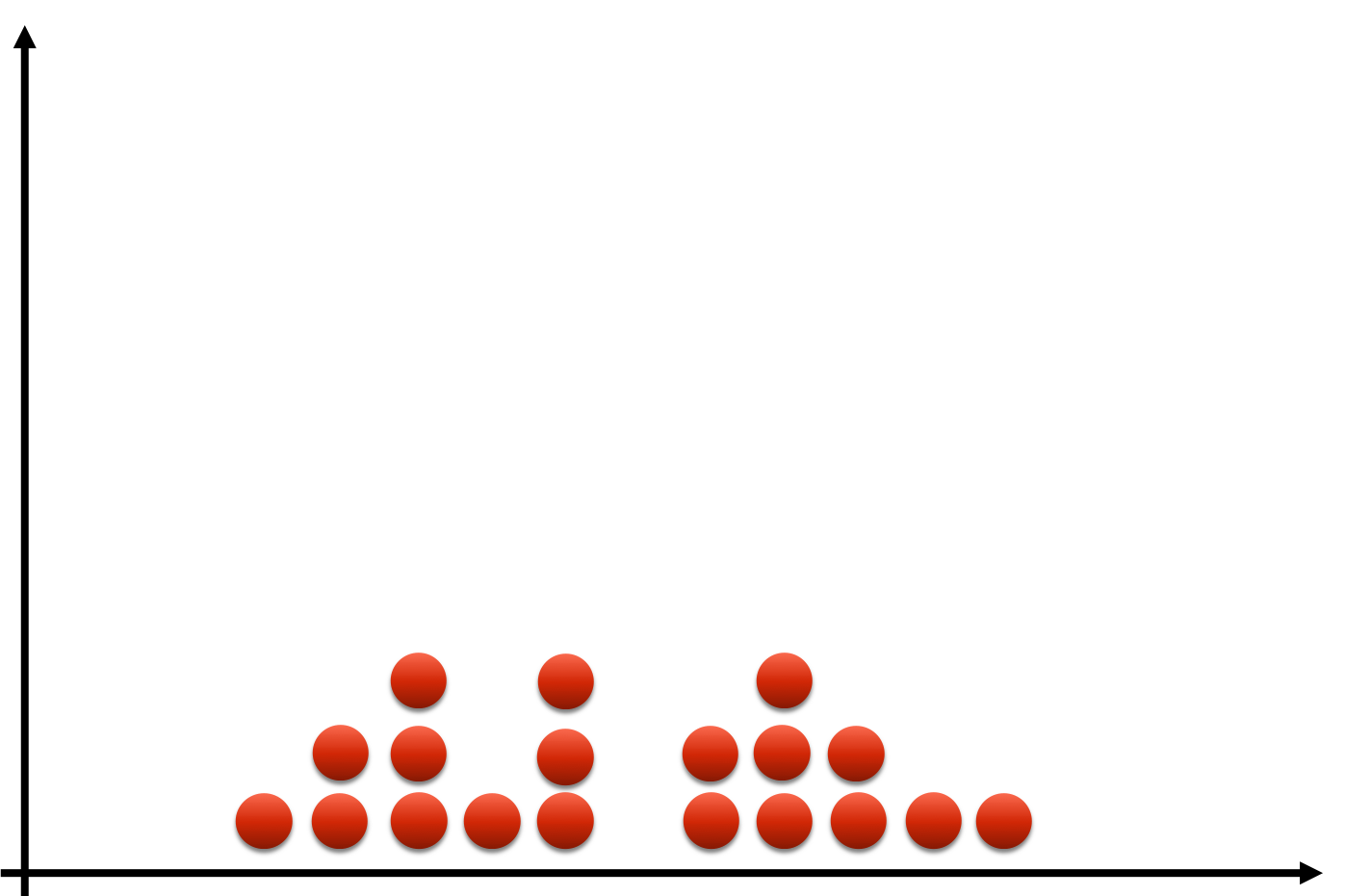

Data smoothing

- Filter: smoothen out 'bumps' of histogram

- Observations accumulate in over time

- Pick particular portfolio loss

- Examine nearby losses

- Form "weighted average" of losses

- Kernel: filter choice; determines "window"

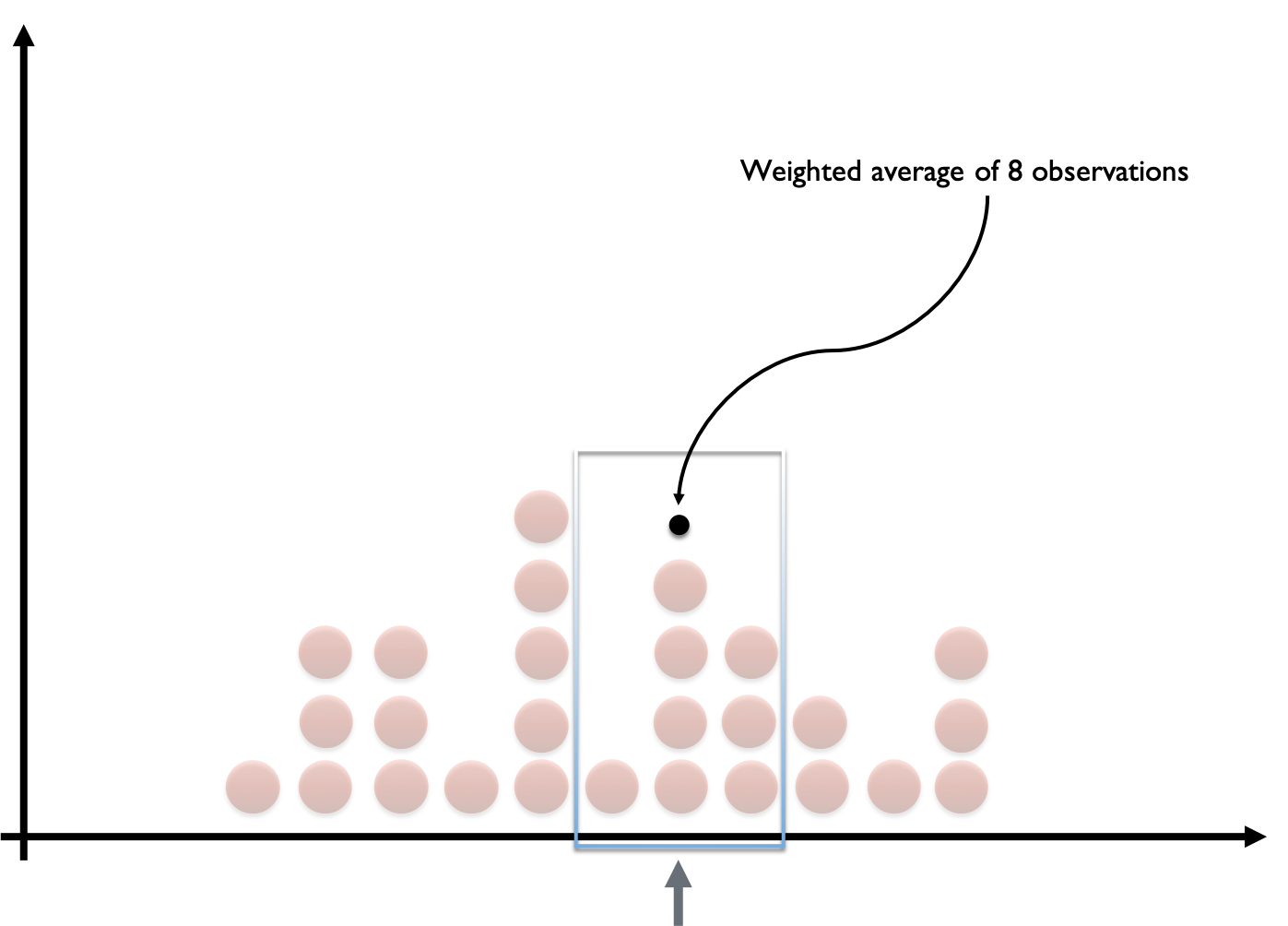

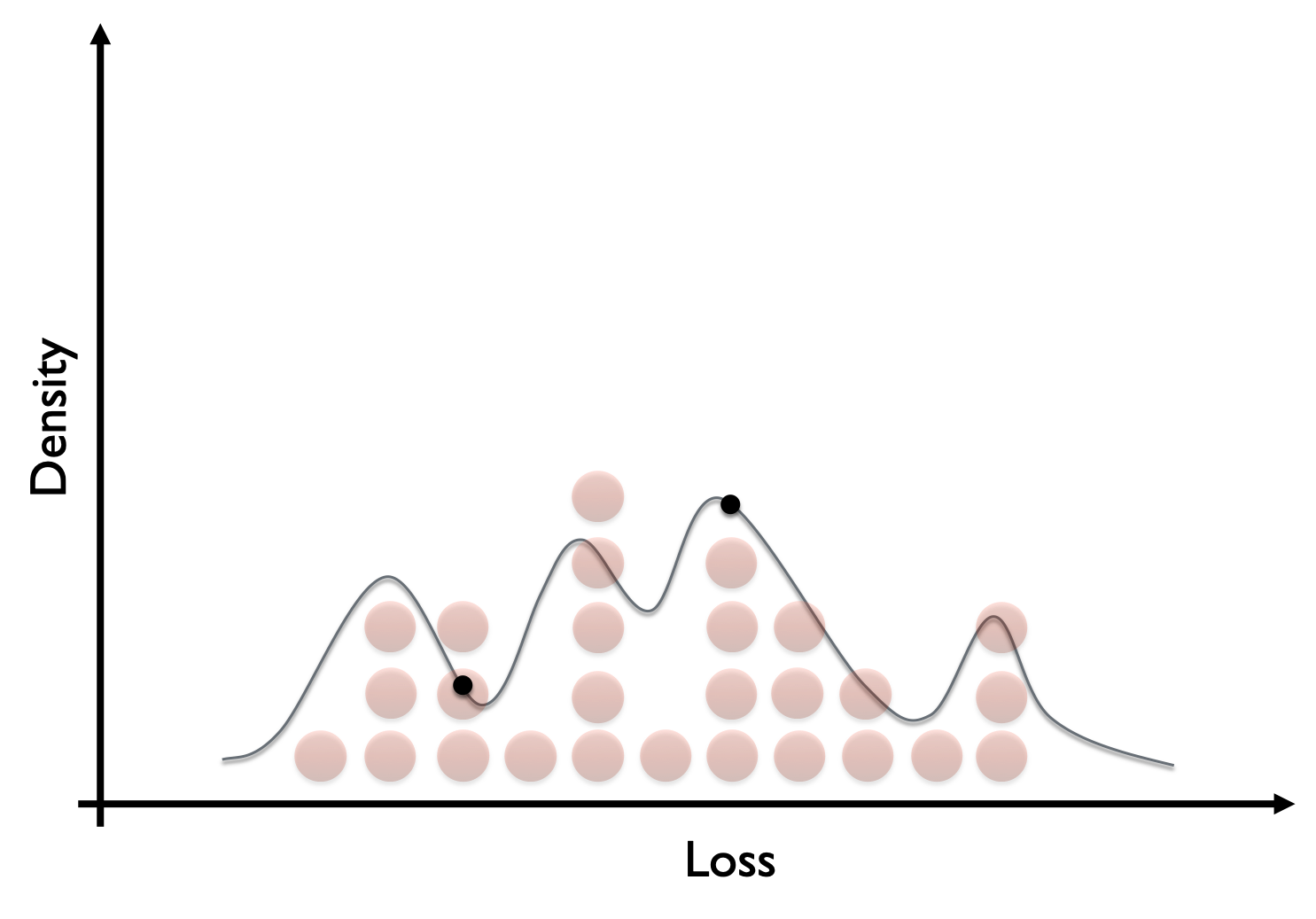

Data smoothing

- Filter: smoothen out 'bumps' of histogram

- Observations accumulate in over time

- Pick particular portfolio loss

- Examine nearby losses

- Form "weighted average" of losses

- Kernel: filter choice; determines "window"

- Move window to another loss

Data smoothing

- Filter: smoothen out 'bumps' of histogram

- Observations accumulate in over time

- Pick particular portfolio loss

- Examine nearby losses

- Form "weighted average" of losses

- Kernel: filter choice; determines "window"

- Move window to another loss

- Kernel density estimate: probability density

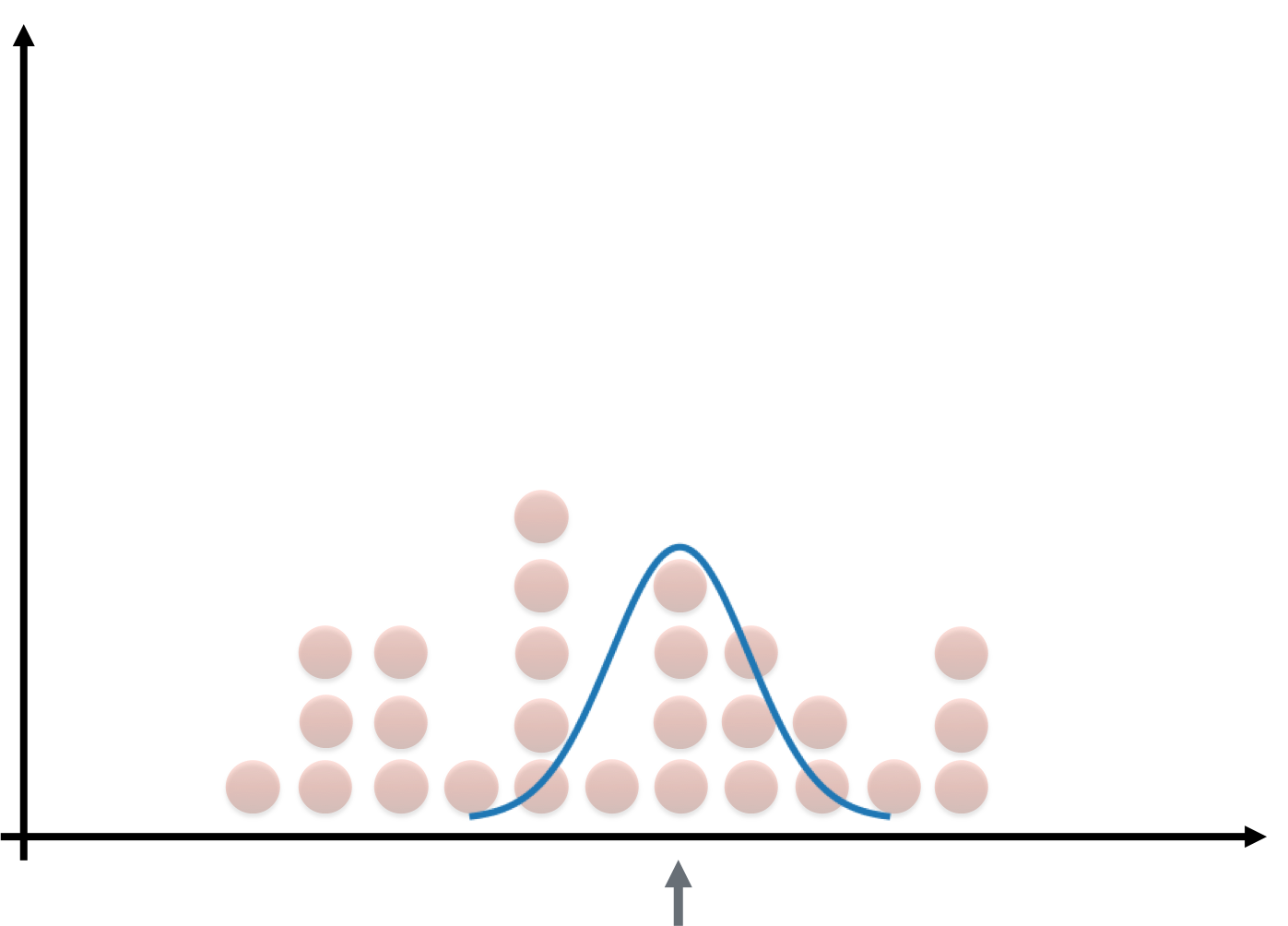

The Gaussian kernel

- Continuous kernel

- Weights all observations by distance from center

- Generally: many different kernels are available

- Used in time series analysis

- Used in signal processing

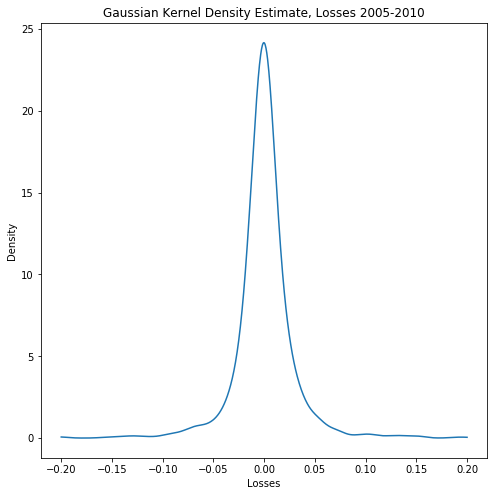

KDE in Python

from scipy.stats import gaussian_kdekde = guassian_kde(losses)loss_range = np.linspace(np.min(losses), np.max(losses), 1000)plt.plot(loss_range, kde.pdf(loss_range))

- Visualization: probability density function from KDE fit

Finding VaR using KDE

- VaR: use

gaussian_kde.resample()method - Find quantile of resulting sample

- CVaR: expected value as previously encountered, but

gaussian_kdehas no.expect()method => compute integral manually- special

.expect()method written for exercise

sample = kde.resample(size = 1000)VaR_99 = np.quantile(sample, 0.99)print("VaR_99 from KDE: ", VaR_99)

VaR_99 from KDE: 0.08796423698448601

Let's practice!

Quantitative Risk Management in Python