Welcome!

Quantitative Risk Management in Python

Dr. Jamsheed Shorish

Computational Economist

About Me

- Computational Economist

- Specializing in:

- asset pricing

- financial technologies ("FinTech")

- computer applications to economics and finance

- Co-instructor, "Economic Analysis of the Digital Economy" at the ANU

- Shorish Research (Belgium): computational business applications

What is Quantitative Risk Management?

- Quantitative Risk Management: Study of quantifiable uncertainty

- Uncertainty:

- Future outcomes are unknown

- Outcomes impact planning decisions

- Risk management: mitigate (reduce effects of) adverse outcomes

- Quantifiable uncertainty: identify factors to measure risk

- Example: Fire insurance. What factors make fire more likely?

- This course: focus upon risk associated with a financial portfolio

Risk management and the Global Financial Crisis

- Great Recession (2007 - 2010)

- Global growth loss more than $2 trillion

- United States: nearly $10 trillion lost in household wealth

- U.S. stock markets lost c. $8 trillion in value

- Global Financial Crisis (2007-2009)

- Large-scale changes in fundamental asset values

- Massive uncertainty about future returns

- High asset returns volatility

- Risk management critical to success or failure

Quick recap: financial portfolios

- Financial portfolio

- Collection of assets with uncertain future returns

- Stocks

- Bonds

- Foreign exchange holdings ('forex')

- Stock options

- Challenge: quantify risk to manage uncertainty

- Make optimal investment decisions

- Maximize portfolio return, conditional on risk appetite

Quantifying return

- Portfolio return: weighted sum of individual asset returns

Pandasdata analysis library- DataFrame

prices .pct_change()method.dot()method ofreturns

prices = pandas.read_csv("portfolio.csv")returns = prices.pct_change()weights = (weight_1, weight_2, ...)portfolio_returns = returns.dot(weights)

Quantifying risk

- Portfolio return volatility = risk

- Calculate volatility via covariance matrix

- Use

.cov()DataFrame method ofreturnsand annualize

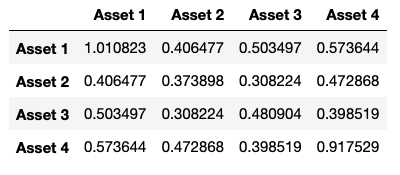

covariance = returns.cov()*252print(covariance)

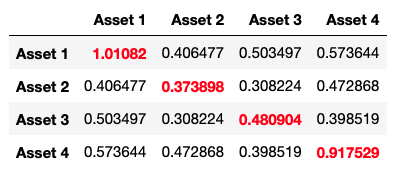

Quantifying risk

- Portfolio return volatility = risk

- Calculate volatility via covariance matrix

- Use

.cov()DataFrame method ofreturnsand annualize - Diagonal of

covarianceis individual asset variances

covariance = returns.cov()*252print(covariance)

Quantifying risk

- Portfolio return volatility = risk

- Calculate volatility via covariance matrix

- Use

.cov()DataFrame method ofreturnsand annualize - Diagonal of

covarianceis individual asset variances - Off-diagonals of

covarianceare covariances between assets

covariance = returns.cov()*252print(covariance)

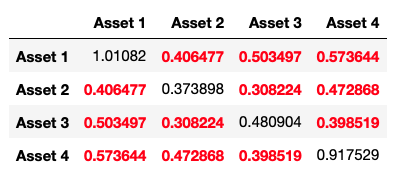

Portfolio risk

- Depends upon asset

weightsin portfolio - Portfolio variance $\sigma_p^2$ is $$ \sigma_p^2 := w^T \cdot \textnormal{Cov}_p \cdot w $$

- Matrix multiplication can be computed using

@operator in Python - Standard deviation is usually used instead of variance

weights = [0.25, 0.25, 0.25, 0.25] # Assumes four assets in portfolioportfolio_variance = np.transpose(weights) @ covariance @ weightsportfolio_volatility = np.sqrt(portfolio_variance)

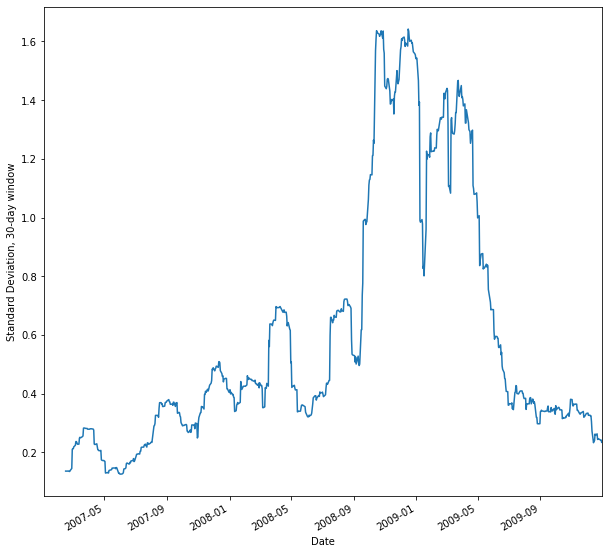

Volatility time series

- Can also calculate portfolio volatility over time

- Use a 'window' to compute volatility over a fixed time period (e.g. week, 30-day 'month')

Series.rolling()creates a window- Observe volatility trend and possible extreme events

windowed = portfolio_returns.rolling(30)volatility = windowed.std()*np.sqrt(252) volatility.plot() .set_ylabel("Standard Deviation...")

Let's practice!

Quantitative Risk Management in Python