Modern portfolio theory

Quantitative Risk Management in Python

Jamsheed Shorish

Computational Economist

The risk-return trade-off

- Risk factors: sources of uncertainty affecting return

- Intuitively: greater uncertainty (more risk) compensated by greater return

- Cannot guarantee return: need some measure of expected return

- average (mean) historical return: proxy for expected future return

Investor risk appetite

- Investor survey: minimum return required for given level of risk?

- Survey response creates (risk, return) risk profile "data point"

- Vary risk level => set of (risk, return) points

- Investor risk appetite: defines one quantified relationship between risk and return

Choosing portfolio weights

- Vary portfolio weights of given portfolio => creates set of (risk, return) pairs

- Changing weights = beginning risk management!

- Goal: change weights to maximize expected return, given risk level

- Equivalently: minimize risk, given expected return level

- Changing weights = adjusting investor's risk exposure

Modern portfolio theory

- Efficient portfolio: portfolio with weights generating highest expected return for given level of risk

- Modern Portfolio Theory (MPT), 1952

- H. M. Markowitz (Nobel Laureate 1990)

- Efficient portfolio weight vector $w^\star$ solves:

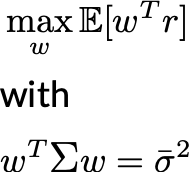

The efficient frontier

- Compute many efficient portfolios for different levels of risk

- Efficient frontier: locus of (risk, return) pairs created by efficient portfolios

PyPortfolioOptlibrary: optimized tools for MPTEfficientFrontierclass: generates one optimal portfolio at a time- Constrained Line Algorithm (

CLA) class: generates the entire efficient frontier- Requires covariance matrix of returns

- Requires proxy for expected future returns: mean historical returns

Investment bank portfolio 2005 - 2010

- Expected returns: historical data

- Covariance matrix:

Covariance Shrinkageimproves efficiency of estimate - Constrained Line Algorithm object

CLA - Minimum variance portfolio:

cla.min_volatility() - Efficient frontier:

cla.efficient_frontier()

expected_returns = mean_historical_return(prices)efficient_cov = CovarianceShrinkage(prices).ledoit_wolf()cla = CLA(expected_returns, efficient_cov)minimum_variance = cla.min_volatility()(ret, vol, weights) = cla.efficient_frontier()

Visualizing the efficient frontier

- Scatter plot of (vol, ret) pairs

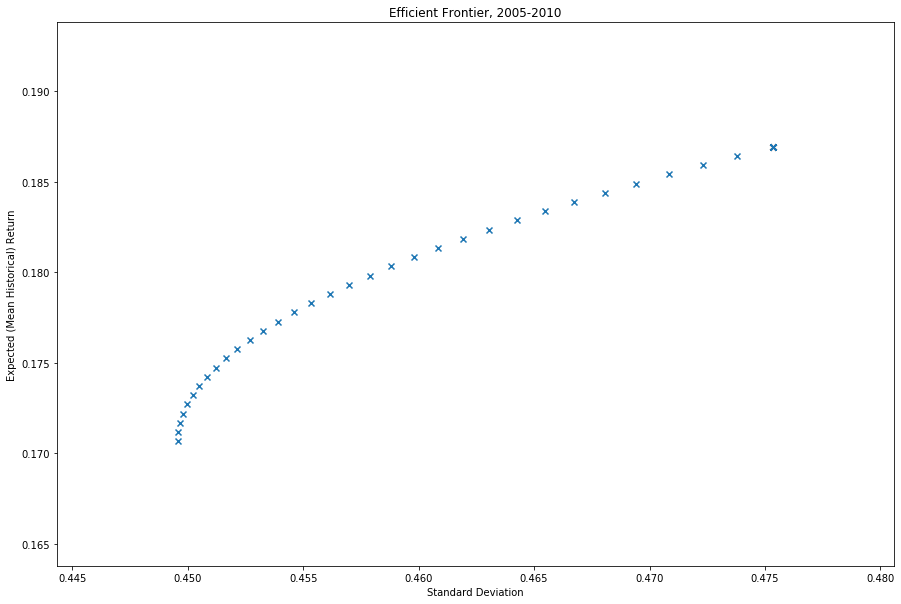

Visualizing the efficient frontier

- Scatter plot of (vol, ret) pairs

- Minimum variance portfolio: smallest volatility of all possible efficient portfolios

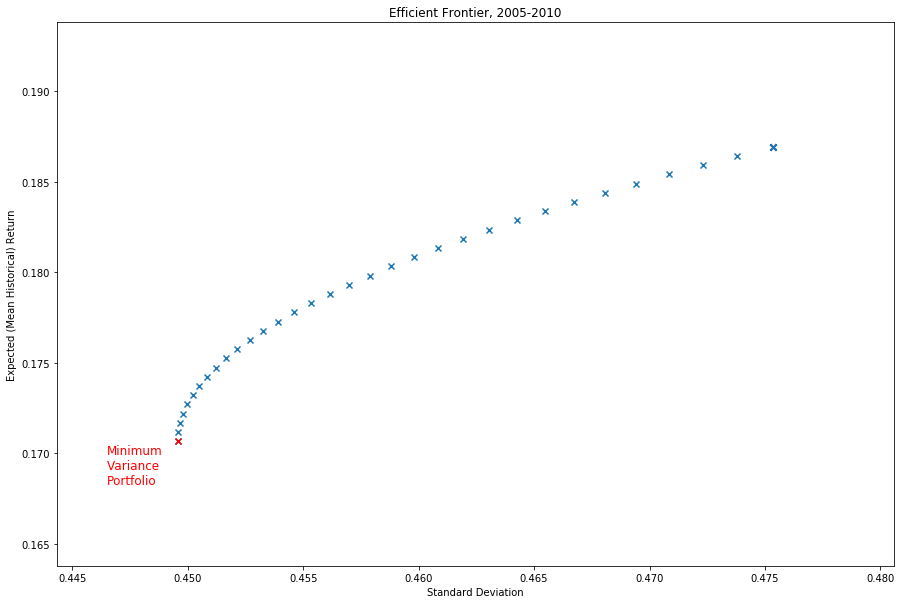

Visualizing the efficient frontier

- Scatter plot of (vol, ret) pairs

- Minimum variance portfolio: smallest volatility of all possible efficient portfolios

- Increasing risk appetite: move along the frontier

Let's practice!

Quantitative Risk Management in Python