Measuring Risk

Quantitative Risk Management in Python

Jamsheed Shorish

CEO, Shorish Research

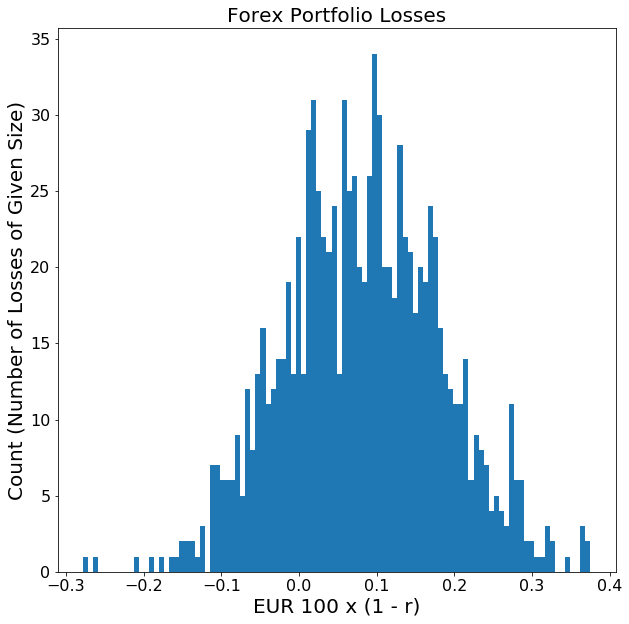

The Loss Distribution

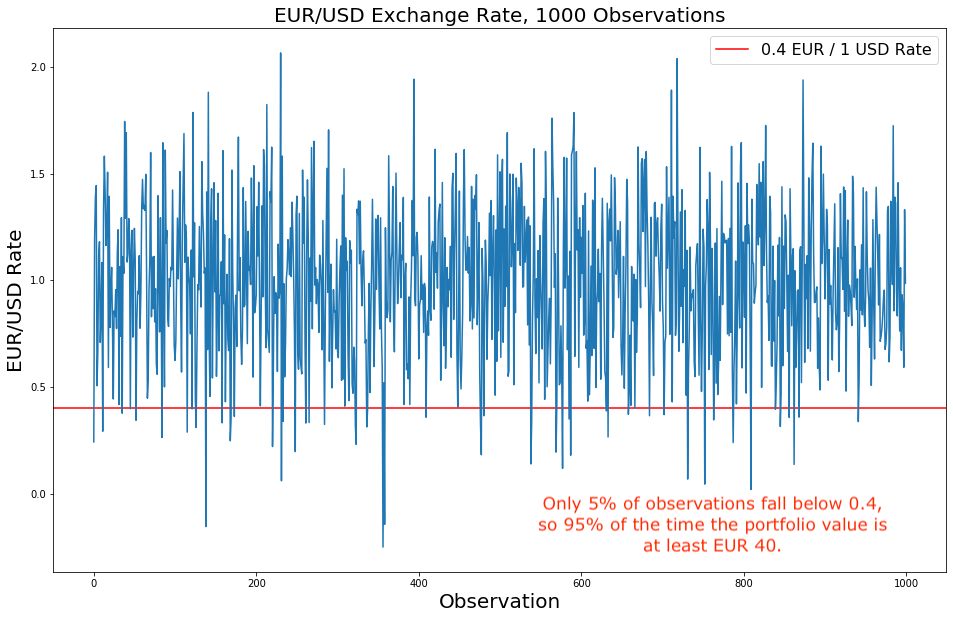

- Forex Example:

- Portfolio value in U.S. dollars is USD 100

- Risk factor =

/

/  exchange rate

exchange rate - Portfolio value in EURO if 1

= 1

= 1  : USD 100 x EUR 1 / USD 1 = EUR 100.

: USD 100 x EUR 1 / USD 1 = EUR 100. - Portfolio value in EURO if r

= 1

= 1  : = USD 100 x EUR r / 1 USD = EUR 100 x r

: = USD 100 x EUR r / 1 USD = EUR 100 x r - Loss = EUR 100 - EUR 100 x r = EUR 100 x (1 - r)

- Loss distribution: Random realizations of r => distribution of portfolio losses in the future

Maximum loss

- What is the maximum loss of a portfolio?

- Losses cannot be bounded with 100% certainty

- Confidence Level: replace 100% certainty with likelihood of upper bound

- Can express questions like "What is the maximum loss that would take place 95% of the time?"

- Here the confidence level is 95%.

Value at Risk (VaR)

- VaR: statistic measuring maximum portfolio loss at a particular confidence level

- Typical confidence levels: 95%, 99%, and 99.5% (usually represented as decimals)

- Forex Example: If 95% of the time EUR / USD exchange rate is at least 0.40, then:

- portfolio value is at least USD 100 x 0.40 EUR / USD = EUR 40,

- portofio loss is at most EUR 40 - EUR 100 = EUR 60,

- so the 95% VaR is EUR 60.

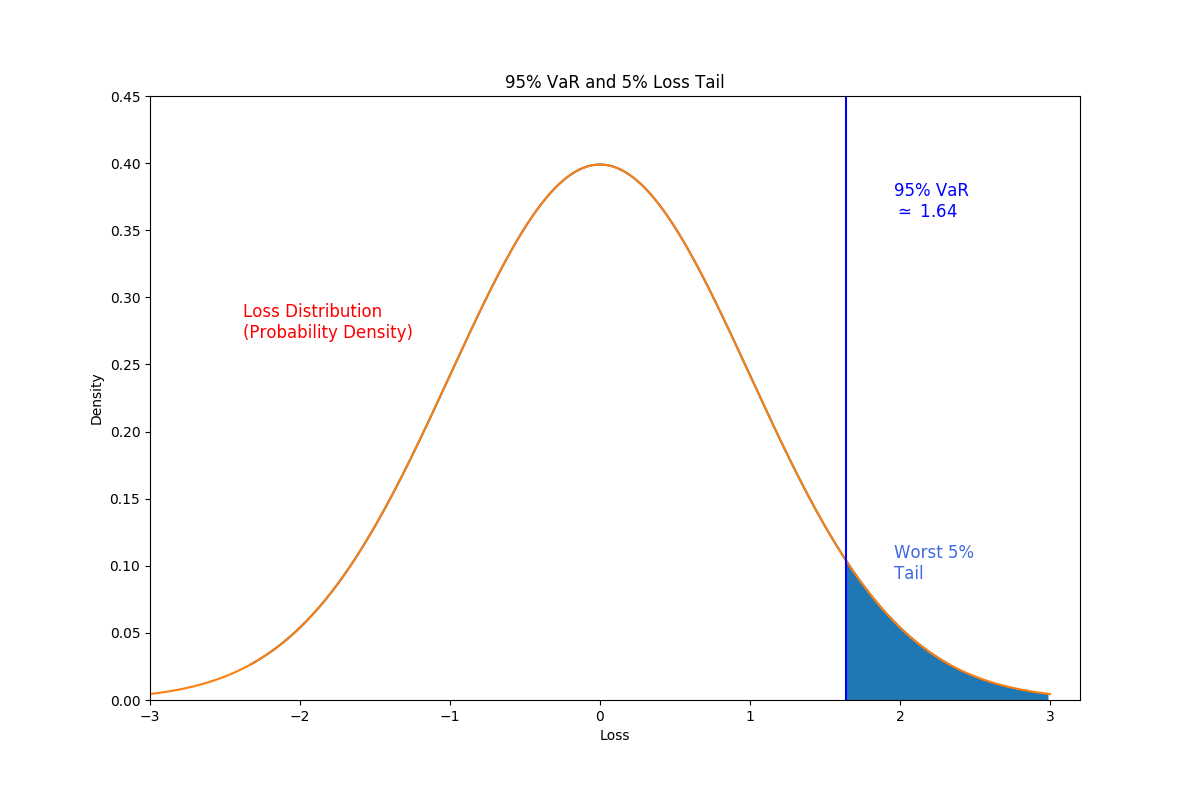

Conditional Value at Risk (CVaR)

- CVaR: measures expected loss given a minimum loss equal to the VaR

- Equals expected value of the tail of the loss distribution:

- $$\textnormal{CVaR}(\alpha) := \frac{1}{1-\alpha}\mathbb{E} \int_{\textnormal{VaR}(\alpha)}^{\bar{x}} x f(x) dx,$$

- $f(\cdot)$ = loss distribution pdf

- $\bar{x}$ = upper bound of the loss (can be infinity)

- $\textnormal{VaR}(\alpha)$ = VaR at the $\alpha$ confidence level.

- Forex Example:

- 95% CVaR = expected loss for 5% of cases when portfolio value smaller than EUR 40

Deriving the VaR

- Specify confidence level, e.g. 95% (0.95)

- Create Series of

lossobservations - Compute

loss.quantile()at specified confidence level VaR = computed

.quantile()at desired confidence levelscipy.statsloss distribution: percent point function.ppf()can also be used

loss = pd.Series(observations)VaR_95 = loss.quantile(0.95) print("VaR_95 = ", VaR_95)

Var_95 = 1.6192834157254088

Deriving the CVaR

- Specify confidence level, e.g. 95% (0.95)

- Create or use sample from loss distribution

- Compute VaR at a specified confidence level, e.g. 0.95.

- Compute CVaR as expected loss (Normal distribution:

scipy.stats.norm.expect()does this).

losses = pd.Series(scipy.stats.norm.rvs(size=1000))VaR_95 = scipy.stats.norm.ppf(0.95)CVaR_95 = (1/(1 - 0.95))*scipy.stats.norm.expect(lambda x: x, lb = VaR_95)print("CVaR_95 = ", CVaR_95)

CVaR_95 = 2.153595332530393

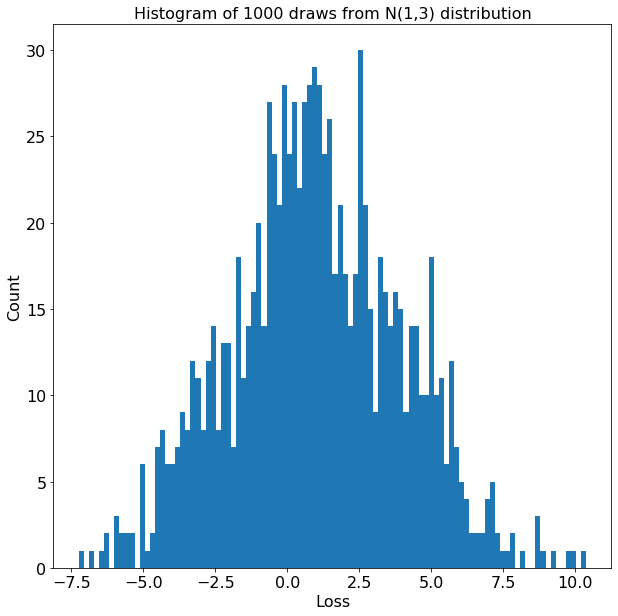

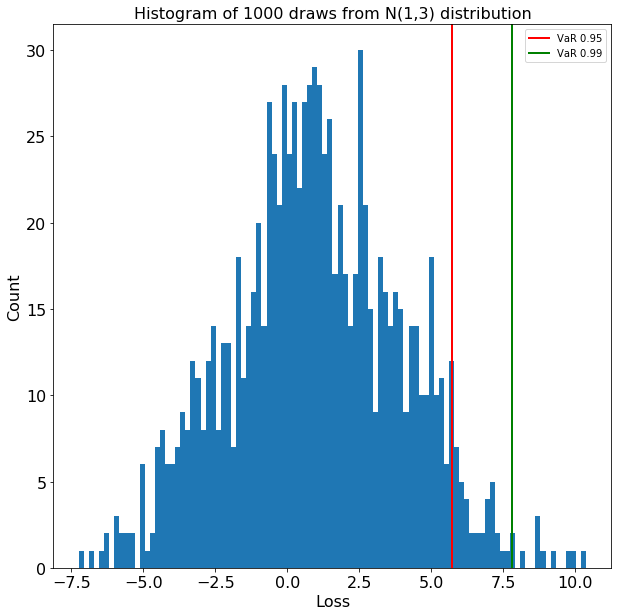

Visualizing the VaR

- Loss distribution histogram for 1000 draws from N(1,3)

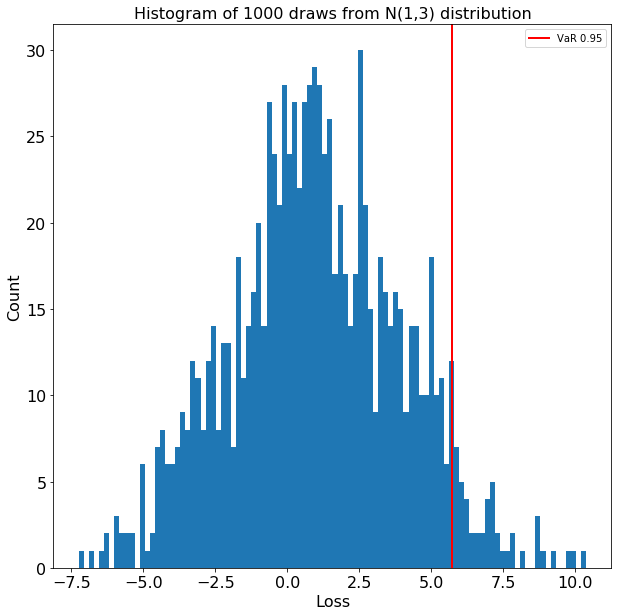

Visualizing the VaR

- Loss distribution histogram for 1000 draws from N(1,3)

- VaR$_{95}$ = 5.72, i.e. VaR at 95% confidence

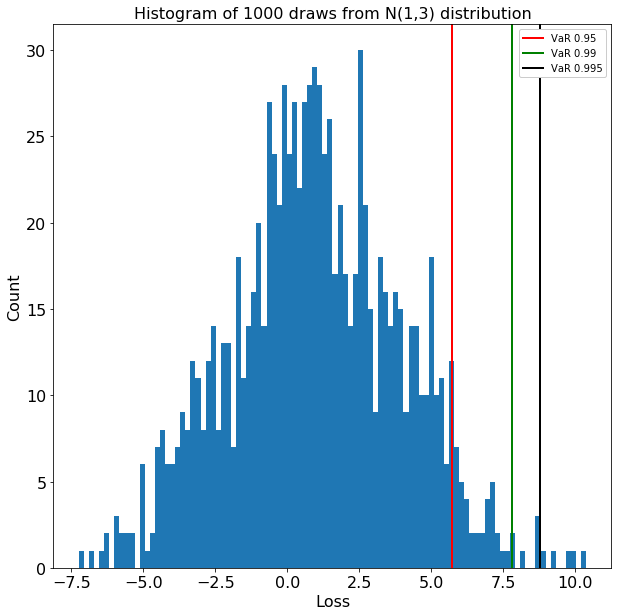

Visualizing the VaR

- Loss distribution histogram for 1000 draws from N(1,3)

- VaR$_{95}$ = 5.72, i.e. VaR at 95% confidence

- VaR$_{99}$ = 7.81, i.e. VaR at 99% confidence

Visualizing the VaR

- Loss distribution histogram for 1000 draws from N(1,3)

- VaR$_{95}$ = 5.72, i.e. VaR at 95% confidence

- VaR$_{99}$ = 7.81, i.e. VaR at 99% confidence

- VaR$_{99.5}$ = 8.78, i.e. VaR at 99.5% confidence

- The VaR measure increases as the confidence level rises

Let's practice!

Quantitative Risk Management in Python