Present value

Financial Analysis in Power BI

Nick Edwards

Capital Markets Analyst

Present value (PV)

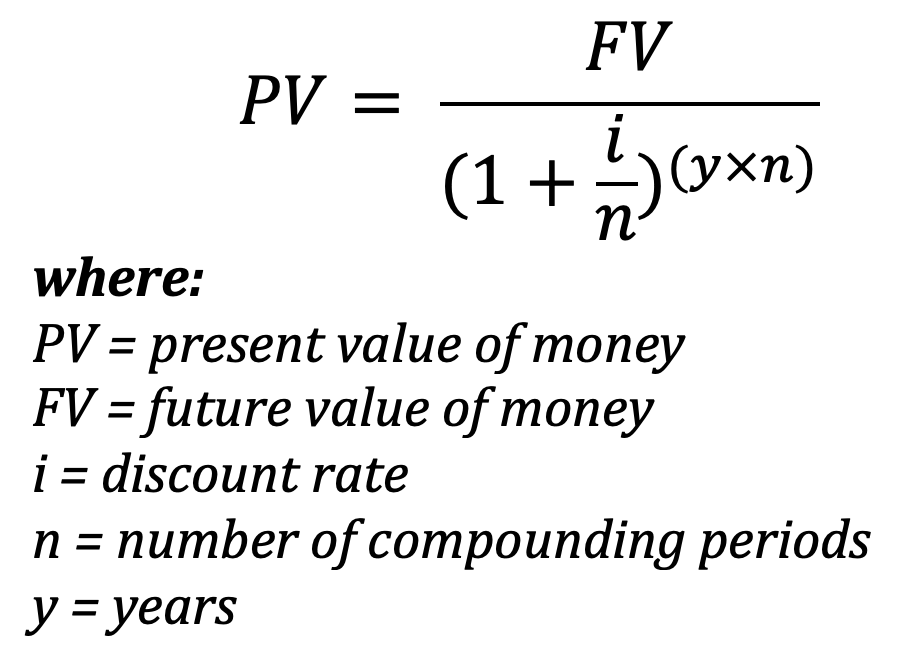

Present value is the current value of money that will be received in the future.

- "How much do I need to invest today to have the equivalent of the future value by the end of the time period?"

- Referred to as "discounting"

Example: Find the present value of $500,000 ten years from now at a 20% discount rate that compounds weekly.

PV = FV/(1+i/n)^(y*n)PV = $500,0000.00/(1+0.2/52)^(10*52)PV = $500,0000.00/(1.00385)^520PV = $500,0000.00/7.36PV = $67,927.73

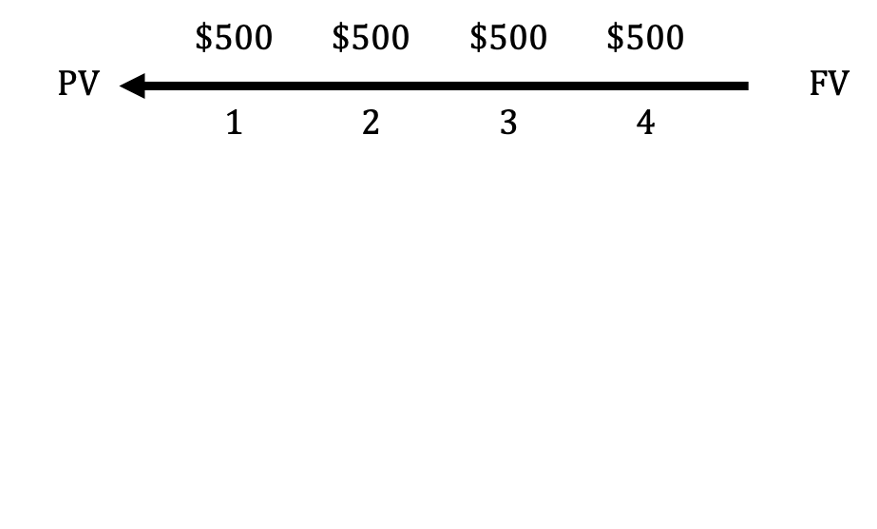

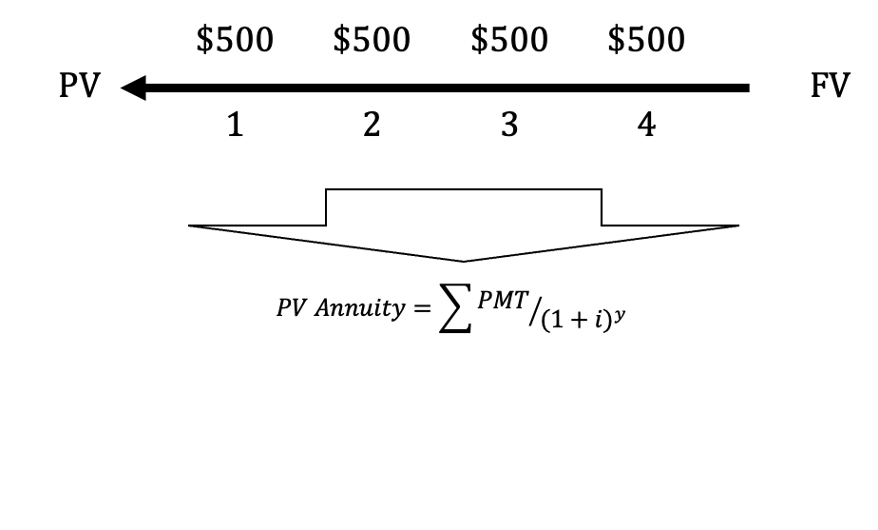

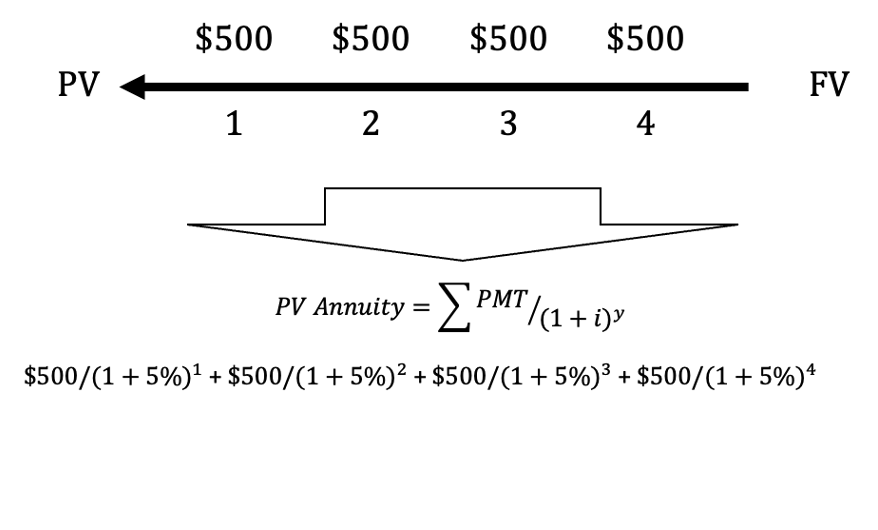

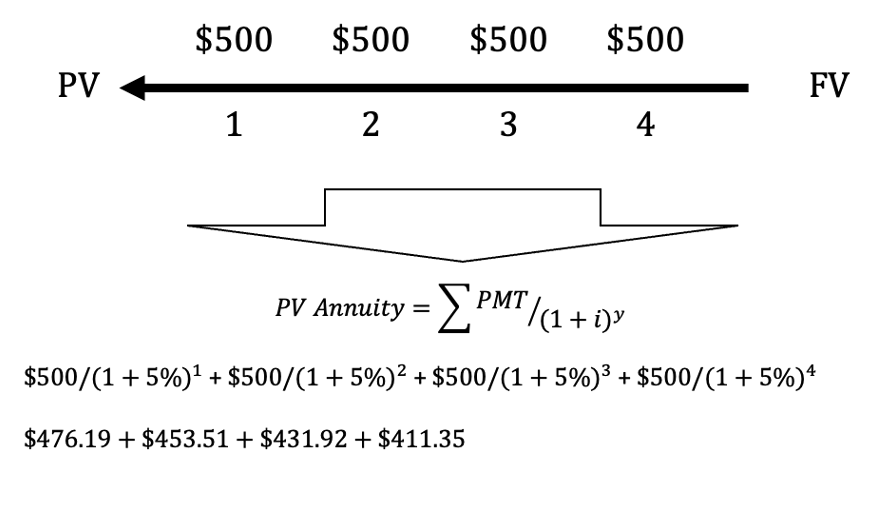

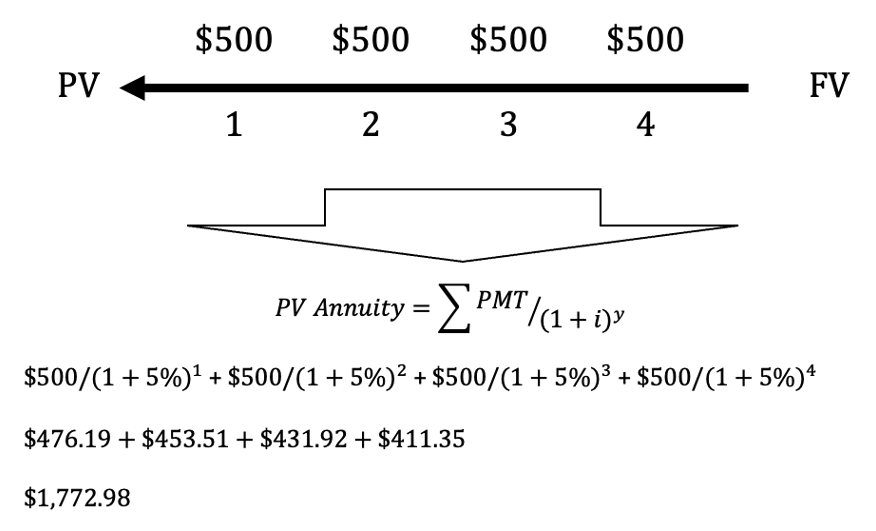

Annuities

Annuities

Annuities

Annuities

Annuities

Let's practice!

Financial Analysis in Power BI