Future value

Financial Analysis in Power BI

Nick Edwards

Capital Markets Analyst

What is time value of money?

Time value of money (TVM) is the concept that money is worth more now than in the future due to its earnings potential.

If you had invested $100 into the S&P 500 in 1957, it would be worth over $200,000 today!

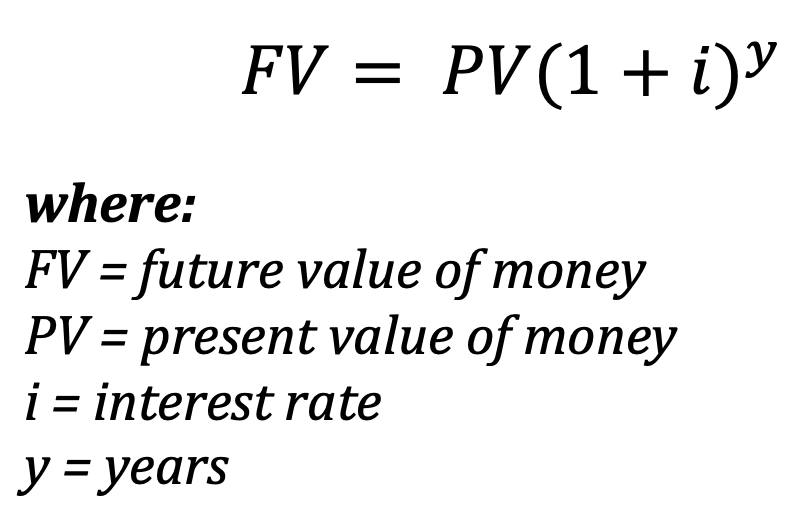

Future value (FV)

- What your investment will be worth in the future based on a rate of return and length of time

Example: Find the value of $1,000 three years from now at a 5% interest rate.

FV = PV x (1+i)^n

FV = $1,000.00 x (1+0.05)^3

FV = $1,000.00 X (1.05)^3

FV = $1,000.00 X 1.15763

FV = $1,157.63

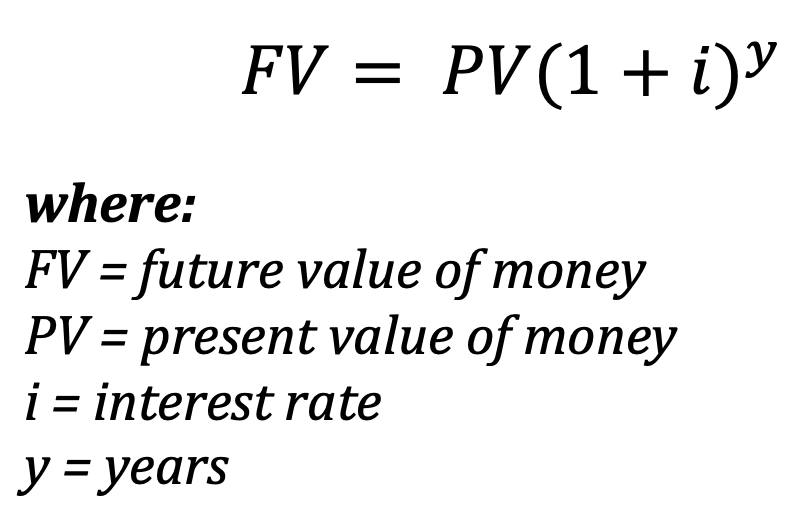

Future value (FV)

- What your investment will be worth in the future based on a rate of return and length of time

Example: Find the value of $1,000 three years from now at a 5% interest rate.

Year 1: $1,000.00 * 5% = $1,050.00

Year 2: $1,050.00 * 5% = $1,102.50

Year 3: $1,102.50 * 5% = $1,157.63

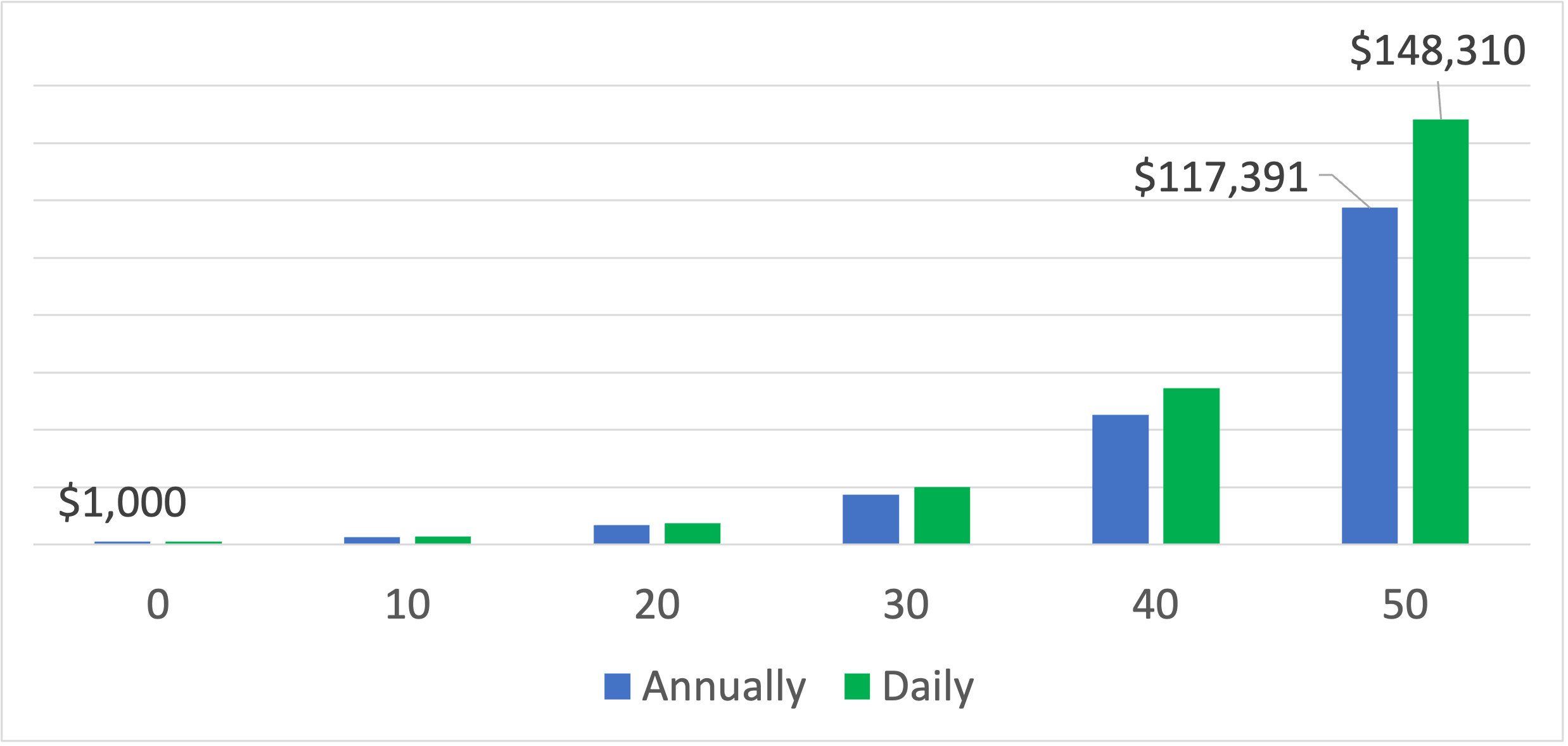

The power of compounding

Compounding is the process in which an asset's earnings are reinvested to generate additional earnings over time.

Example: Compare $1,000 compounding annually vs. daily over 50 years at a 10% rate.

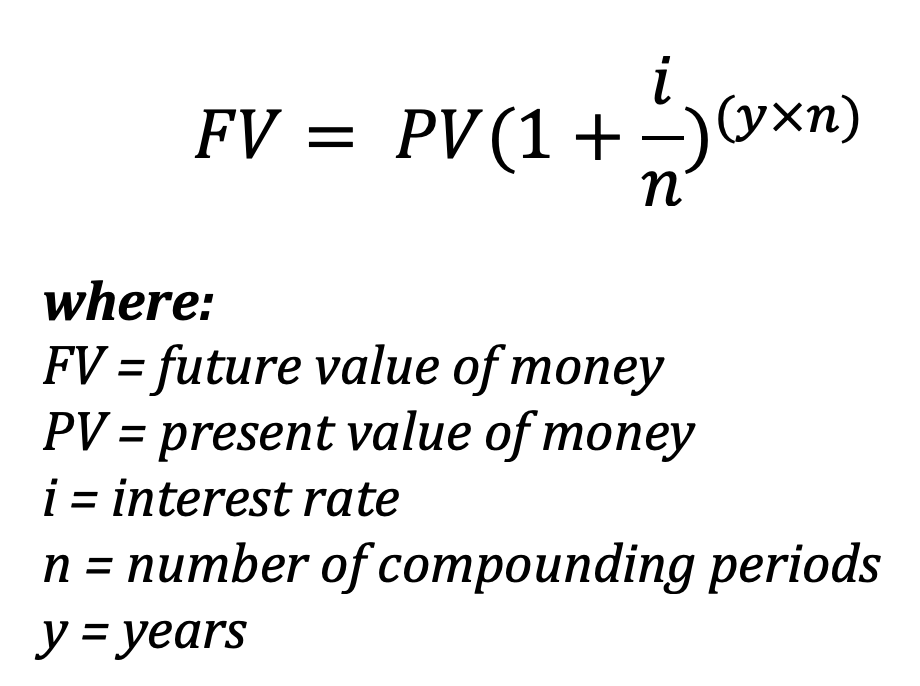

Calculate with compounding interest

Step 1: Divide i by n

Step 2: Multiple y by n

Example: Find the value of $1,000 two years from now at a 5% interest rate compounding monthly.

FV = PV x (1+i/n)^(y*n)

FV = $1,000 x (1+0.0041)^(12*2)

FV = $1,000 X (1.0041)^24

FV = $1,000 X 1.10494

FV = $1,104.94

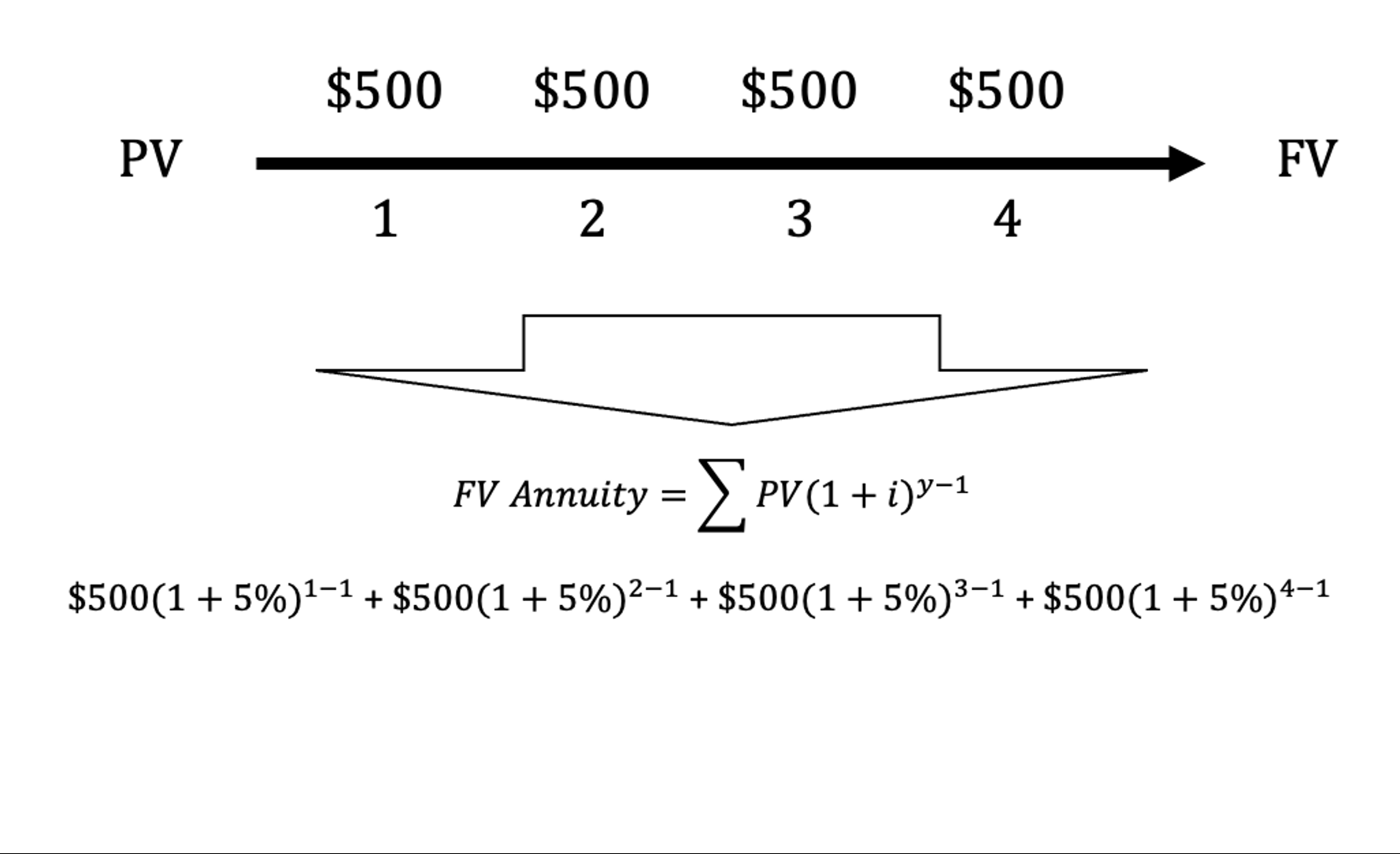

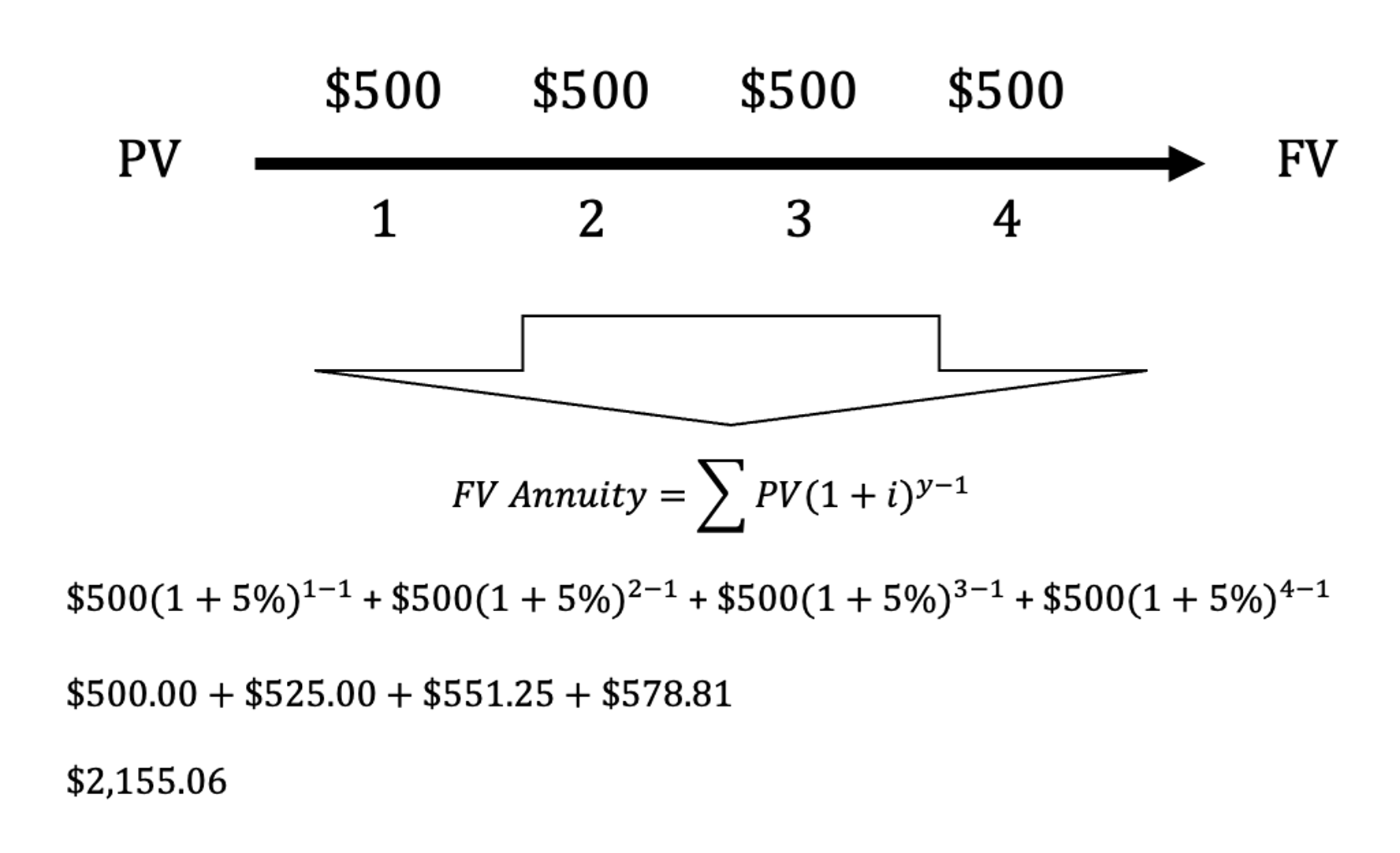

Annuities

- Annuities are a cash flow structure where fixed payments are made at regular intervals

Annuities

- Annuities are a cash flow structure where fixed payments are made at regular intervals

Annuities

- Annuities are a cash flow structure where fixed payments are made at regular intervals

Annuities

- Annuities are a cash flow structure where fixed payments are made at regular intervals

Annuities

- Annuities are a cash flow structure where fixed payments are made at regular intervals

Let's practice!

Financial Analysis in Power BI