Capital Budgeting

Financial Analysis in Power BI

Nick Edwards

Capital Markets Analyst

What is capital budgeting?

Capital budgeting is the process of allocating money for new projects that generate cash flows.

- Analysts will estimate the cash flows from the project and give a recommendation

- Budgets are limited, resources are scarce, so many projects are mutually exclusive

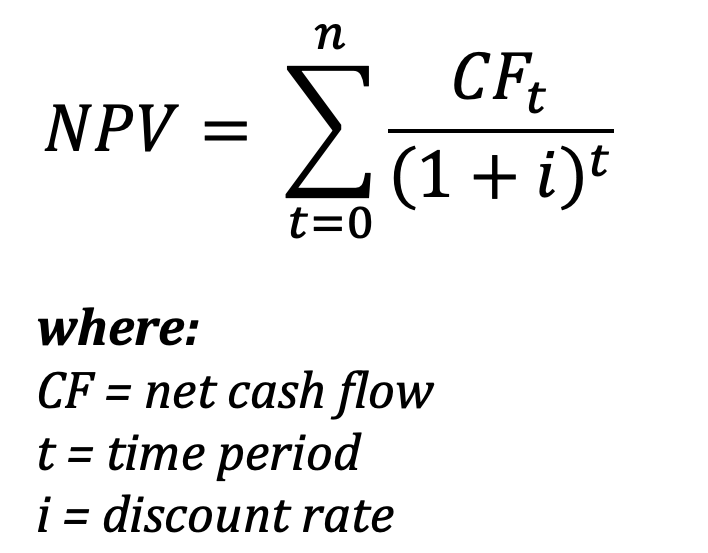

Net present value (NPV)

Net present value is the sum of all discounted cash flows.

Essentially just a series of present value calculations

NPV investment criteria

- If NPV > 0 then invest

- If NPV < 0 then don't

1 https://www.investopedia.com/terms/n/npv.asp

Net present value (NPV)

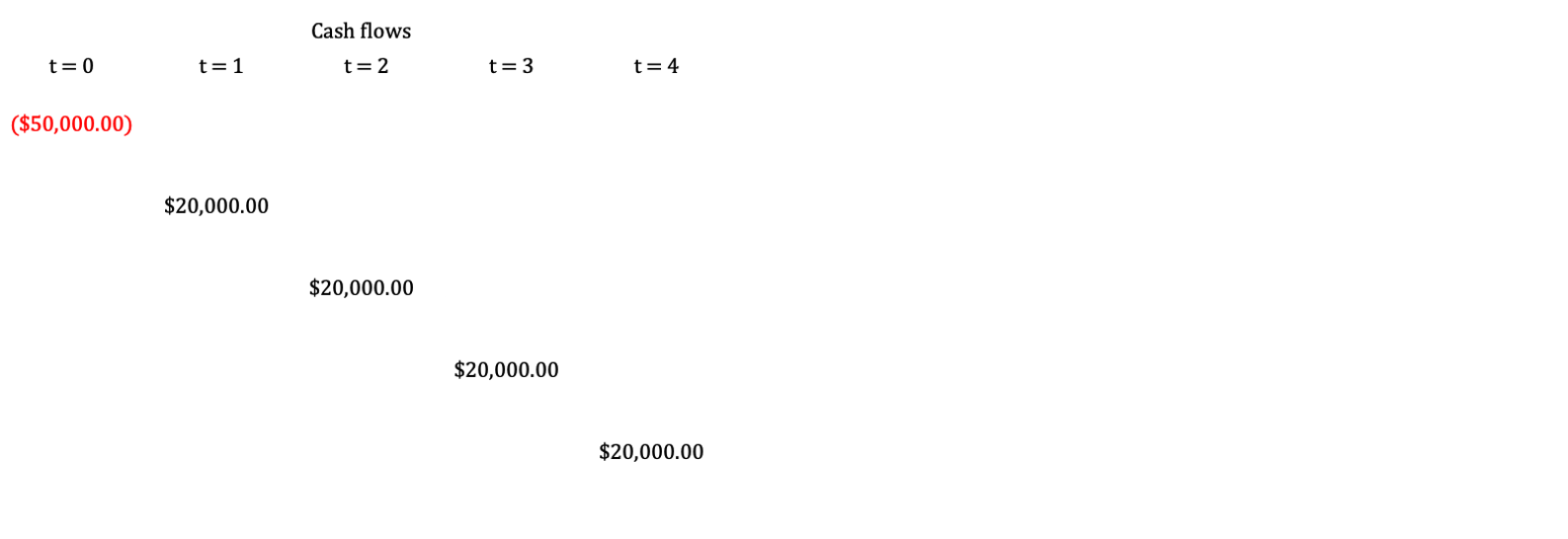

Example: Should a company invest in this project at a 10% discount rate?

Net present value (NPV)

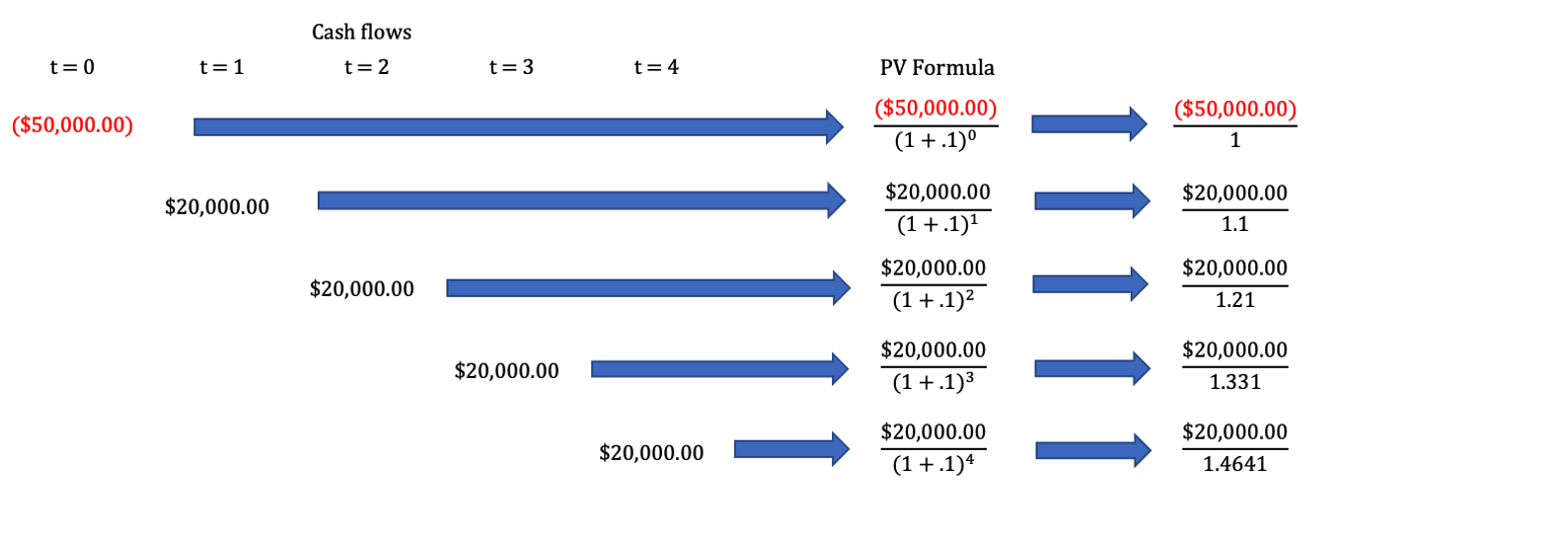

Example: Should a company invest in this project at a 10% discount rate?

Net present value (NPV)

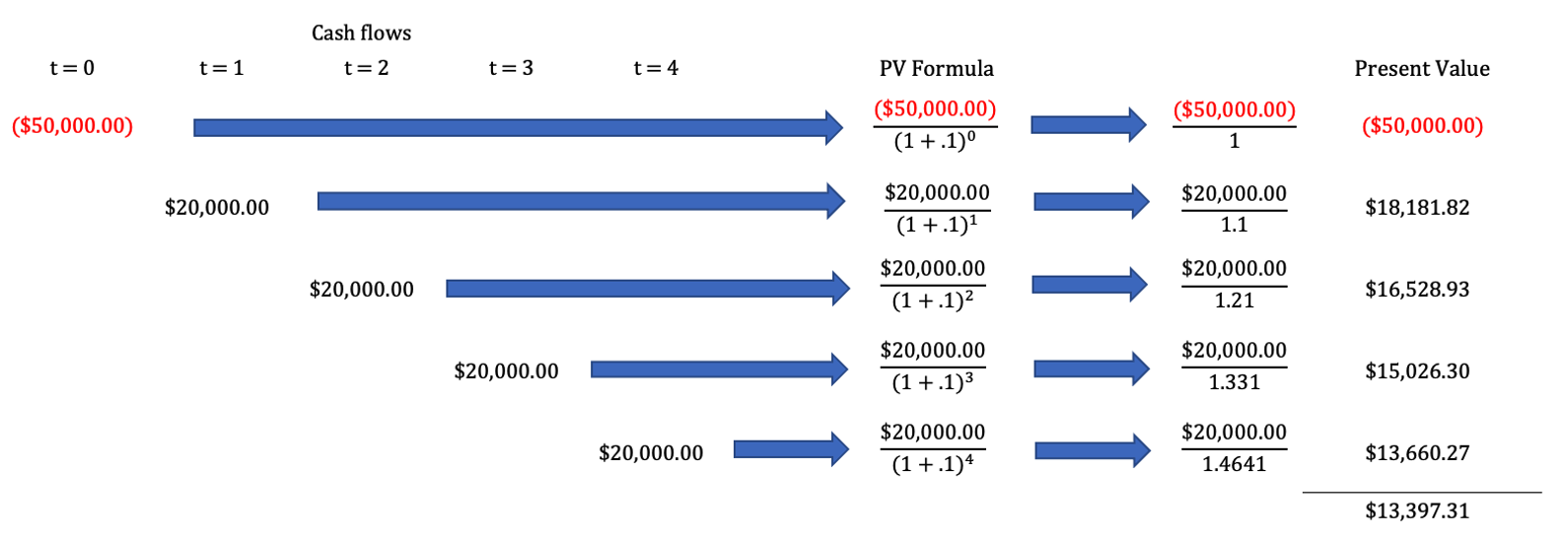

Example: Should a company invest in this project at a 10% discount rate?

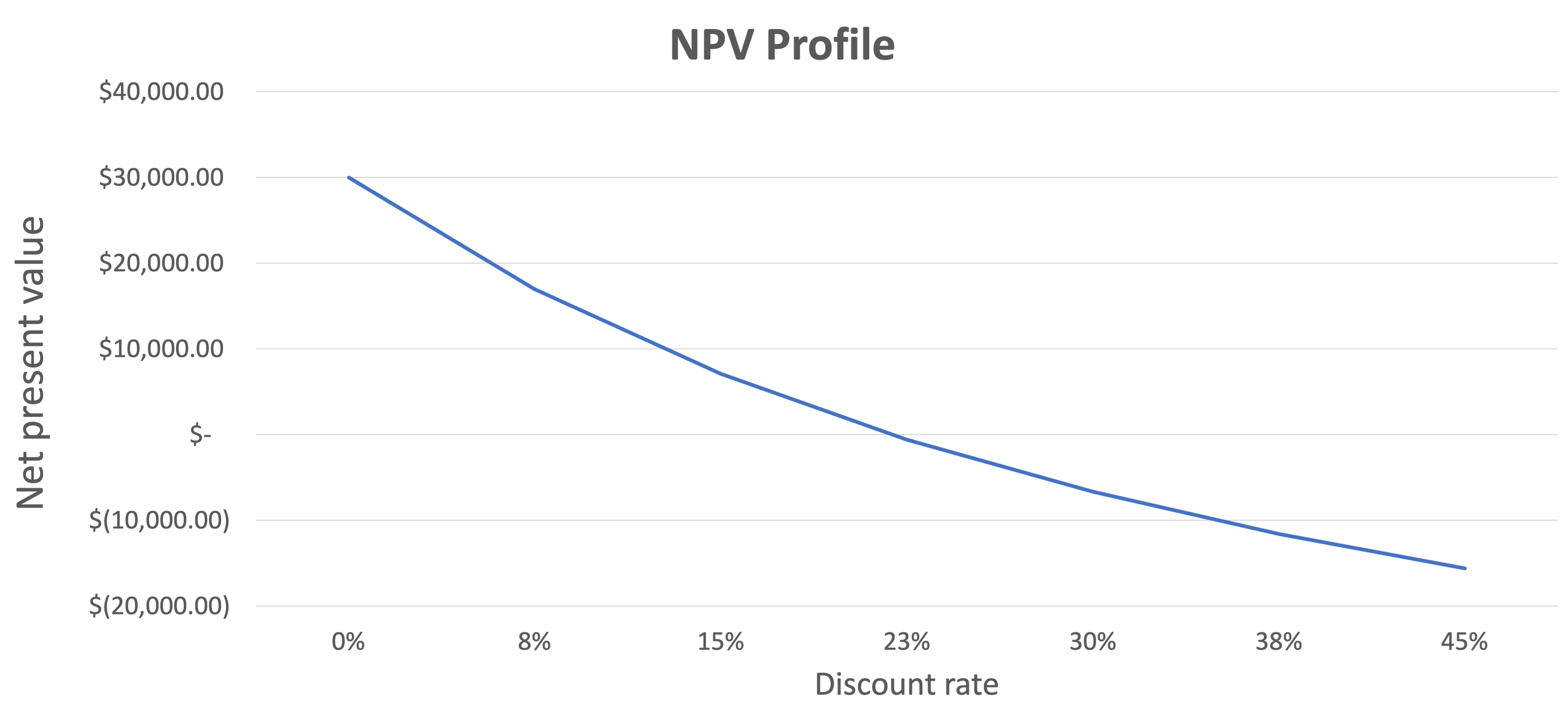

Discount rates and NPV

Where do discount rates come from...

Opportunity cost

is the next best alternative return that was given up to pursue the selected project

- i.e. bonds, stocks, other investments

Cost of capital

is the cost of raising money for the project

- Made up by debt and equity

- Weighted average cost of capital (WACC) is the combination of the cost of debt and equity

1 https://www.investopedia.com/terms/c/costofcapital.asp

Profitability index (PI)

- Profitability index is a ratio of NPV that gives dollar earned per dollar spent

- Useful in prioritizing projects when capital is limited

- Anything less than one should not be undertaken (NPV would be negative)

Example:

PI = 1+(NPV/Invested amount)

PI = 1+($13,397.31/$50,000.00)

PI = 1+0.27

PI = 1.27

1 https://www.investopedia.com/terms/p/profitability.asp

Choosing the right project

Choose the investment with the highest NPV

- "The golden rule"

- NPV represents a real dollar amount

NPV has it's limitations:

- Cash flows are estimates

- Does not consider qualitative risks or business objectives

- Other metrics can be used depending on the case

Let's practice!

Financial Analysis in Power BI