Other traditional asset investing

Data-Driven Decision Making for Business

Ted Kwartler

Data Dude

Investing in a vacation condo

| Month | Occupied Nights | Avg Per Night |

|---|---|---|

| Jan-21 | 6 | $53 |

| Feb-21 | 12 | $95 |

| Mar-21 | 18 | $134 |

Money coming in

| Month | Occupied Nights | Avg Per Night |

|---|---|---|

| Jan-21 | 6 | $53 |

| Feb-21 | 12 | $95 |

| Mar-21 | 18 | $134 |

Total money coming in

| Month | Occupied Nights | Avg Per Night | Gross Income |

|---|---|---|---|

| Jan-21 | 6 | $53 | $318 |

| Feb-21 | 12 | $95 | $1140 |

| Mar-21 | 18 | $134 | $2412 |

$$

Gross Income

- 6 nights * $53 = 318

- 12 nights * $95 = 1140

- 18 nights * $134 = 2412

Money going out

| Fixed Cost | Variable Costs | Occupied Nights | Total Costs |

|---|---|---|---|

| $100 | $110 | 6 | $760 |

| $100 | $95 | 12 | $1240 |

| $100 | $85 | 18 | $1630 |

$$

Fixed Cost + Variable Costs = Total Costs

- 100 + ($110 * 6 nights occupied) = 760

- 100 + ($95 * 12 nights occupied) = 1240

- 100 + ($85 * 18 nights occupied) = 1630

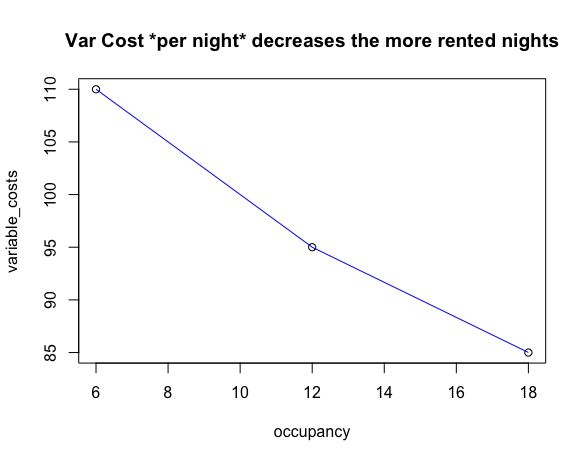

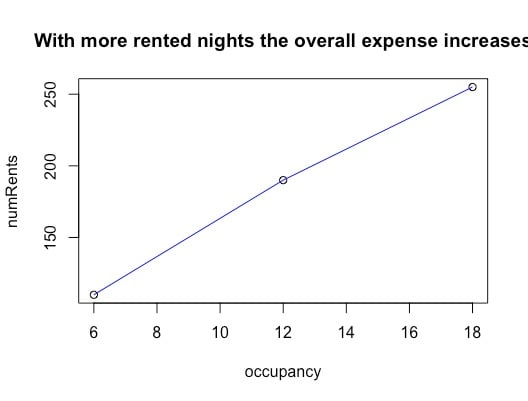

How should variable costs behave?

$$

$$

Calculating the operating expense ratio (OER)

| Month | Occupied Nights | Avg Per Night | Gross Income | Total Costs | Income - Costs | OER |

|---|---|---|---|---|---|---|

| Jan-21 | 6 | $53 | 795 | 760 | 35 | 0.955 |

| Feb-21 | 12 | $95 | 1,140 | 1,240 | -100 | 1.087 |

| Mar-21 | 18 | $134 | 2,412 | 1,630 | 782 | 0.675 |

$$

Operating Expense Ratio: Total Costs / Gross Income

- 760 / 795 = 0.955

- 1240 / 1140 = 1.087

- 1630 / 2412 = 0.675

Summarizing OER

| Month | Occupied Nights | Avg Per Night | Gross Income | Total Costs | Income - Costs | OER |

|---|---|---|---|---|---|---|

| Jan-21 | 6 | $53 | 795 | 760 | 35 | 0.955 |

| Feb-21 | 12 | $95 | 1,140 | 1,240 | -100 | 1.087 |

| Mar-21 | 18 | $134 | 2,412 | 1,630 | 782 | 0.675 |

- OER =

(0.955,1.087,0.675) - Weights:

- (6 Jan nights / 36 total nights) =

0.167 - (12 Feb nights / 36 total nights) =

0.33 - (18 Mar nights / 36 total nights) =

0.5

- (6 Jan nights / 36 total nights) =

- Weighted avg =

(0.955 * 0.167) + (1.087 * 0.33) + (0.675 * 0.5) = 0.859

Another investing ratio: cap rate

| Month | gross_income | total_costs | net |

|---|---|---|---|

| Jan-21 | $795 | 760 | 35 |

| Feb-21 | $1140 | 1240 | -100 |

| Mar-21 | $1340 | 1300 | 40 |

| Apr-21 | $1850 | 1350 | 500 |

| May-21 | $5000 | 2000 | 3000 |

| Jun-21 | $7000 | 2200 | 4800 |

| ... | ... | ... | ... |

| Dec-21 | $850 | 950 | -100 |

Cap Rate: Net Income / Total Cost

- Assume the annual net income= $20,000

net_income = ($35-100+782+...-100) =20000

- Assume the purchase price = $100,000

purchase_price = 100000

- Sum annual net income / total cost of the property

cap_rate = 20000 / 100000 = .20

Comparing properties

| ID | Beds | Baths | Square Feet | OER | Cap Rate |

|---|---|---|---|---|---|

| Property_1 | 2 | 1 | 750 | 0.86 | 0.2 |

| Property_2 | 3 | 1.5 | 1250 | 1.05 | 0.27 |

| Property_3 | 3 | 2 | 1500 | 0.75 | 0.33 |

| Property_4 | 2 | 1.5 | 1100 | 1.23 | 0.11 |

| Property_5 | 4 | 2 | 2000 | 0.68 | 0.13 |

Comparing properties

| ID | Beds | Baths | Square Feet | OER | Cap Rate |

|---|---|---|---|---|---|

| Property_1 | 2 | 1 | 750 | 0.86 | 0.2 |

| Property_3 | 3 | 2 | 1500 | 0.75 | 0.33 |

| Property_5 | 4 | 2 | 2000 | 0.68 | 0.13 |

$$

- Keep only OER < 1

Comparing properties

| ID | Beds | Baths | Square Feet | OER | Cap Rate |

|---|---|---|---|---|---|

| Property_3 | 3 | 2 | 1500 | 0.75 | 0.33 |

$$

- Keep only OER < 1

- Maximize cap rate

Let's practice!

Data-Driven Decision Making for Business